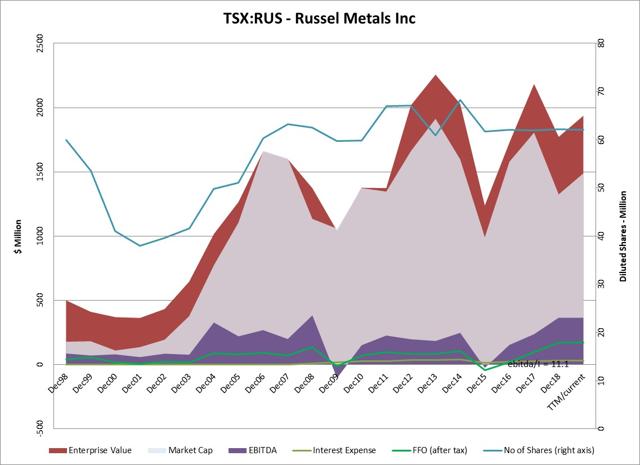

Russel Metals Inc. (TSX:RUS) is a leading North American metals distribution and value-added processing company headquartered in Canada and trades on the Toronto Stock Exchange and on the U.S. OTC exchange (OTCPK:RUSMF) as well as in Germany and France. The company distributes steel products in North America through three segments: metals service centers, energy products and steel distributors. It had revenues of $4.2 billion Canadian dollars in 2018, with 65% of that coming from Canada and 35% from the U.S. Russel Metals has a market cap of $1.49 billion Canadian dollars and an Enterprise Value of $1.94 billion Canadian dollars. (The CAD to USD exchange rate is currently 1.33.)

Figure 1- Revenue Segments - 2018

Russel Metals provides processing and distribution services to a base of approximately 43,000 end users through a network of 50 locations in Canada and 14 locations in the United States. The Company's network of metals service centers carries a line of metal products in a range of sizes, shapes and specifications, including carbon hot rolled and cold finished steel, pipe and tubular products, stainless steel, aluminum and other non-ferrous specialty metals. The Company's energy products operations distribute oil country tubular goods, line pipe, tubes, flanges, valves and fittings to the energy industry. The Company's steel distributors segment is engaged in selling steel to other steel service centers and equipment manufacturers. The company because of its wide ranging supplier and customer relationship has built a narrow moat.

Investment thesis

Russel Metals hit a 52-week high of $31.90 in February 2018 and a 52-week low of $19.87 in December 2018. This volatility does not seem to be justified by fundamentals, as the company has achieved record level of revenue and cash flow. The market seems to be pricing in a recession, which is nowhere in sight. Economic activity in North America remains strong and in the medium term (one to two years), the risk of a recession seems to be low. Oil patch activity in Canada is recovering, and this should provide a tail wind to Russel's large energy product segment.

Valuation

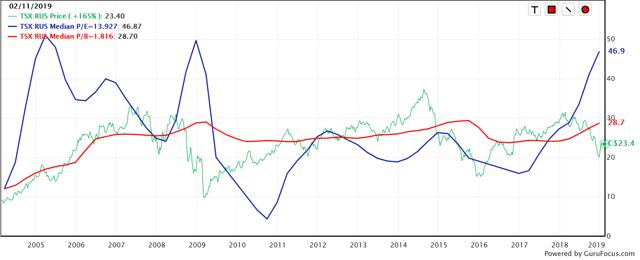

The company is trading below historical median price-earnings and price-book ratios. Based on historical ratios, the company should trade somewhere between $30 and $40.

Figure 2 - Valuation over 15 years

Figure 2 - Valuation over 15 years

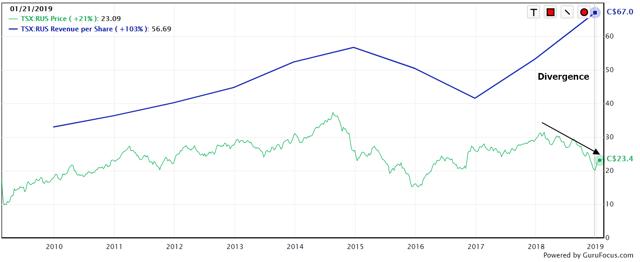

Revenue per share continues to rise, indicating that the market is anticipating a recession or economic slowdown, which is premature.

