Baird has adjusted its price target for United Rentals (URI, Financial), increasing it from $535 to $571. This revision comes as the firm updates its financial model in the wake of United Rentals' first-quarter performance results.

Despite the increase in projected share value, Baird maintains a Neutral rating on United Rentals. The change reflects a reassessment of the company's earnings outlook and financial health, but does not yet signal a shift to a more bullish stance.

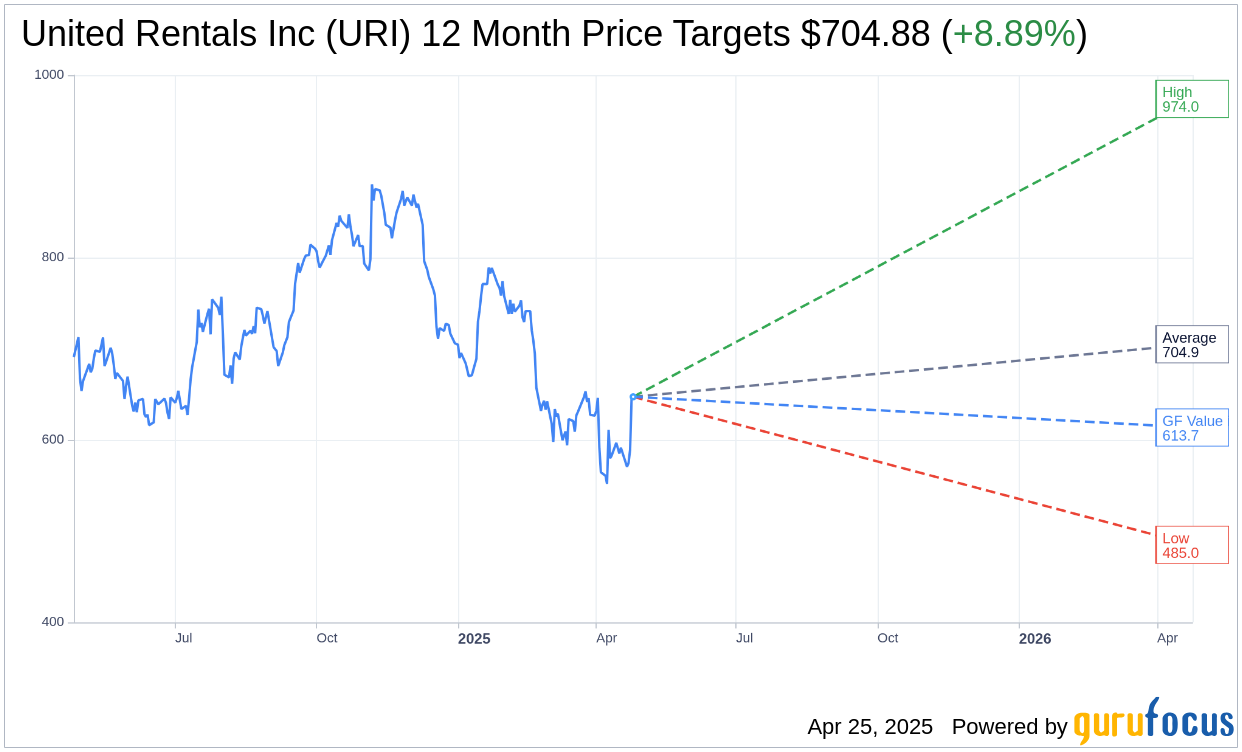

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for United Rentals Inc (URI, Financial) is $704.88 with a high estimate of $974.00 and a low estimate of $485.00. The average target implies an upside of 8.89% from the current price of $647.36. More detailed estimate data can be found on the United Rentals Inc (URI) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, United Rentals Inc's (URI, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for United Rentals Inc (URI, Financial) in one year is $613.66, suggesting a downside of 5.21% from the current price of $647.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the United Rentals Inc (URI) Summary page.

URI Key Business Developments

Release Date: January 30, 2025

- Total Revenue: Grew 9.8% year over year to almost $4.1 billion.

- Rental Revenue: Increased by 9.7% to $3.4 billion.

- Fleet Productivity: Increased by 4.3% as reported.

- Adjusted EBITDA: Reached a record of $1.9 billion with a margin of over 46%.

- Adjusted EPS: Grew to $11.59, a fourth-quarter record.

- Specialty Rental Revenue: Grew more than 30% year over year.

- Used Equipment Sales: Generated over $850 million in the quarter.

- Free Cash Flow: Nearly $2.1 billion with a margin of over 13%.

- Shareholder Returns: Over $1.9 billion returned through share buybacks and dividends.

- Quarterly Dividend: Increased by 10% to $1.79 per share.

- Net Leverage: 1.8x at the end of December.

- Total Liquidity: Over $2.8 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- United Rentals Inc (URI, Financial) reported record fourth-quarter revenue of $4.1 billion, a 9.8% year-over-year increase.

- The company achieved a fourth-quarter record adjusted EBITDA of $1.9 billion, with a margin of over 46%.

- Specialty rental revenue grew impressively by more than 30% year over year.

- United Rentals Inc (URI) generated nearly $2.1 billion in free cash flow, translating to a healthy free cash flow margin of over 13%.

- The company announced a 10% increase in its quarterly dividend to $1.79 per share, reflecting confidence in future growth.

Negative Points

- The adjusted EBITDA margin experienced a compression of 210 basis points year over year.

- Used equipment sales contributed to a 9% decline in used gross profit dollars, impacting adjusted EBITDA.

- SG&A expenses increased by $36 million year over year, aligning with revenue growth but indicating higher operational costs.

- The company paused its share repurchase plan ahead of the H&E acquisition, potentially impacting shareholder returns.

- The ongoing normalization of the used equipment market presents a headwind to profitability.