On April 24, 2025, Alphabet Inc (GOOGL, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. The company reported a significant increase in revenue and earnings, showcasing its strong market position and growth potential.

Company Overview

Alphabet Inc, the parent company of Google, is a leading player in the interactive media industry. The California-based conglomerate generates nearly 90% of its revenue from Google services, primarily through advertising sales. Other revenue streams include subscription services like YouTube TV and YouTube Music, platform sales from the Play Store, and hardware sales such as Chromebooks and Pixel smartphones. Google Cloud contributes approximately 10% of Alphabet's revenue, with additional investments in emerging technologies like self-driving cars (Waymo) and health (Verily).

Financial Performance and Challenges

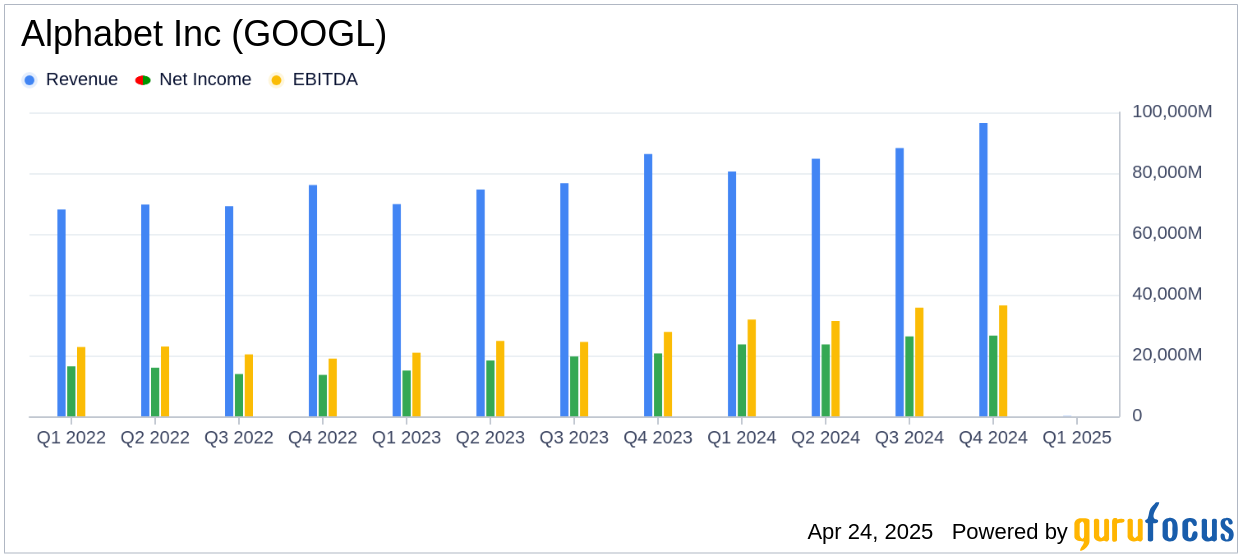

Alphabet Inc reported a 12% year-over-year increase in consolidated revenues, reaching $90.2 billion for Q1 2025. This growth was driven by double-digit increases across Google Search, YouTube ads, Google subscriptions, platforms, devices, and Google Cloud. The company's net income surged by 46% to $34.54 billion, while earnings per share (EPS) rose by 49% to $2.81, significantly exceeding the analyst estimate of $2.01.

Despite the impressive performance, Alphabet faces challenges such as maintaining growth momentum in a competitive market and navigating regulatory scrutiny. These challenges could impact future profitability and market positioning.

Key Financial Achievements

Alphabet's operating income increased by 20%, with an expanded operating margin of 34%. The company also announced a 5% increase in its quarterly cash dividend, now at $0.21 per share, reflecting its strong cash flow and commitment to returning value to shareholders.

Income Statement Highlights

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Revenues | $80,539 million | $90,234 million |

| Operating Income | $25,472 million | $30,606 million |

| Net Income | $23,662 million | $34,540 million |

| Diluted EPS | $1.89 | $2.81 |

Balance Sheet and Cash Flow Insights

Alphabet's total assets increased to $475.37 billion, with significant investments in non-marketable securities and property and equipment. The company's cash and cash equivalents remained stable at $23.26 billion, reflecting its strong liquidity position. Alphabet's robust cash flow supports its strategic investments and shareholder returns.

Segment Performance

Google Services revenue grew by 10% to $77.3 billion, driven by strong performance in Google Search, YouTube ads, and subscription services. Google Cloud revenue increased by 28% to $12.3 billion, highlighting the growing demand for cloud solutions and AI infrastructure.

Commentary and Strategic Outlook

Sundar Pichai, CEO, stated: “We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI. This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation.”

Conclusion

Alphabet Inc's Q1 2025 results demonstrate its robust growth trajectory and strategic focus on AI and cloud services. The company's ability to exceed earnings expectations and deliver strong financial performance underscores its leadership in the interactive media industry. However, ongoing challenges such as market competition and regulatory pressures remain areas to watch for investors.

Explore the complete 8-K earnings release (here) from Alphabet Inc for further details.