- AllianceBernstein Holding L.P. (AB, Financial) reports a strong start to 2025 with significant inflows and AUM growth.

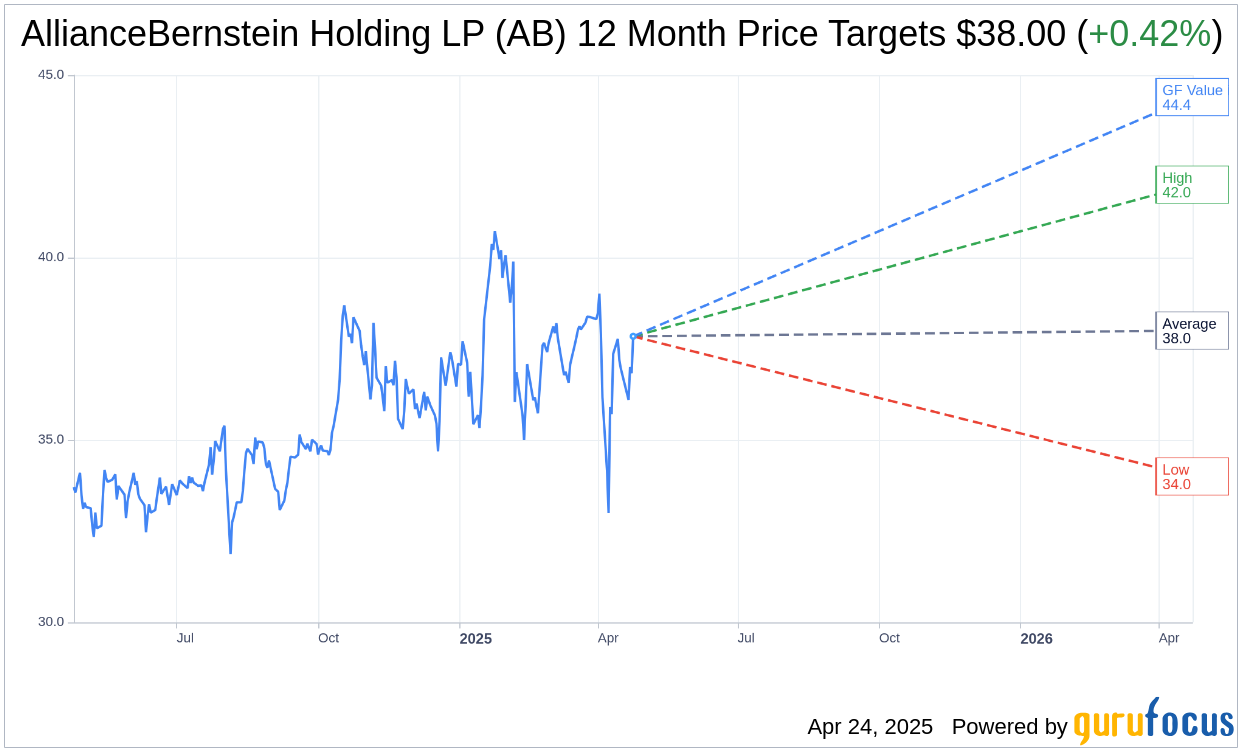

- Analyst consensus implies a modest price upside, with notable future growth potential based on GF Value.

- The firm's strategic ambitions target an increase in AUM to $90-$100 billion by 2027.

AllianceBernstein Holding L.P. (AB) kicked off 2025 on a high note, announcing a formidable first quarter with active net inflows reaching $2.7 billion. The bulk of this success, $2.4 billion, came courtesy of their tax-exempt franchise. In a testament to its growth trajectory, AllianceBernstein's private markets assets under management (AUM) saw a remarkable 20% increase from the previous year, totaling $75 billion. With eyes set on the future, the firm is targeting an impressive AUM expansion to between $90 billion and $100 billion by the year 2027.

Wall Street Analysts' Projections

Wall Street analysts have weighed in, offering one-year price targets for AllianceBernstein Holding LP (AB, Financial). The average target price stands at $38.00, with a range stretching from a high of $42.00 to a low of $34.00. This average presents a modest upside of 0.56% from the current trading price of $37.79. For a deeper dive into these estimates, visit the AllianceBernstein Holding LP (AB) Forecast page.

Moreover, consensus from seven brokerage firms places AllianceBernstein Holding LP (AB, Financial) at an average recommendation of 2.6, reflecting a "Hold" status. The recommendation scale ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell.

Assessing AllianceBernstein's Valuation

According to GuruFocus' proprietary analysis, the estimated GF Value for AllianceBernstein Holding LP (AB, Financial) over the next year is $44.40. This suggests a significant upside potential of 17.49% from the current stock price of $37.79. The GF Value is GuruFocus' calculated estimate of the stock's fair value, derived from historical trading multiples, past business growth, and future business performance estimates. Additional detailed data and insights are available on the AllianceBernstein Holding LP (AB) Summary page.