Telsey Advisory has revised its price target for ThredUP (TDUP, Financial), increasing it from $3 to $6 while maintaining an Outperform rating on the company’s shares. This update follows ThredUP's robust performance to conclude FY25, where its Q4 revenue and adjusted EBITDA margin surpassed revised expectations. The analyst cites ThredUP's minimal tariff exposure and the opportunity to capitalize on rising apparel prices as factors supporting the optimistic outlook for the stock.

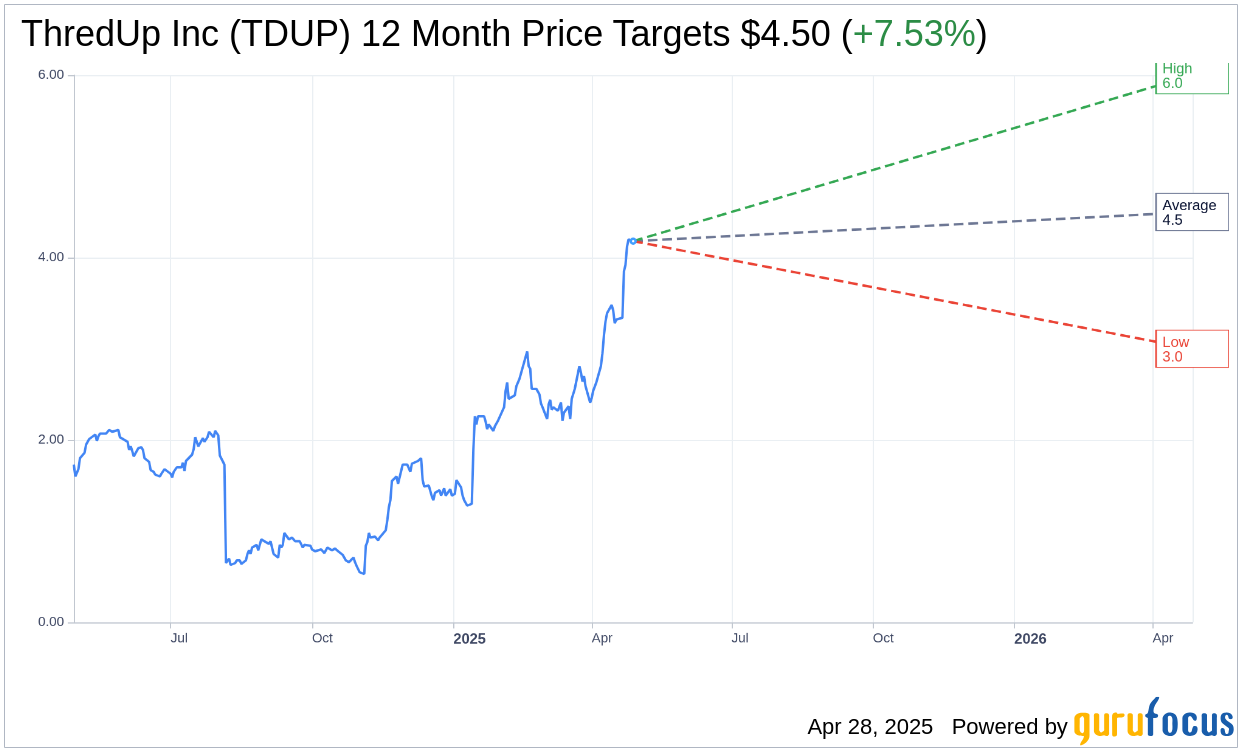

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for ThredUp Inc (TDUP, Financial) is $4.50 with a high estimate of $6.00 and a low estimate of $3.00. The average target implies an upside of 7.53% from the current price of $4.19. More detailed estimate data can be found on the ThredUp Inc (TDUP) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, ThredUp Inc's (TDUP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ThredUp Inc (TDUP, Financial) in one year is $1.90, suggesting a downside of 54.6% from the current price of $4.185. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ThredUp Inc (TDUP) Summary page.

TDUP Key Business Developments

Release Date: March 03, 2025

- Revenue: $67.3 million for Q4 2024, a 9.5% increase year over year.

- Gross Margin: 80.4% for Q4 2024, a 290 basis points increase from the previous year.

- Adjusted EBITDA: $5 million or 7.4% of revenue for Q4 2024, representing a 330 basis points margin improvement.

- Active Buyers: 1.3 million, a decline of 6% year over year.

- Order Growth: 1.2 million orders, a 2% increase year over year.

- Cash and Investments: Ended Q4 2024 with $52.8 million, down from $57.1 million at the beginning of the quarter.

- CapEx: $2.5 million in Q4 2024, totaling $6.6 million for the year.

- 2025 Revenue Guidance: $270 million to $280 million, representing 6% growth at the midpoint.

- 2025 Gross Margin Guidance: Expected to be in the range of 77% to 79% of revenue.

- 2025 Adjusted EBITDA Guidance: Approximately flat to 2024's 3.3%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ThredUp Inc (TDUP, Financial) reported a 9.5% year-over-year increase in revenue for Q4 2024, driven by marketing investments, AI upgrades, and a focus on core business.

- Customer acquisition remained strong, with new customer volume up 32% year-over-year in Q4, and Q1 shaping up to be one of the strongest acquisition quarters in the company's history.

- The company achieved its first full year of adjusted profitability in 2024, with a significant improvement in adjusted EBITDA margins.

- ThredUp Inc (TDUP) is leveraging generative AI to enhance the shopping experience, with AI search functionality driving higher conversion rates and new shopping methods being introduced.

- The company is confident in reaching positive free cash flow on an annual basis in 2025, supported by multi-year investments in infrastructure, technology, and software.

Negative Points

- Active buyers declined by 6% year-over-year, despite the increase in new customer volume.

- Gross margins are expected to decline slightly in 2025 due to higher incentives required for converting first-time buyers.

- The company faces uncertainty in the consumer environment, with potential impacts from tariffs and inflation on consumer spending.

- ThredUp Inc (TDUP) plans to maintain similar adjusted EBITDA margins in 2025, indicating limited margin expansion despite revenue growth.

- The company is still in the early stages of aggressively investing in marketing and operations, which may pose risks if trends do not play out as expected.