GuruFocus is happy to announce that it launched an improved version of the DCF Calculator page.

The improved DCF Calculator page includes a valuation zone scale that contains five valuation zones based on a stock’s margin of safety: significantly undervalued, modestly undervalued, fair valued, modestly overvalued and significantly overvalued.

What is discounted cash flow?

A discounted cash flow model values a stock based on projected cash flows over the next 10 to 20 years. GuruFocus’ DCF Calculator considers two 10-year stages: a growth stage and a terminal stage. The parameters for the model include earnings per share, 10-year earnings per share growth rate, discount rate, terminal stage growth rate and tangible book value per share.

By default, the terminal stage growth rate is 4%, while the discount rate equals the 10-year Treasury constant maturity rate plus a 6% equity risk premium.

How to do a DCF calculation on GuruFocus

Users can access the DCF Calculator by clicking on “DCF Calculator” underneath the “Tools” tab.

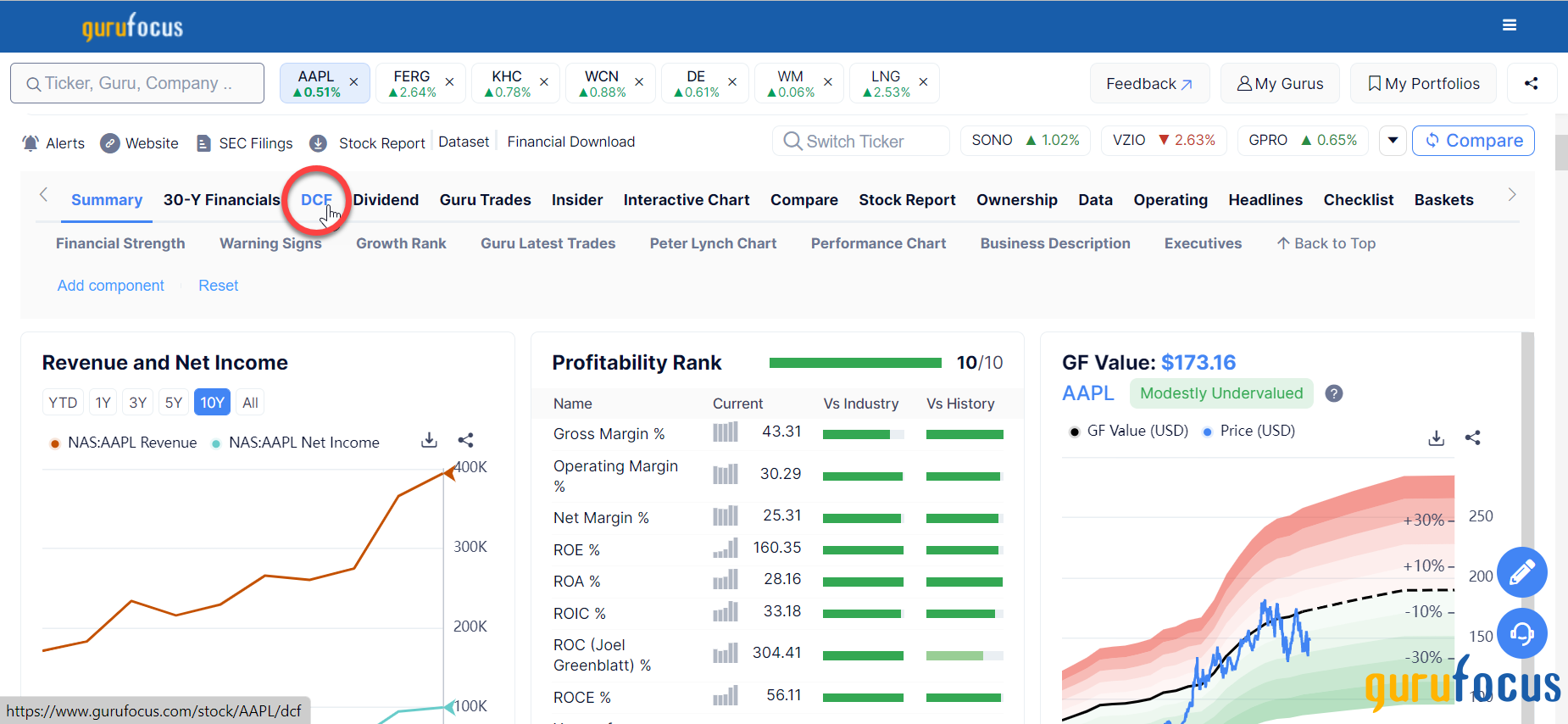

You can also click on the “DCF” tab from a company’sstock summary page.

