- Scotiabank (BNS, Financial) expects a net income surge of C$62 million from its investment in KeyCorp (KEY).

- The adjusted net income contribution could rise to C$71 million after amortization.

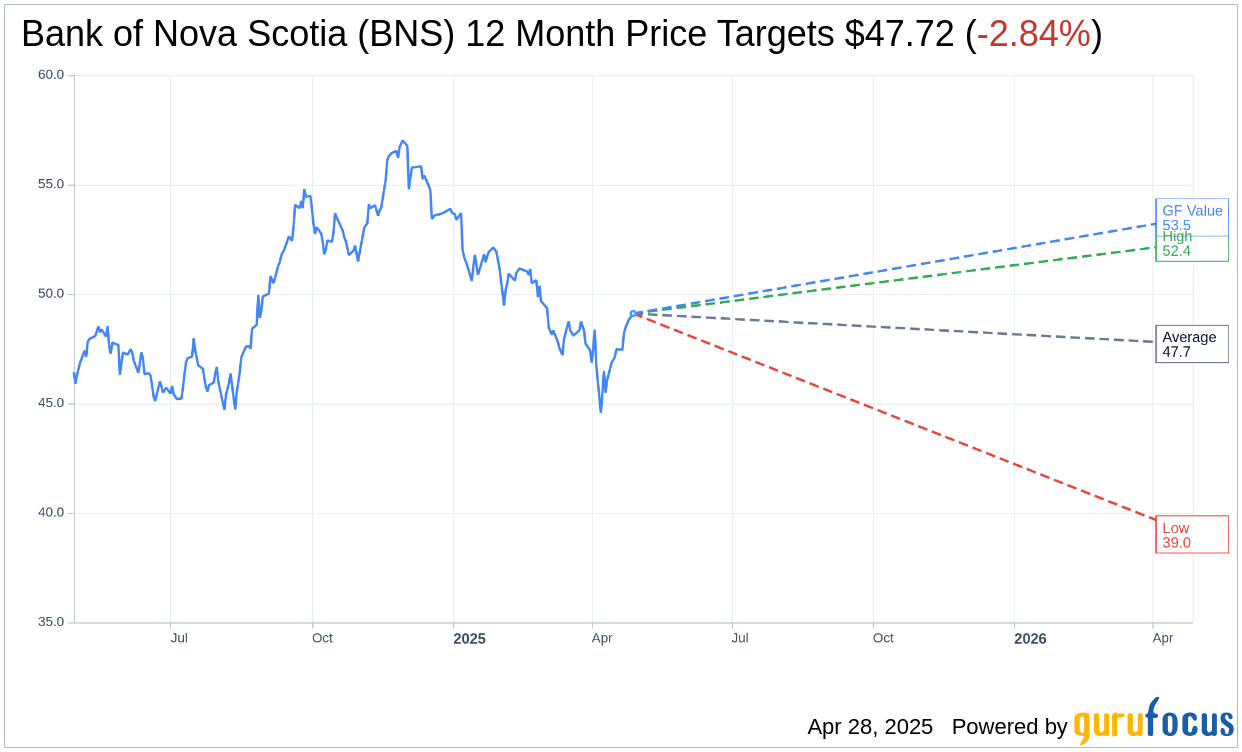

- Analysts maintain a "Hold" status with a potential upside in GF Value estimates.

Scotiabank (BNS) is poised for a significant financial uplift in its fiscal second quarter, projecting a net income increase of approximately C$62 million, thanks to its substantial 14.9% stake in KeyCorp (KEY). Once adjusted for a C$9 million amortization of intangible assets, the boost to adjusted net income is forecasted to reach C$71 million. This anticipation has positively impacted BNS shares, which climbed 1.19% in pre-market trading.

Wall Street Analysts' Forecast and Recommendations

For investors closely watching Bank of Nova Scotia (BNS, Financial), the insights from Wall Street analysts reveal a range of expectations. Based on data from 4 analysts, the one-year average price target is pegged at $47.72. With a high prediction of $52.35 and a low of $39.02, the average target suggests a downside of 2.84% from the current share price of $49.11.

In terms of brokerage analysis, Scotiabank holds an average recommendation rating of 3.5, indicating a "Hold" stance. This rating, compiled from assessments by 2 brokerage firms, falls on a scale where 1 signifies a "Strong Buy," and 5 represents a "Sell" recommendation.

Understanding the GF Value Projection

According to GuruFocus, the estimated GF Value for Scotiabank (BNS, Financial) over the next year is $53.50. This suggests a potential upside of 8.94% from the current price of $49.11. The GF Value metric provides an insightful estimate of the stock's fair trading value, drawing from historical trading multiples, past business growth, and future performance projections.

For investors keen on a deeper dive into market estimates and evaluations, more comprehensive data can be accessed on the Bank of Nova Scotia (BNS, Financial) Summary page. This information can guide investors in making more informed decisions amid the evolving financial landscape.