On April 24, 2025, South Plains Financial Inc (SPFI, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. South Plains Financial Inc operates as a bank holding company, providing a wide range of commercial and consumer financial services to small and medium-sized businesses and individuals. The company's principal business activities include commercial and retail banking, along with insurance, investment, trust, and mortgage services.

Performance Overview and Challenges

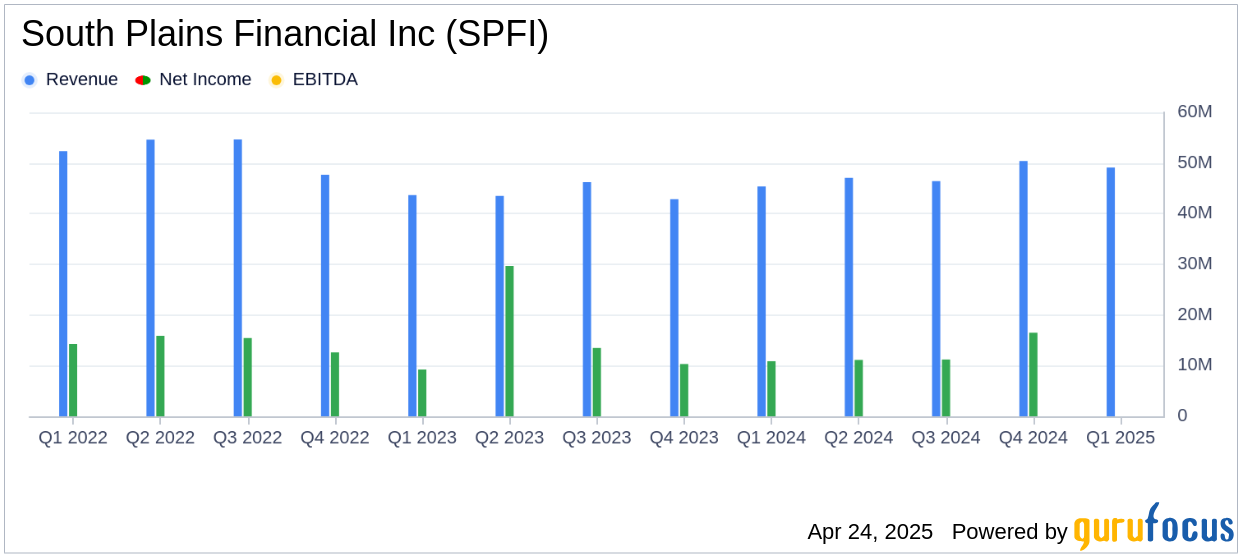

South Plains Financial Inc reported a net income of $12.3 million for the first quarter of 2025, a decrease from $16.5 million in the previous quarter but an increase from $10.9 million in the same quarter last year. The diluted earnings per share (EPS) for the quarter was $0.72, surpassing the analyst estimate of $0.67. However, the company's revenue of $48.5 million fell short of the estimated $48.93 million.

The company's performance is crucial as it reflects its ability to generate profits and manage costs effectively. Challenges such as declining interest income and increased noninterest expenses could pose risks to future profitability.

Financial Achievements and Industry Importance

South Plains Financial Inc achieved a net interest margin of 3.81% on a tax-equivalent basis, up from 3.75% in the previous quarter and 3.56% in the same quarter last year. This improvement is significant for banks as it indicates efficient management of interest income and expenses, crucial for profitability in the banking industry.

Key Financial Metrics

Net interest income remained stable at $38.5 million compared to the previous quarter, while interest expense decreased to $21.4 million from $22.8 million. The average cost of deposits decreased to 219 basis points, reflecting improved cost management. Noninterest income decreased to $10.6 million, primarily due to lower mortgage banking revenues.

| Metric | Q1 2025 | Q4 2024 | Q1 2024 |

|---|---|---|---|

| Net Income ($M) | 12.3 | 16.5 | 10.9 |

| Diluted EPS ($) | 0.72 | 0.96 | 0.64 |

| Net Interest Margin (%) | 3.81 | 3.75 | 3.56 |

Analysis of Company's Performance

South Plains Financial Inc's performance in the first quarter of 2025 highlights its ability to maintain profitability despite challenges. The company's focus on improving deposit costs and expanding its loan portfolio contributed to its positive EPS performance. However, the decline in noninterest income and increased expenses indicate areas that require attention to sustain growth.

Curtis Griffith, South Plains’ Chairman and Chief Executive Officer, commented, “We delivered strong first quarter results highlighted by solid deposit growth, healthy margin expansion as our cost of funds continued to improve, and loan growth that was in line with our expectations.”

Overall, South Plains Financial Inc's first quarter results demonstrate resilience in a challenging environment, with strategic initiatives aimed at enhancing profitability and growth. Investors and stakeholders will be keen to see how the company navigates future challenges while capitalizing on growth opportunities.

Explore the complete 8-K earnings release (here) from South Plains Financial Inc for further details.