What is an example of a DCF calculation?

Suppose Apple Inc. (AAPL) has earnings per share of $6.11 with a 10-year earnings growth rate of 14.9%. Based on a discount rate of 10%, the present value of the growth-stage cash flows is $78.26.

During the terminal stage, consider earnings growth of 4% over 10 years. Based on the same discount rate, the present value of the terminal-stage cash flows is $70.30. The fair value of Apple based on the DCF earnings model is $148.55.

How to set the parameters for the DCF Calculator

To set the parameters for the DCF Calculator, simply change the values in the cells provided:

Stock Price: The default value is the current price of the stock. You can change the stock price to calculate the margin of safety given a target stock price.

Based on earnings or free cash flow: GuruFocus’ DCF Calculator uses earnings per share as the default method. If you want to do a free cash flow valuation, you can switch the calculator to “FCF” mode. You can also enter your own base value in the cell provided.

Discount rate %: The default value equals the 10-year Treasury constant maturity rate plus a 6% equity risk premium. You can change the discount rate by entering the desired value or pressing the plus or minus buttons.

Tangible book value: The default value equals the company’s tangible book value per share. If you wish to add a specific value to the intrinsic value to the stock, you can add that value by entering it in this cell.

Growth-stage growth rate and years: The default values are 10 years at the 10-year earnings growth rate. You can change the values to consider a longer / shorter growth period or a faster / slower growth rate.

Terminal-stage growth rate and years: The default values are 10 years at a growth rate of 4%. You can change the values to consider a longer / shorter terminal-stage period or a faster / slower rate of terminal growth. Make sure that the terminal-stage growth rate is less than the discount rate for the DCF calculation to converge.

You can save the DCF Calculator parameters by clicking on the stacked radio button and then the “Save Parameters” item in the drop-down menu.

How to read the DCF Fair Value output

The Fair Value section gives you the fair value of the stock based on the parameters set and the margin of safety. The section will be green if the margin of safety is positive or red if the margin of safety is negative.

The output also contains a color scale containing five valuation zones: significantly undervalued in deep green, modestly undervalued in light green, fair valued in yellow, modestly overvalued in orange and significantly overvalued in red. Based on the margin of safety computed, the scale will point to one of the zones indicated.

For example, based on Apple's stock price of $148.55 and fair value of $148.56, the margin of safety is 0.01%. Based on this margin of safety, the DCF Calculator believes that Apple is fair valued.

What is the Reverse DCF model?

The “Reverse DCF model” starts with the fair value and calculates the growth-stage growth rate needed to justify the current share price. If the required growth rate is lower than the historical 10-year growth rate, the stock’s fair value may be achievable. On the other hand, if the required growth rate is higher than the historical growth rate, the stock’s fair value may be a little too high, resulting in possible overvaluation.

What is a key limitation to using DCF?

One limitation to using the DCF model is that the future cash flows are based on a 10-year growth rate. Thus, the DCF model assumes that the cash flows are predictable and consistently growing at the historical 10-year growth rate.

For stocks with a business predictability rank of one star, GuruFocus’ DCF Calculator gives a warning label that the DCF result may not be accurate due to the low business predictability. The screen shot below gives an example for Tesla Inc. (TSLA).

How to calculate DCF in Excel

Excel’s NPV (net present value) function allows a user to input a series of cash flows over 20 years and discount them at the discount rate. For each year, increase the cash flow at the historical growth rate for the first 10 years and then, the terminal-stage growth rate for the next 10 years. The fair value is the net present value of all 20 cash flows discounted at the discount rate.

You can also try the GURUF DCF Calculator template for the Excel Add-In and Google Sheets.

If you have further questions, you can contact us or schedule a free session.