Wells Fargo, through its analyst Matthew Akers, has elevated the price target for General Dynamics (GD, Financial) from $236 to $282 while maintaining an Equal Weight rating on the stock. This adjustment reflects the firm's assessment of the company's resilience in the face of potential tariff impacts. Despite General Dynamics withholding specifics on tariff influences, Wells Fargo observes that the company's predominantly U.S.-based or USMCA-compliant supply chain positions it to handle these challenges effectively.

The analysis implies that there could be favorable prospects for General Dynamics' financial guidance, which currently does not incorporate the effects of share repurchases. Wells Fargo's outlook suggests that the company's strategic positioning could offer additional growth potential that isn't reflected in existing forecasts.

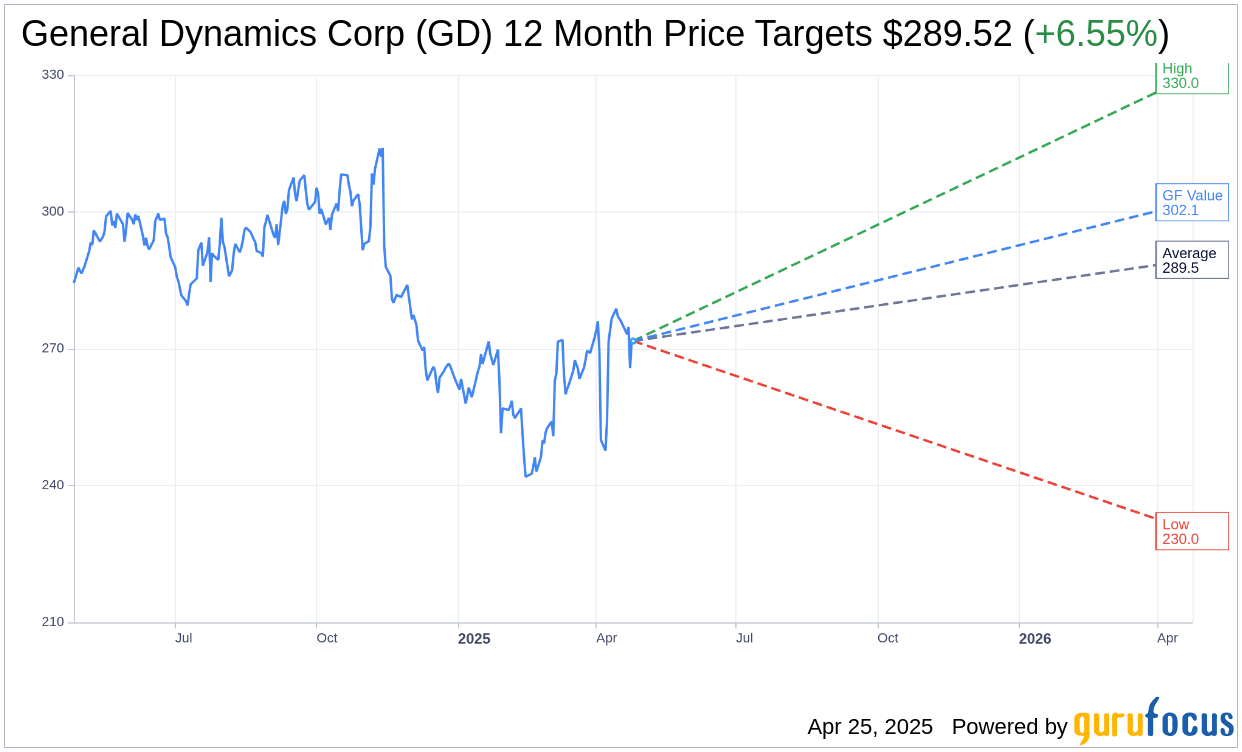

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for General Dynamics Corp (GD, Financial) is $289.52 with a high estimate of $330.00 and a low estimate of $230.00. The average target implies an upside of 6.55% from the current price of $271.71. More detailed estimate data can be found on the General Dynamics Corp (GD) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, General Dynamics Corp's (GD, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for General Dynamics Corp (GD, Financial) in one year is $302.13, suggesting a upside of 11.2% from the current price of $271.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the General Dynamics Corp (GD) Summary page.

GD Key Business Developments

Release Date: April 23, 2025

- Revenue: $12.2 billion, up 13.9% year-over-year.

- Earnings per Diluted Share: $3.66, up 27.1% year-over-year.

- Operating Earnings: $1.268 billion, up 22.4% year-over-year.

- Net Earnings: $994 million, up 24.4% year-over-year.

- Operating Margin: 10.4%, a 70-basis point improvement over the previous year.

- Free Cash Flow: Negative $290 million for the quarter.

- Capital Expenditures: $142 million, 1.2% of sales.

- Shareholder Returns: $980 million returned through dividends and share repurchases.

- Backlog: $89 billion at quarter end.

- Book to Bill Ratio: Overall less than 1, Technologies group at 1.1.

- Aerospace Revenue: $3.03 billion, up 45.2% year-over-year.

- Aerospace Operating Margin: 14.3%.

- Combat Systems Revenue: $2.18 billion, up 3.5% year-over-year.

- Marine Systems Revenue Growth: 7.7% year-over-year.

- Technologies Group Revenue: $3.43 billion, up 6.8% year-over-year.

- Technologies Group Operating Margin: Improved from 9.2% to 9.6%.

- Net Debt Position: $8.4 billion.

- Effective Tax Rate: 17.2% for the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- General Dynamics Corp (GD, Financial) reported a strong first quarter with earnings of $3.66 per diluted share, a 27.1% increase from the previous year.

- Revenue increased by 13.9% to $12.2 billion, with operating earnings up 22.4% and net earnings up 24.4%.

- The Aerospace segment led with a 45.2% revenue increase, driven by a 50% increase in aircraft deliveries, including the introduction of the G700.

- The Technologies group had a strong quarter with a book-to-bill ratio of 1.1, reflecting robust demand for advanced technology solutions.

- The Marine Systems segment demonstrated impressive revenue growth, driven by Columbia class and Virginia class construction, and increased DDG-51 construction.

Negative Points

- Free cash flow for the quarter was negative $290 million, impacted by inventory buildup and working capital requirements.

- The total backlog decreased slightly to $89 billion due to a book-to-bill ratio of less than one, influenced by a 14% revenue increase.

- The supply chain continues to face delays and quality issues, affecting the Marine Systems segment's ability to achieve operating leverage.

- The Aerospace segment faces potential impacts from tariffs, with uncertainty around how these will affect export revenue.

- The Technologies group faces uncertainty in the IT services market due to the administration's evolving spending priorities.