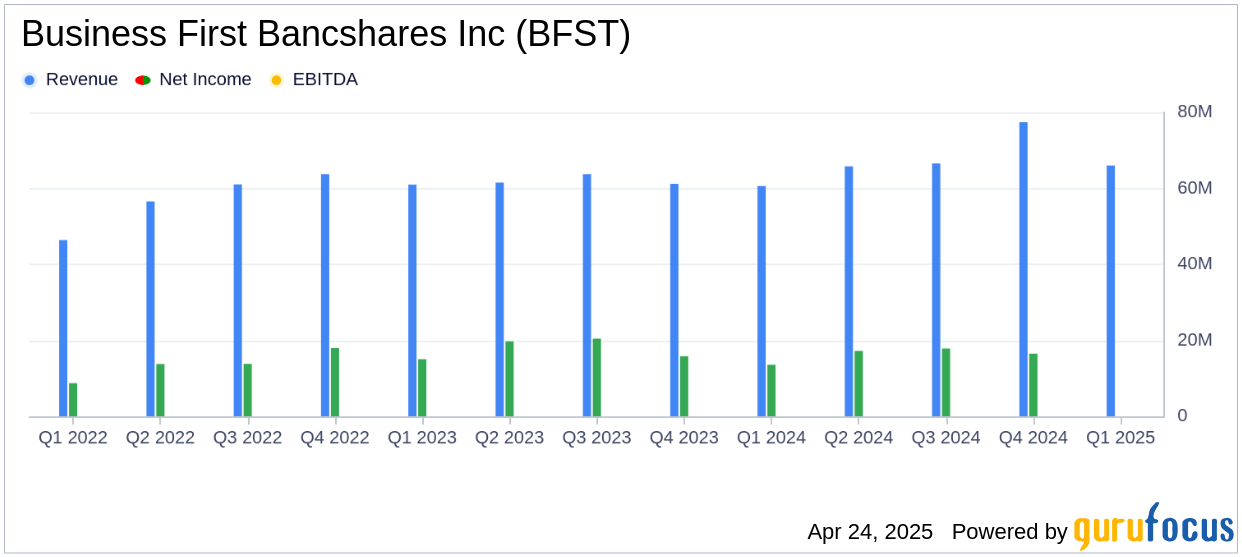

On April 24, 2025, Business First Bancshares Inc (BFST, Financial) released its 8-K filing announcing its financial results for the first quarter of 2025. The company reported a net income of $19.2 million, or $0.65 per diluted common share, exceeding the analyst estimate of $0.59 per share. Business First Bancshares Inc is a bank holding company offering a range of financial services, including personal and commercial banking, treasury management, and wealth solutions, primarily generating revenue from interest income on loans and securities.

Performance and Challenges

Business First Bancshares Inc demonstrated robust financial performance in Q1 2025, with a notable increase in net income compared to the previous quarter. The company's net interest income rose to $66.0 million, and its net interest margin expanded to 3.68%, reflecting effective management of funding costs. However, the company faced challenges with credit quality, as the ratio of nonperforming loans increased to 0.69% of loans held for investment, highlighting potential risks in loan performance.

Financial Achievements

The company's financial achievements are significant in the banking industry, where net interest margin and capital growth are critical indicators of financial health. Business First Bancshares Inc's tangible book value per common share increased to $20.84, reflecting strong earnings and positive fair value adjustments in the securities portfolio. The company's return on average assets improved to 1.00%, indicating efficient asset utilization.

Key Financial Metrics

Business First Bancshares Inc's income statement revealed a provision for credit losses of $2.8 million, a decrease from the previous quarter, indicating improved credit risk management. The company's balance sheet showed a slight decrease in loans held for investment and a reduction in deposits by $53.1 million, primarily due to customer withdrawals. Despite these challenges, the company maintained a strong capital position, with common equity to total assets increasing to 9.69%.

Commentary and Analysis

“We are excited to start the year off with solid earnings,” said Jude Melville, chairman, president, and CEO of Business First Bancshares. “We increased our capital, our reserves, and our per share tangible book value at healthy rates, while demonstrating diversity of our revenue streams and growth of margins in our core spread business.”

The company's strategic focus on capital growth and revenue diversification is evident in its financial results. The expansion of net interest margin and the increase in tangible book value per share underscore the company's ability to navigate a challenging economic environment. However, the increase in nonperforming loans and the decrease in deposits highlight areas that require ongoing attention to sustain growth and profitability.

Conclusion

Business First Bancshares Inc's Q1 2025 earnings report reflects a strong start to the year, with earnings surpassing analyst estimates and demonstrating resilience in a competitive banking landscape. The company's focus on capital growth, revenue diversification, and technological initiatives positions it well for future success, although challenges in credit quality and deposit retention remain areas to monitor closely.

Explore the complete 8-K earnings release (here) from Business First Bancshares Inc for further details.