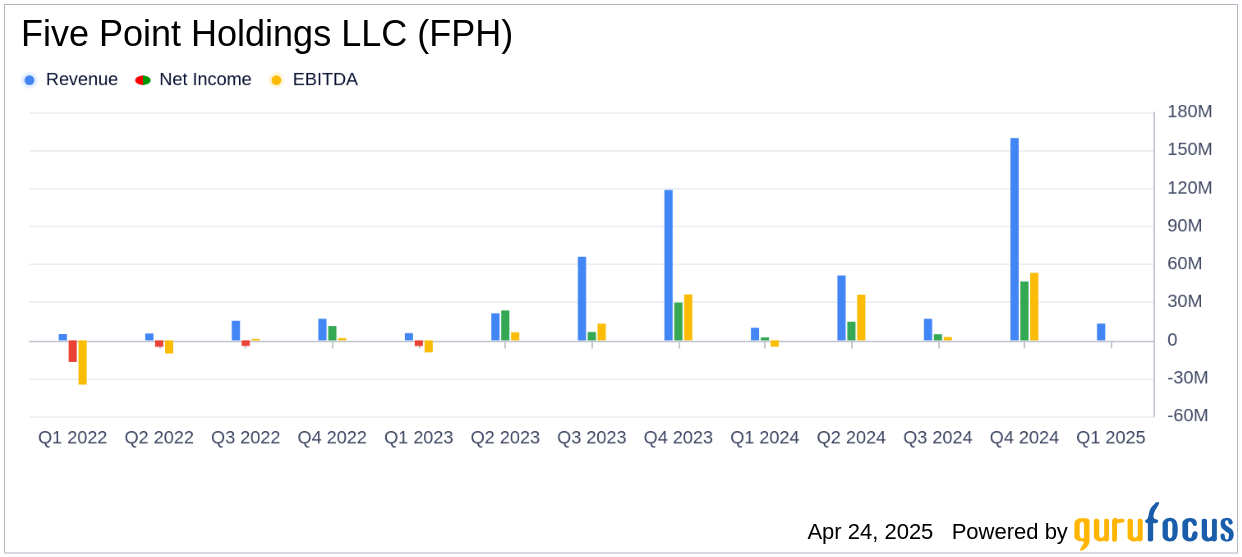

On April 24, 2025, Five Point Holdings LLC (FPH, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. Five Point Holdings LLC, a prominent developer of mixed-use, master-planned communities in California, reported a consolidated net income of $60.6 million for the quarter. The company, which operates through segments in Valencia, San Francisco, and Great Park, derives most of its revenue from the Great Park segment.

Performance Highlights and Challenges

Five Point Holdings LLC reported consolidated revenues of $13.2 million, primarily from management services. The company faced challenges due to market uncertainties, particularly concerning elevated mortgage rates and their impact on homebuyer demand. Despite these challenges, CEO Dan Hedigan expressed optimism, stating,

Homebuilder demand remained strong during the first quarter. At our Great Park Neighborhoods community, we closed a number of significant homesite sales and also signed multiple purchase agreements for additional homesites that are scheduled to close in the fourth quarter of 2025."

Financial Achievements and Industry Importance

The company's financial achievements include the sale of 325 homesites at the Great Park Neighborhoods for $278.9 million and receiving $143.3 million in distributions and incentive compensation from the Great Park Venture. These achievements are crucial for a real estate company like Five Point Holdings LLC, as they reflect the company's ability to generate significant revenue from its core operations despite market volatility.

Key Financial Metrics

Five Point Holdings LLC's balance sheet as of March 31, 2025, showed cash and cash equivalents of $528.3 million, contributing to a total liquidity of $653.3 million. The company's debt to total capitalization ratio stood at 19.2%, indicating a conservative leverage position. The equity in earnings from unconsolidated entities was $71.4 million, with the Great Park Venture contributing significantly to this figure.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenues | $13.2 million | $9.9 million |

| Net Income | $60.6 million | $6.1 million |

| Net Income Attributable to the Company | $23.3 million | $2.3 million |

Analysis of Company Performance

Five Point Holdings LLC's performance in the first quarter of 2025 demonstrates resilience in the face of economic uncertainties. The company's strategic focus on its core segments, particularly the Great Park, has allowed it to maintain strong financial results. The upgrade of its senior notes rating to B+ by S&P Global Ratings further underscores the company's solid financial standing.

Overall, Five Point Holdings LLC's first quarter results reflect its ability to navigate market challenges while capitalizing on opportunities within the real estate sector. Investors and stakeholders will be keen to see how the company continues to manage market conditions and leverage its assets for sustained growth.

Explore the complete 8-K earnings release (here) from Five Point Holdings LLC for further details.