Figure 3 - Revenue per share and share price have diverged

Figure 3 - Revenue per share and share price have diverged

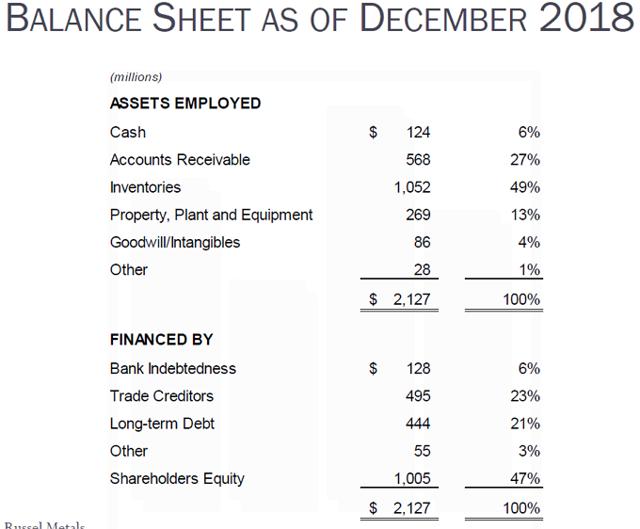

Balance sheet

The company has a good balance sheet:

- Equity-asset ratio: 0.47

- Debt-Ebitda: 1.57

- Interest coverage: above 10 (which should be recession resistant)

Long-term debt is less than half of equity. The company’s debt is also rated as BB+ by Standard and Poor's and Ba2 by Moody’s with a stable outlook.

Figure 4 - Balance sheet (source: company presentation)

Cash flow

Cash flow in 2018 adjusted for changes in working capital (Buffet – Bernhard free cash flow) has been very strong ($222 million) in spite of President Trump's tariffs and depressed rig counts in Canada. Distributors like Russel are little affected by tariffs as the costs are simply passed on to the customers who in turn pass them on to the consumers.

Figure 6 - Operating cash flows (source: chart by author and data from GuruFocus.com)

Potential catalyst: oil patch recovery

Figure 7 - As rig count recovers, Russel, which is major supplier of tubulars and other pieces for horizontal drilling, should benefit. (Source: BOE Report)

Dividend

The company pays a dividend of 6.3%. Dividend growth has been flat over the last three years. While the company did cut its dividend following the financial crisis, it has a decent record of paying dividends over the last 15 years and almost all the free cash flow is returned to shareholders. Given the robust cash flow, the dividend appears to be safe.

Figure 8: Annualized dividend per share

Insider buying

The company has seen significant insider buying activity as its stock rebounded from its 52-week lows in December. Insiders who were selling stock in the high $20s and $30s earlier in the year are now buying stock in the open market below $25. This would indicate that the stock is at a decent valuation as judged by people who know the company best. Insiders in this company seem to be adept at trading in and out of the stock.

Figure 9- Insider activity is highly supportive (source: The Globe & Mail)

Figure 9- Insider activity is highly supportive (source: The Globe & Mail)

Concluding thoughts

Risk to the investment thesis is that this is a highly pro-cyclical stock, and that it may be at peak economic activity. This economic risk is more than mitigated by reasonable valuation, increasing revenues and strong insider buying activity. Both steel prices and oil and gas drilling activity in Canada are on the upswing. The strong balance sheet and high dividend yield (6.3%) should further protect downside in case the economy does weaken.

This is not a buy-and-hold stock but a trading stock. It is a good candidate for a swing trader, and now is a good time to go long Russel Metals. If the stock descends back into the low $30s, it should then be sold after taking cues from the insiders.

- CEO Buys, CFO Buys: Stocks that are bought by their CEO/CFOs.

- Insider Cluster Buys: Stocks that multiple company officers and directors have bought.

- Double Buys: Companies that both Gurus and Insiders are buying

- Triple Buys: Companies that both Gurus and Insiders are buying, and Company is buying back.