On May 22, 2025, Autodesk Inc (ADSK, Financial) released its 8-K filing for the first quarter of fiscal 2026, ending April 30, 2025. The company, founded in 1982, is a leading application software provider serving industries such as architecture, engineering, construction, product design, manufacturing, and media and entertainment. Autodesk's software solutions cater to the design, modeling, and rendering needs of these sectors, boasting over 4 million paid subscribers across 180 countries.

Performance Overview

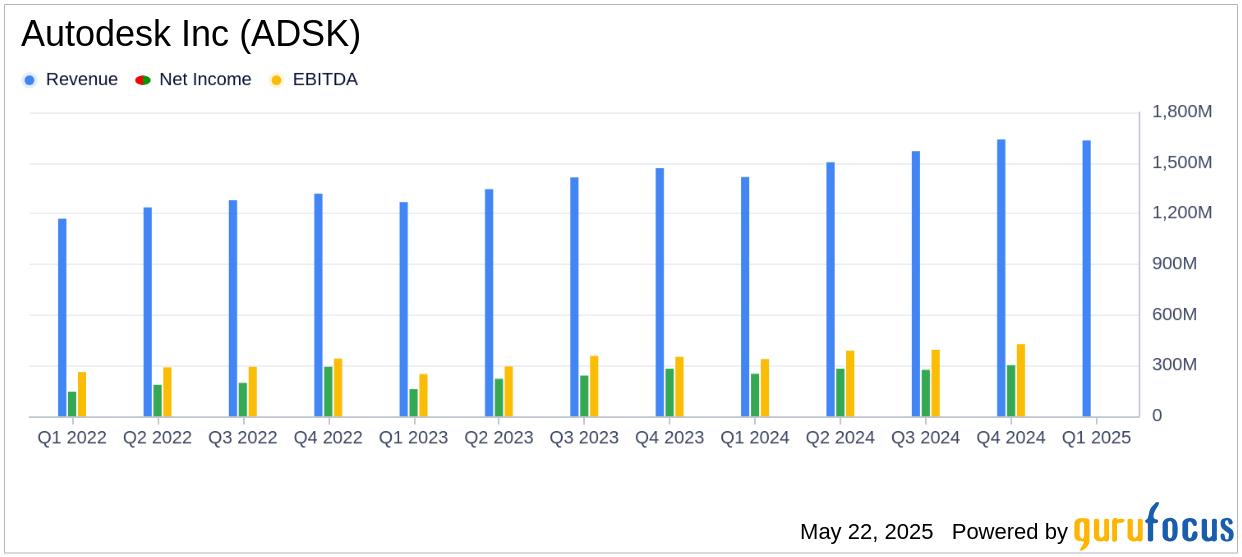

Autodesk Inc (ADSK, Financial) reported a 15% year-over-year increase in revenue, reaching $1.633 billion, aligning with the estimated revenue of $1,606.94 million. The company's GAAP earnings per share (EPS) was $0.70, which fell short of the estimated EPS of $0.83. However, the non-GAAP EPS was $2.29, significantly surpassing the estimated EPS of $0.83. This performance is crucial as it reflects the company's ability to navigate through uncertain geopolitical and macroeconomic conditions.

Financial Achievements and Challenges

Autodesk's financial achievements include a 29% increase in billings to $1,434 million and a 14% rise in cash flow from operating activities to $564 million. The free cash flow also grew by 14% to $556 million. These achievements are vital for a software company like Autodesk, as they indicate strong operational efficiency and the ability to generate cash, which can be reinvested into growth initiatives or returned to shareholders.

Despite these positive results, Autodesk faces challenges such as a 7 percentage point decline in GAAP operating margin to 14%. This decline could pose a problem if it continues, as it may affect profitability. Additionally, the company is cautious about its growth assumptions due to macroeconomic uncertainties, which could impact future performance.

Detailed Financial Metrics

Key metrics from the income statement include a non-GAAP operating margin of 37%, up by 3 percentage points. The balance sheet shows deferred revenue at $3,929 million, a slight decrease of 1%, while unbilled deferred revenue increased by 67% to $3,228 million. The remaining performance obligations (RPO) rose by 21% to $7,157 million, indicating strong future revenue potential.

| Metric | Q1 FY26 | YoY Change |

|---|---|---|

| Billings | $1,434 million | 29% |

| Revenue | $1,633 million | 15% |

| GAAP Operating Margin | 14% | -7 ppt |

| Non-GAAP Operating Margin | 37% | 3 ppt |

| GAAP EPS | $0.70 | -$0.46 |

| Non-GAAP EPS | $2.29 | $0.42 |

| Cash Flow from Operating Activities | $564 million | 14% |

| Free Cash Flow | $556 million | 14% |

Commentary and Analysis

“Against an uncertain geopolitical, macroeconomic, and policy backdrop, our strong performance in the first quarter of fiscal 26 set us up well for the year," said Andrew Anagnost, Autodesk president and CEO. "We continue to make the right decisions to drive long-term shareholder value by focusing on our strategic priorities in cloud, platform, and AI; optimizing our sales and marketing to drive higher margins; and allocating more capital to share repurchases as our free cash flow grows.”

Autodesk's strategic focus on cloud, platform, and AI, along with optimizing sales and marketing, is crucial for maintaining competitive advantage and driving future growth. The company's ability to generate substantial free cash flow allows for capital allocation towards share repurchases, enhancing shareholder value.

Conclusion

Autodesk Inc (ADSK, Financial) has demonstrated resilience and strong financial performance in Q1 FY26, despite facing macroeconomic challenges. The company's strategic initiatives and robust cash flow generation position it well for future growth. However, investors should monitor the company's operating margins and macroeconomic conditions that could impact its performance.

Explore the complete 8-K earnings release (here) from Autodesk Inc for further details.