- Meta Platforms (META, Financial) unveils its LlamaCon conference, focusing on advancements in artificial intelligence.

- Analyst projections suggest a 28.56% potential upside from META's current stock price.

- Meta's collaboration strategies with tech giants like Nvidia, AMD, and Microsoft may impact future investor decisions.

Meta Platforms (META) has launched its highly anticipated LlamaCon conference, underscoring the company's strategic initiatives in the realm of artificial intelligence. The event is set to feature significant developments with Llama 4 and shed light on Meta's capital expenditure strategies on GPUs in partnership with industry leaders Nvidia and AMD. Furthermore, speculated partnerships with major corporations such as Microsoft and Databricks could play a pivotal role in shaping investor sentiment.

Wall Street Analysts Forecast

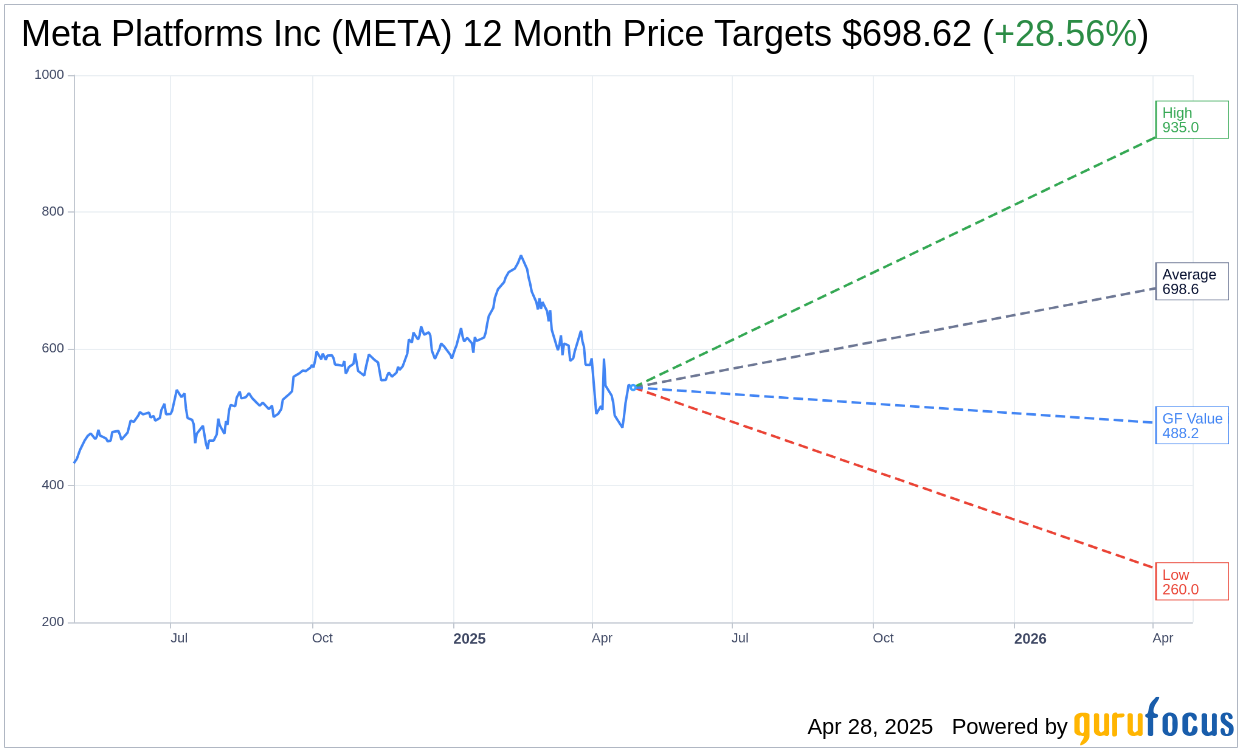

According to projections from 62 esteemed analysts, the average price target for Meta Platforms Inc (META, Financial) over the next year stands at $698.62. This target symbolizes a potential upside of 28.56% from the current trading price of $543.43, with expectations ranging from a high of $935.00 to a low of $260.00. For a more comprehensive analysis, visit the Meta Platforms Inc (META) Forecast page.

The consensus recommendation from 72 brokerage firms places Meta Platforms Inc (META, Financial) at an average rating of 1.8, indicating an "Outperform" stance. On the rating scale from 1 to 5, 1 reflects a Strong Buy, whereas 5 suggests a Sell position, highlighting investor confidence in Meta's future prospects.

In contrast, the estimated GF Value suggests a fair value of $488.22 for Meta Platforms Inc (META, Financial) within the coming year, pointing towards a potential downside of 10.16% from its current stock price of $543.43. The GF Value is an essential metric, calculated based on the historical trading multiples of the stock, past business growth, and potential future performance predictions. For further insights, explore the Meta Platforms Inc (META) Summary page.