On April 24, 2025, Northfield Bancorp Inc (NFBK, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. Northfield Bancorp Inc, the holding company for Northfield Bank, provides banking services in New York and New Jersey, focusing on deposits, credit, and other banking services for individuals and corporate customers.

Performance Overview

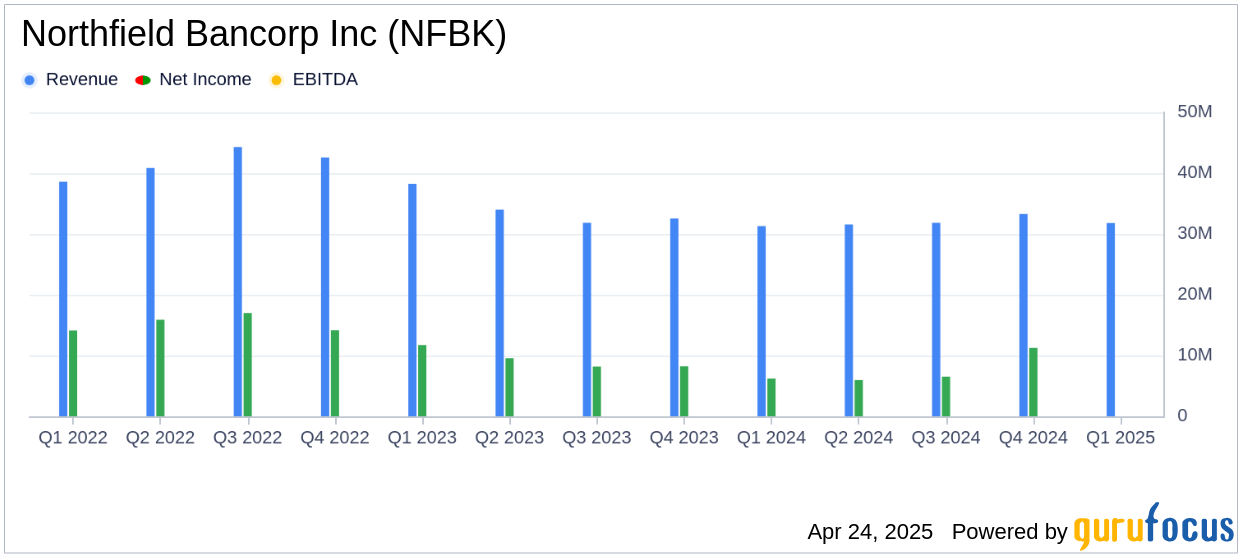

Northfield Bancorp Inc reported a diluted earnings per share (EPS) of $0.19 for the first quarter of 2025, surpassing the analyst estimate of $0.18. However, the company's revenue of $31.8 million fell short of the estimated $32.01 million. The EPS showed an improvement from $0.15 in the first quarter of 2024 but was lower than the $0.27 reported in the fourth quarter of 2024, which included a $3.4 million gain from a property sale.

Key Financial Achievements

The company's net interest margin increased to 2.38% from 2.18% in the previous quarter and 2.03% in the same quarter last year. This improvement was driven by lower funding costs and higher yields on interest-earning assets. Deposits, excluding brokered deposits, rose by $133.6 million, or 13.8% annualized, while the cost of deposits slightly decreased to 1.94% from 1.95% at the end of 2024.

Income Statement Highlights

Net income for the quarter was $7.9 million, compared to $6.2 million in the first quarter of 2024. The increase was primarily due to a $3.9 million rise in net interest income, offset by a $2.2 million increase in the provision for credit losses on loans. Non-interest income decreased by $359,000, while non-interest expenses fell by $897,000, mainly due to reduced employee compensation and benefits.

Balance Sheet and Cash Flow Insights

Total assets increased by $43.6 million to $5.71 billion, with a notable rise in available-for-sale debt securities. Loans declined by $30.7 million, primarily due to a decrease in multifamily loans. The company maintained strong liquidity with $1.12 billion in unpledged available-for-sale securities and $547 million in loans readily available for pledge.

Asset Quality and Liquidity

Asset quality remained robust, with non-performing loans to total loans at 0.48%. The company also announced a $10.0 million stock repurchase plan, following the completion of a $5.0 million plan during the quarter. A cash dividend of $0.13 per share was declared, payable on May 21, 2025.

"The Northfield team continued to focus on growing our franchise, deploying our strong capital base, and delivering solid financial performance for the quarter," stated Steven M. Klein, Chairman and CEO. "We remained focused on serving our communities, and the fundamentals of reducing our funding costs and increasing the yield on our interest-earning assets resulting in higher net interest income and net interest margin."

Conclusion

Northfield Bancorp Inc's first quarter results reflect a solid performance in terms of earnings per share, despite a slight revenue miss. The company's strategic focus on managing funding costs and enhancing asset yields has contributed to improved net interest margins. However, challenges such as increased provisions for credit losses and a decline in loan balances highlight areas for continued attention. The company's commitment to maintaining strong liquidity and asset quality positions it well for future growth.

Explore the complete 8-K earnings release (here) from Northfield Bancorp Inc for further details.