- Virtus Investment Partners (VRTS, Financial) faces market challenges but reports increased earnings per share.

- Analysts forecast an 8.79% upside potential, with a target price of $166.75.

- GuruFocus estimates a GF Value suggesting a 22.75% upside from the current price.

Virtus Investment Partners (NASDAQ: VRTS) confronted notable challenges during Q1 2025 as market volatility contributed to reduced assets under management and persistent net outflows. In the face of these hurdles, the company reported an improvement in earnings per share year-over-year and observed positive investment trends in ETFs and fixed-income strategies. By the end of March, total assets under management (AUM) stood at $167.5 billion.

Wall Street Analysts Forecast

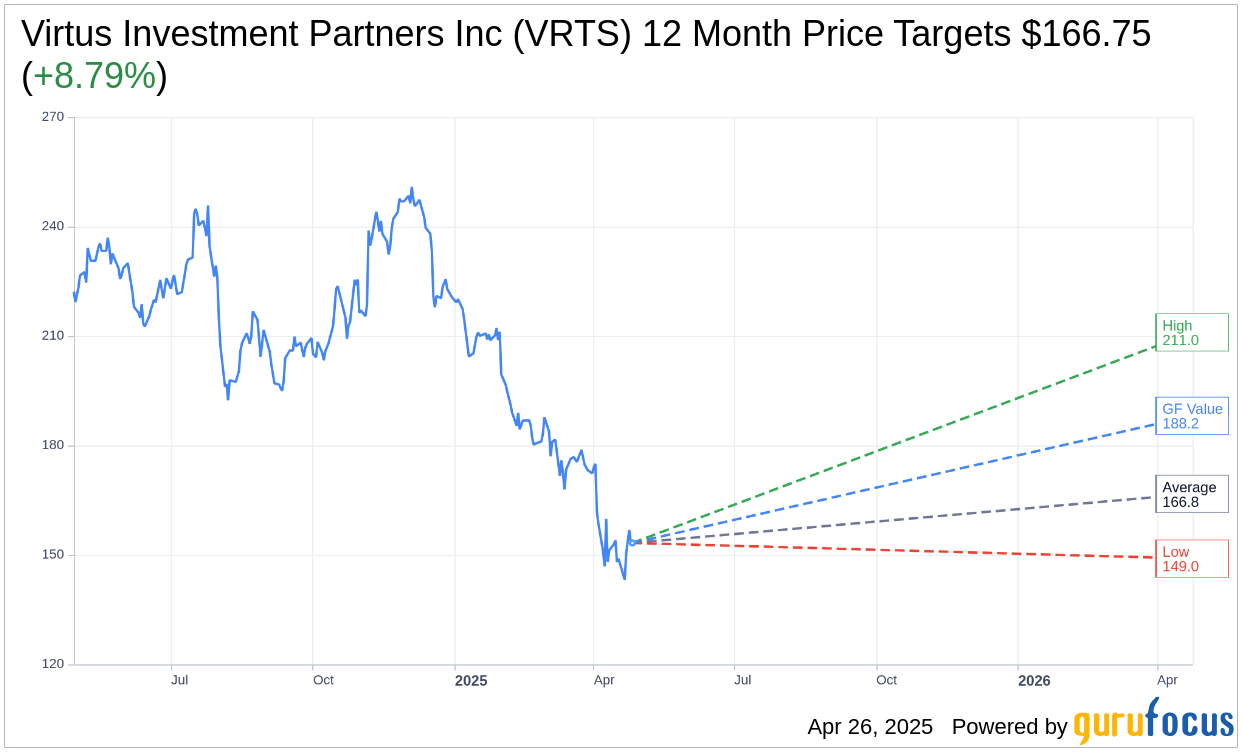

Wall Street analysts present a varied outlook for Virtus Investment Partners Inc. (VRTS, Financial), with four analysts offering a one-year average price target of $166.75. Estimates range from a high of $211.00 to a low of $149.00, representing an implied upside potential of 8.79% from the current market price of $153.28. Investors can explore more detailed projections on the Virtus Investment Partners Inc (VRTS) Forecast page.

The consensus recommendation from four brokerage firms places Virtus Investment Partners Inc. (VRTS, Financial) within a "Hold" spectrum, with an average brokerage recommendation of 3.3. This rating operates on a scale where 1 denotes a "Strong Buy" and 5 signifies a "Sell" stance, indicating a cautious sentiment among analysts.

The GF Value estimate by GuruFocus suggests Virtus Investment Partners Inc. (VRTS, Financial) could reach a value of $188.15 within one year, implying a potential upside of 22.75% from the current price point of $153.28. The GF Value is determined by historical trading multiples, prior business growth, and future business performance forecasts. Detailed insights are accessible on the Virtus Investment Partners Inc (VRTS) Summary page.