Exploring the Fund's Strategic Moves in the Healthcare Sector

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) recently submitted its N-PORT filing for the fourth quarter of 2024, revealing strategic investment decisions. The fund, based in Boston and London, focuses on companies engaged in healthcare advancements, including biotechnology, pharmaceuticals, and medical equipment. With an emphasis on growth driven by aging demographics, innovation, and rising global incomes, the fund aims to capitalize on increasing healthcare spending. The portfolio managers prioritize stocks that are reasonably priced relative to their fundamental value, with potential for long-term growth. This approach involves evaluating factors such as market share potential for larger companies and research and development prospects for smaller entities.

Summary of New Buy

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) added a total of six stocks, with notable additions including:

- The most significant addition was Abbott Laboratories (ABT, Financial), with 273,749 shares, accounting for 3.23% of the portfolio and a total value of $32,513,170 million.

- The second largest addition to the portfolio was Gilead Sciences Inc (GILD, Financial), consisting of 225,867 shares, representing approximately 2.08% of the portfolio, with a total value of $20,910,770.

- The third largest addition was Edwards Lifesciences Corp (EW, Financial), with 149,979 shares, accounting for 1.06% of the portfolio and a total value of $10,701,000.

Key Position Increases

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) also increased stakes in a total of eight stocks, among them:

- The most notable increase was Bristol-Myers Squibb Co (BMY, Financial), with an additional 108,314 shares, bringing the total to 601,243 shares. This adjustment represents a significant 21.97% increase in share count, a 0.64% impact on the current portfolio, with a total value of $35,605,610.

- The second largest increase was Straumann Holding AG (XSWX:STMN, Financial), with an additional 22,825 shares, bringing the total to 71,699. This adjustment represents a significant 46.7% increase in share count, with a total value of CHF 9,369,990.

Summary of Sold Out

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) completely exited three holdings in the fourth quarter of 2024, as detailed below:

- Humana Inc (HUM, Financial): The fund sold all 55,766 shares, resulting in a -1.78% impact on the portfolio.

- Pfizer Inc (PFE, Financial): The fund liquidated all 359,209 shares, causing a -0.94% impact on the portfolio.

Key Position Reduces

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) also reduced positions in 15 stocks. The most significant changes include:

- Reduced Stryker Corp (SYK, Financial) by 39,569 shares, resulting in a -57.11% decrease in shares and a -1.28% impact on the portfolio. The stock traded at an average price of $367.2 during the quarter and has returned 12.57% over the past 3 months and 10.06% year-to-date.

- Reduced Sanofi SA (XPAR:SAN, Financial) by 104,190 shares, resulting in a -31.74% reduction in shares and a -1.05% impact on the portfolio. The stock traded at an average price of €99.32 during the quarter and has returned 2.62% over the past 3 months and 6.85% year-to-date.

Portfolio Overview

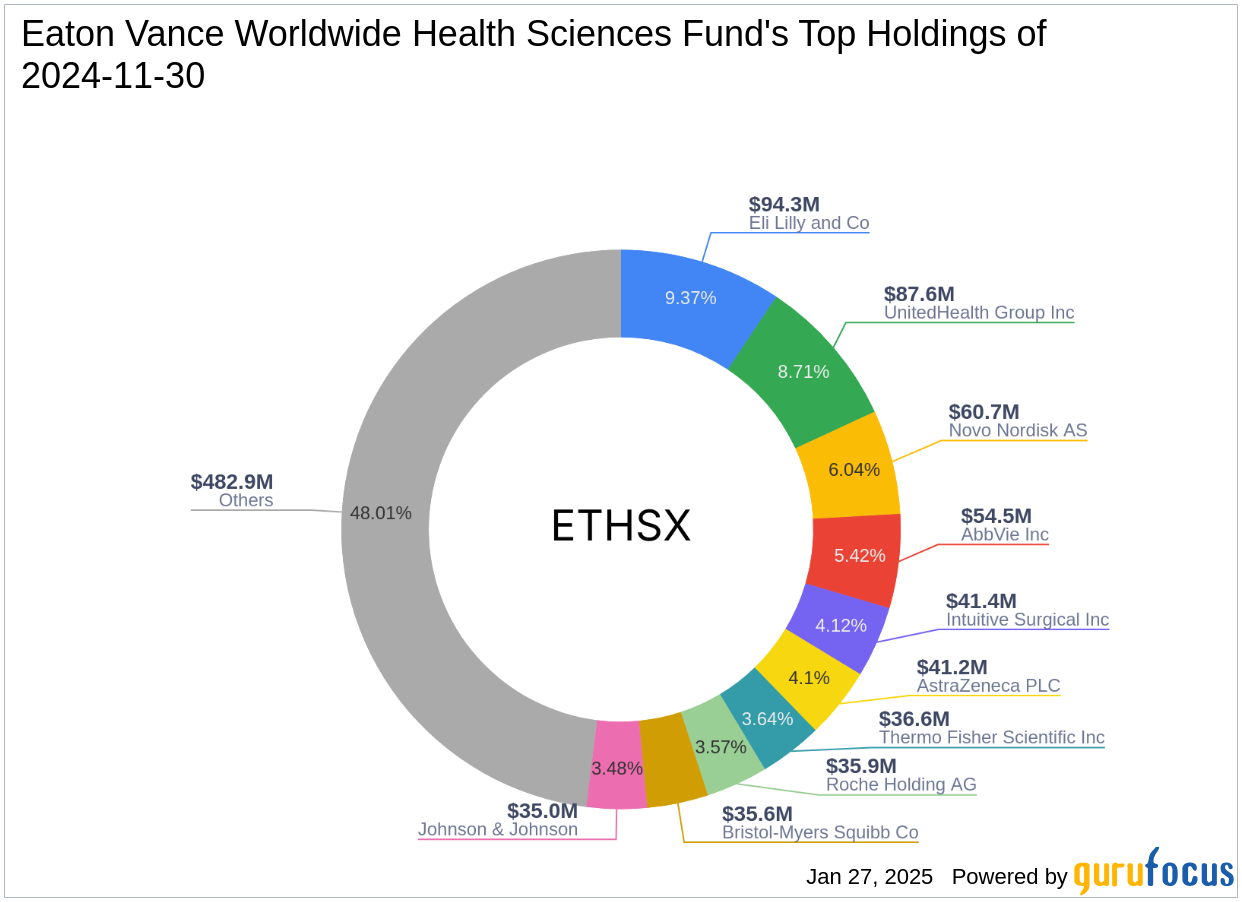

At the fourth quarter of 2024, Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio)'s portfolio included 46 stocks. The top holdings included 9.37% in Eli Lilly and Co (LLY, Financial), 8.71% in UnitedHealth Group Inc (UNH, Financial), 6.04% in Novo Nordisk AS (OCSE:NOVO B, Financial), 5.42% in AbbVie Inc (ABBV, Financial), and 4.12% in Intuitive Surgical Inc (ISRG, Financial).

The holdings are mainly concentrated in one of the 11 industries: Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: