Summary:

- EZCORP (EZPW, Financial) set to release Q2 earnings on April 28th, with projections of a 10.7% EPS growth.

- Analysts set an average one-year price target of $18.50, indicating potential upside.

- The stock's current "Outperform" rating reflects positive market sentiment.

EZCORP Inc. (NASDAQ: EZPW) is preparing to unveil its second-quarter earnings results on April 28th, after the market closes. Wall Street anticipates a moderately positive report, forecasting a 10.7% annual increase in earnings per share (EPS) to $0.31 and an 8.7% uplift in revenue, reaching $310.35 million. Historical performance reveals EZCORP has consistently surpassed EPS expectations 88% of the time, further buoyed by recent favorable revisions.

Wall Street Analysts Forecast

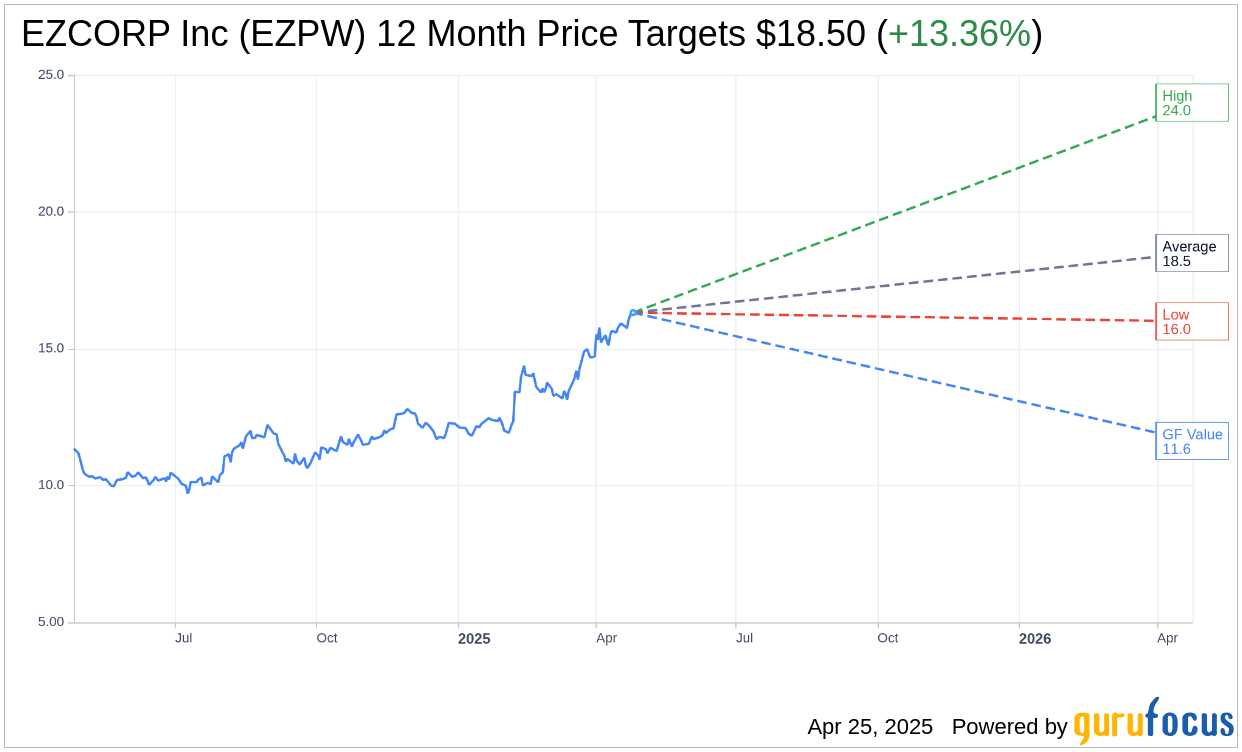

Wall Street analysts have shared their one-year price targets for EZCORP Inc. (EZPW, Financial), presenting an average target of $18.50. This target lies between a high of $24.00 and a low of $16.00, suggesting a promising upside of 13.36% from the current trading price of $16.32. Investors can explore more intricate forecasts on the EZCORP Inc. (EZPW) Forecast page.

Currently, the consensus from four brokerage firms rates EZCORP Inc. (EZPW, Financial) at an average recommendation of 2.0, indicating an "Outperform" status. In the brokerage rating system, a score of 1 represents a Strong Buy, while a 5 indicates a Sell.

The GuruFocus GF Value metric estimates EZCORP Inc.'s (EZPW, Financial) fair value at $11.63 over the next year. This suggests a potential downside of 28.74% from its current price of $16.32. The GF Value is calculated by considering historical trading multiples, past growth, and projected future performance. For a deeper analysis, please visit the EZCORP Inc. (EZPW) Summary page.