Key Highlights:

- Stanley Black & Decker maintains its quarterly dividend, rewarding long-term investors.

- Analysts project a potential 48.40% upside for SWK's stock price.

- Current consensus from brokerage firms suggests holding SWK shares.

Stanley Black & Decker (SWK, Financial) continues to reward its investors by sustaining its quarterly dividend of $0.82 per share. This decision keeps the company's forward yield steady at 5.33%, offering a reliable income stream for shareholders. The dividend will be paid out on June 17 to those who are shareholders by June 3, aligning the ex-dividend date with the record date.

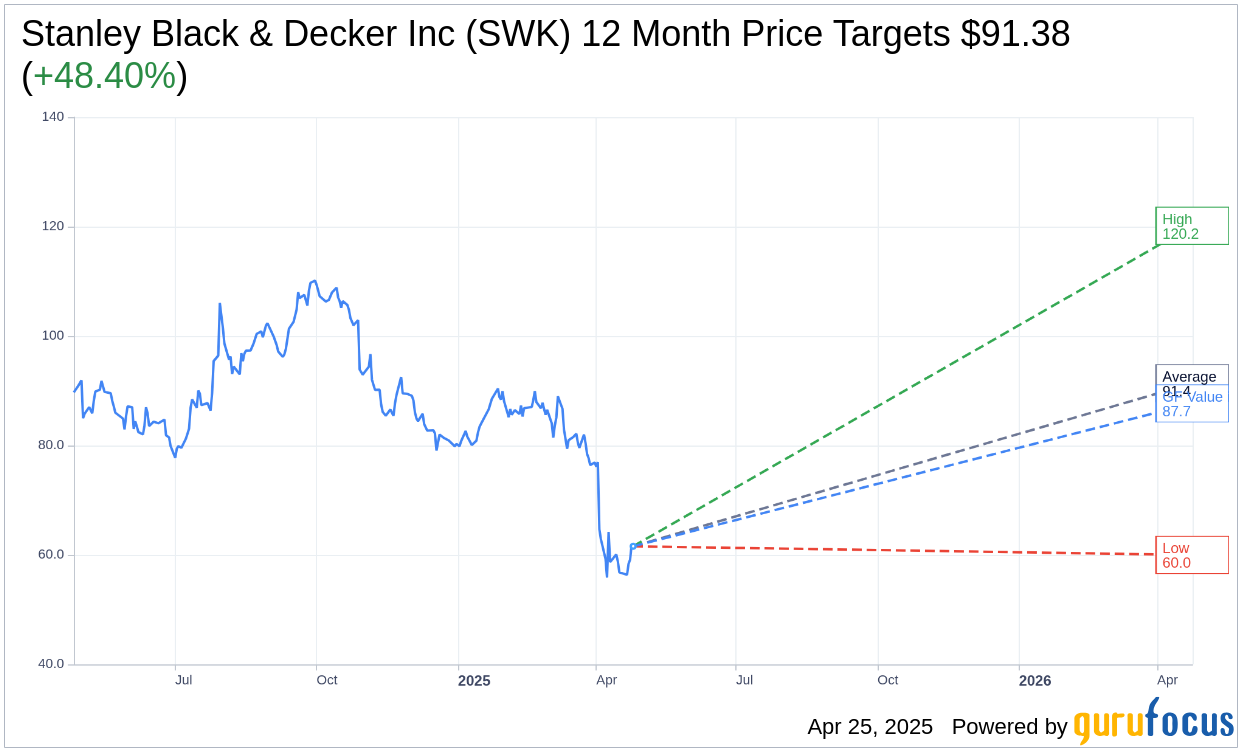

Wall Street Analysts Forecast

Analyst sentiment on Stanley Black & Decker Inc (SWK, Financial) remains optimistic. Based on projections from 14 analysts, the average price target is set at $91.38, with forecasts spanning from a high of $120.15 to a low of $60.00. This average price target signals a potential upside of 48.40% from its present trading price of $61.58. For more detailed projections, visit the Stanley Black & Decker Inc (SWK) Forecast page.

The consensus among 21 brokerage firms is a recommendation score of 2.7 for Stanley Black & Decker Inc (SWK, Financial), suggesting a "Hold" status. It's important to note that this rating scale ranges from 1 (Strong Buy) to 5 (Sell), placing SWK comfortably in the middle.

Utilizing GuruFocus's proprietary metrics, the projected GF Value for Stanley Black & Decker Inc (SWK, Financial) stands at $87.69, indicating a potential upside of 42.4% from its current market price of $61.58. The GF Value estimate reflects a stock's fair trading value, based on historical multiples, past growth, and future business performance estimates. More comprehensive data is available on the Stanley Black & Decker Inc (SWK) Summary page.

Also check out: (Free Trial)