- UnitedHealth Group (UNH, Financial) experiences an 18% stock drop after missing earnings expectations.

- Despite a downturn in the Dow, the S&P 500 manages to see gains.

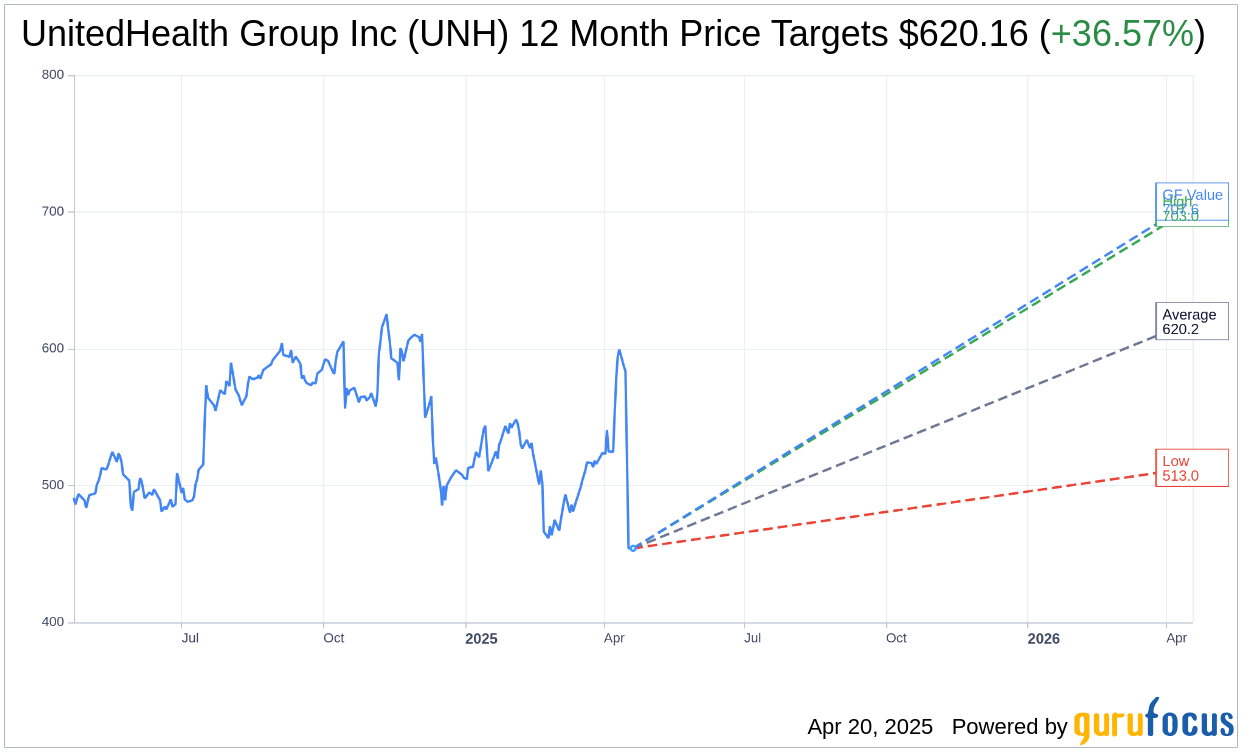

- Analysts project a considerable upside for UNH with a consensus "Outperform" rating.

UnitedHealth Group (NYSE: UNH) has recently experienced a turbulent period, with its stock plummeting by 18% following a disappointing earnings report and a subsequent reduction in its annual forecast. This decline has notably impacted the Dow Jones Industrial Average, while the S&P 500's gains underscore the differing methodologies in their index weightings.

Wall Street Analysts' Predictions for UNH Stock

According to 25 analysts, the one-year price target for UnitedHealth Group Inc. stands at an average of $620.16. This includes a high estimate of $703.00 and a low of $513.00, implying a potential upside of 36.57% from its present price of $454.11. For more in-depth data, investors can visit the UnitedHealth Group Inc (UNH, Financial) Forecast page.

Brokerage Firms' Recommendations

The consensus recommendation from 29 brokerage firms positions UnitedHealth Group Inc. with an average recommendation of 1.7, suggesting an "Outperform" status. The rating scale, which ranges from 1 (Strong Buy) to 5 (Sell), reflects a generally positive outlook among professionals.

GuruFocus's GF Value Estimation

GuruFocus' proprietary metrics estimate the GF Value for UnitedHealth Group at $707.61 in one year's time, suggesting a remarkable upside of 55.82% from the current share price of $454.11. The GF Value is derived from historical trading multiples and business growth trends, alongside future performance estimates. For more detailed insights, explore the UnitedHealth Group Inc (UNH, Financial) Summary page.

In summary, while recent events have cast shadows over UnitedHealth Group's immediate performance, consensus predictions and proprietary evaluations from GuruFocus indicate potential for notable upward movement, offering a compelling case for consideration among investors.