On January 3, 2025, Franklin Resources Inc, a prominent investment management firm, executed a significant transaction involving ClearBridge Energy Midstream Opportunity Fund Inc (EMO, Financial). The firm reduced its holdings in EMO by 8,772 shares, marking a 51.67% decrease in its position. This transaction reflects a strategic decision by Franklin Resources Inc to adjust its investment portfolio, potentially in response to market conditions or internal investment strategies. The shares were traded at a price of $47 each, leaving the firm with a total of 8,204 shares in EMO, which now constitutes a minimal 0.06% of its portfolio.

Franklin Resources Inc: A Profile of the Firm

Franklin Resources Inc, also known as Franklin Templeton Investments, was founded in 1847 and has grown to become a global leader in investment management. The firm is renowned for its focus on conservatively managed mutual funds, offering a diverse range of products under the Franklin, Templeton, Mutual Series, and Fiduciary brands. With over 8,000 employees worldwide, Franklin Resources Inc manages assets for more than 25 million investors, generating revenues exceeding $8 billion. The firm's top holdings include major technology and healthcare companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), NVIDIA Corp (NVDA, Financial), and UnitedHealth Group Inc (UNH, Financial).

ClearBridge Energy Midstream Opportunity Fund Inc: Company Overview

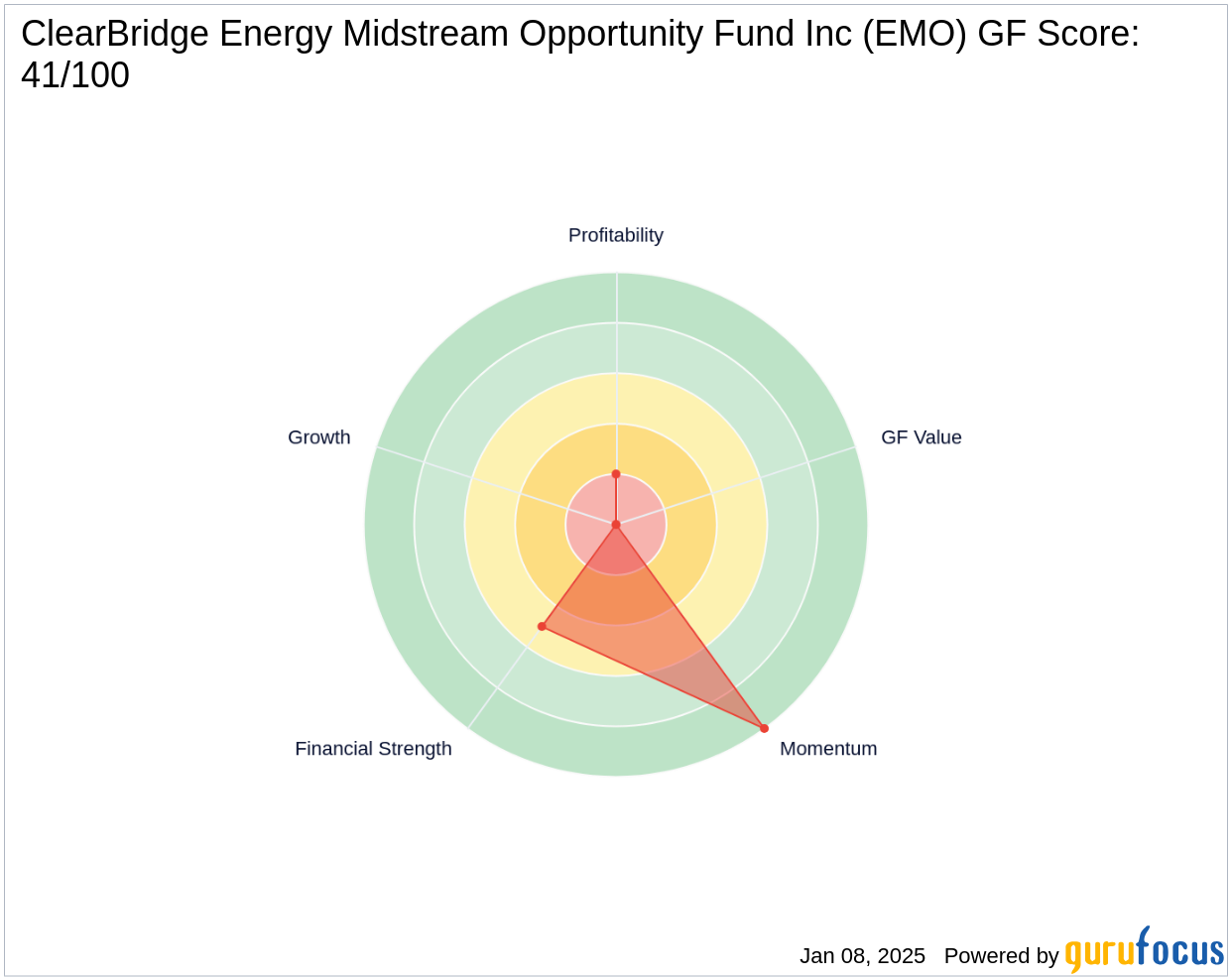

ClearBridge Energy Midstream Opportunity Fund Inc is a non-diversified, closed-end management investment company based in the USA. The fund's primary investment objective is to provide a high level of total return with an emphasis on cash distributions. As of the latest data, EMO has a market capitalization of $600.363 million and a current stock price of $46.95. The fund's GF Score is 41/100, indicating a poor future performance potential. The balance sheet and profitability ranks are 5/10 and 2/10, respectively, suggesting moderate financial strength and low profitability.

Impact of the Transaction

The reduction in holdings by Franklin Resources Inc has a minimal impact on its overall portfolio, given that EMO now represents only 0.06% of the firm's investments. The decision to decrease the stake in EMO could be influenced by the fund's financial metrics and market performance. With a price-to-earnings ratio of 3.10, EMO may appear undervalued, yet its GF Value Rank and growth rank are not favorable, indicating potential challenges in achieving future growth.

Financial Metrics and Market Performance

EMO's financial metrics reveal a mixed picture. The fund's Piotroski F-Score is 5, suggesting moderate financial health, while the Altman Z score is not available, indicating potential financial distress. The year-to-date price change is a modest 0.49%, but the stock has experienced a significant decline of 50.34% since its IPO in 2011. The momentum rank is strong at 10/10, with a 14-day Relative Strength Index (RSI) of 51.93, indicating neutral momentum.

Conclusion and Implications for Investors

Franklin Resources Inc's decision to reduce its holdings in ClearBridge Energy Midstream Opportunity Fund Inc may be driven by the fund's current valuation and financial performance. Despite a low price-to-earnings ratio suggesting potential undervaluation, the fund's poor profitability and growth prospects may have influenced the firm's strategic decision. Value investors should consider these factors when evaluating EMO as a potential investment, weighing the fund's current valuation against its future performance potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.