On April 24, 2025, Digital Realty Trust Inc (DLR, Financial) released its 8-K filing, detailing its financial results for the first quarter of 2025. Digital Realty, a leading global provider of data center, colocation, and interconnection solutions, operates over 300 data centers worldwide, with nearly 40 million rentable square feet across five continents. The company primarily focuses on providing higher-level services to tenants, outsourcing their IT needs to Digital Realty.

Performance Overview

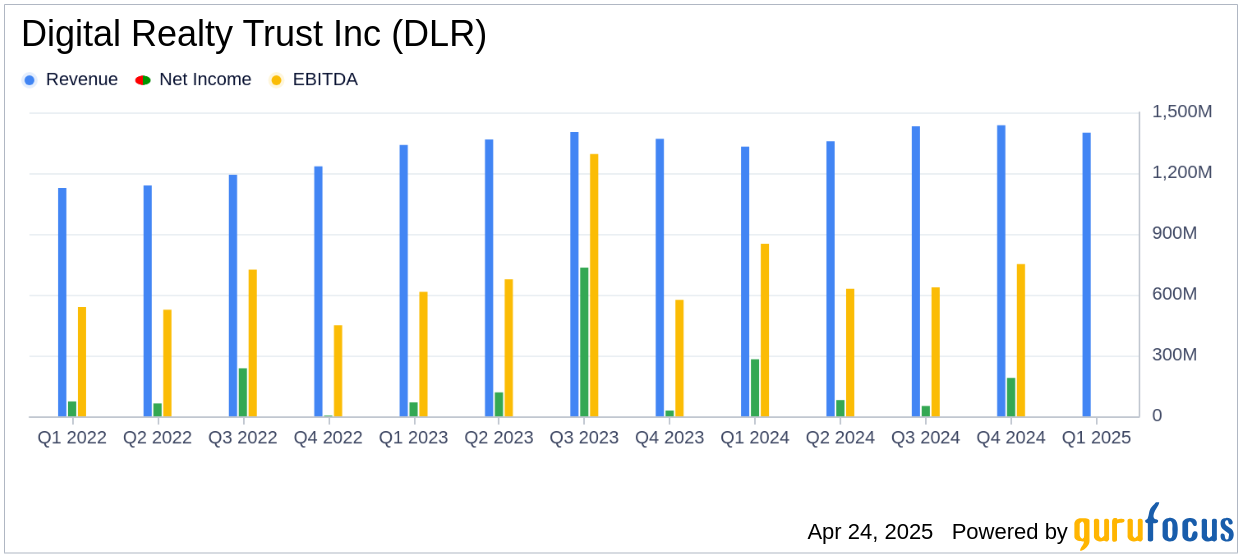

Digital Realty reported revenues of $1.4 billion for Q1 2025, which fell short of the estimated $1.426 billion. This represents a 2% decrease from the previous quarter but a 6% increase from the same quarter last year. The company's net income was $106 million, translating to $0.27 per share, which is above the estimated earnings per share of $0.26. This is a decline from $0.51 per share in the previous quarter and $0.82 per share in the same quarter last year.

Financial Achievements and Challenges

Despite the revenue miss, Digital Realty achieved a significant milestone with its Core Funds From Operations (Core FFO) per share reaching $1.77, surpassing the previous quarter's $1.73 and the same quarter last year's $1.67. The company also reported a Constant-Currency Core FFO per share of $1.79. These achievements are crucial for a REIT like Digital Realty, as they reflect the company's ability to generate cash flow to support dividends and growth.

“Robust demand across our key product segments drove strong leasing and acceleration in Core FFO per share growth in the first quarter,” said Digital Realty President & Chief Executive Officer Andy Power.

Income Statement and Key Metrics

Digital Realty's Adjusted EBITDA for Q1 2025 was $791 million, marking a 5% increase from the previous quarter and an 11% increase from the same quarter last year. The Funds From Operations (FFO) stood at $571 million, or $1.67 per share, compared to $1.61 per share in the previous quarter and $1.41 per share in the same quarter last year. These metrics are vital as they provide insights into the company's operational efficiency and profitability.

Leasing and Investment Activities

In Q1 2025, Digital Realty signed total bookings expected to generate $242 million of annualized GAAP rental revenue. The company also signed renewal leases representing $147 million of annualized cash rental revenue, with rental rates on renewal leases increasing by 5.6% on a cash basis and 7.1% on a GAAP basis.

Digital Realty's investment activities included the acquisition of three land parcels in Charlotte, North Carolina, and the formation of its U.S. Hyperscale Data Center Fund, raising over $1.7 billion in equity commitments. These strategic moves are designed to enhance the company's growth and market presence.

Balance Sheet and Debt Management

As of March 31, 2025, Digital Realty had approximately $17.0 billion of total debt, with a net debt-to-Adjusted EBITDA ratio of 5.1x. The company's debt-plus-preferred-to-total enterprise value was 26.6%, and the fixed charge coverage was 4.9x. Effective debt management is crucial for maintaining financial stability and supporting future growth initiatives.

Conclusion

Digital Realty Trust Inc (DLR, Financial) demonstrated resilience in Q1 2025, with strong Core FFO growth despite revenue challenges. The company's strategic investments and robust leasing activity position it well for future growth. However, managing debt levels and maintaining operational efficiency will be key to sustaining its competitive edge in the data center industry.

Explore the complete 8-K earnings release (here) from Digital Realty Trust Inc for further details.