- NextEra Energy Inc. (NEE, Financial) has received an upgraded stock rating from hold to buy.

- Analyst predictions suggest a significant potential upside of 25.99%.

- The company's future looks promising with a potential 10% annual dividend growth.

NextEra Energy's (NEE) stock rating has been elevated from hold to buy by Envision Research. This upgrade reflects growing confidence in the company's ability to sustain approximately 10% annual dividend growth, buoyed by its solid historical performance and recent earnings guidance.

Wall Street Analysts Forecast

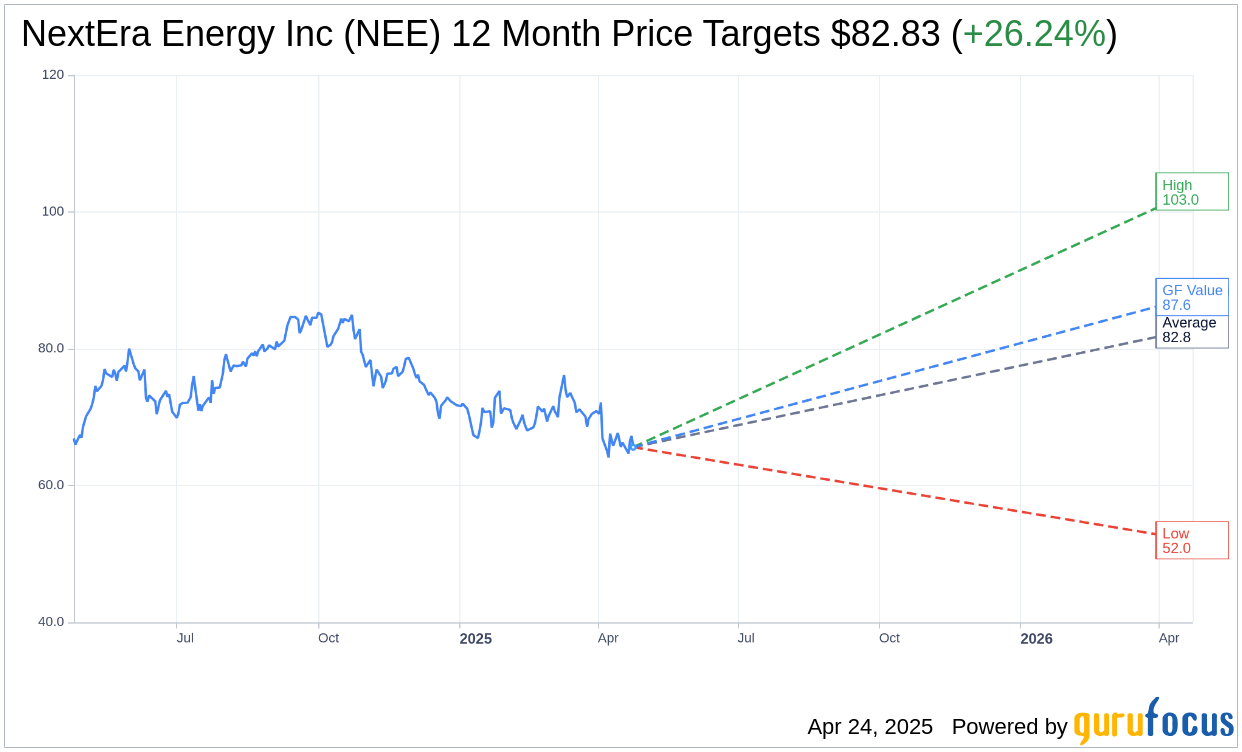

In a comprehensive review by 19 analysts, the one-year price target for NextEra Energy Inc. (NEE) averages at $82.83, with estimates ranging from a high of $103.00 to a low of $52.00. This average price target indicates a potential upside of 25.99% from the current trading price of $65.74. For a more detailed analysis, explore the NextEra Energy Inc (NEE, Financial) Forecast page.

According to the consensus from 23 brokerage firms, NextEra Energy Inc.'s (NEE) average recommendation stands at 2.2, suggesting an "Outperform" status. The rating scale spans from 1, indicating a Strong Buy, to 5, denoting a Sell.

Per GuruFocus estimates, the anticipated GF Value for NextEra Energy Inc. (NEE) within a year is calculated at $87.57, revealing a potential upside of 33.21% from the current price of $65.74. The GF Value is GuruFocus's estimation of a stock's fair trading value, derived from historical trading multiples, past business growth, and future performance forecasts. Further in-depth data can be accessed on the NextEra Energy Inc (NEE, Financial) Summary page.