Churchill Downs (CHDN, Financial) experiences a challenging first quarter as weather conditions and an unfavorable calendar impact its Gaming and Live and Historical Racing segments. The company is responding to these difficulties, compounded by weaker consumer demand, by pausing major development projects at its track. Originally budgeted at $900 million over several years, these projects are being reassessed in light of the current economic environment.

Citizens JMP analysts suggest that this strategic shift could ultimately benefit the company. By halting these long-term investments, Churchill Downs may accelerate its debt reduction schedule, potentially improving its financial leverage quicker than anticipated by 2026.

The firm's stock, however, reflects the current challenges, dropping 7% in morning trading to $97.58. Despite the dip, Citizens maintains an Outperform rating on Churchill Downs with a target price of $157, signaling confidence in its long-term prospects.

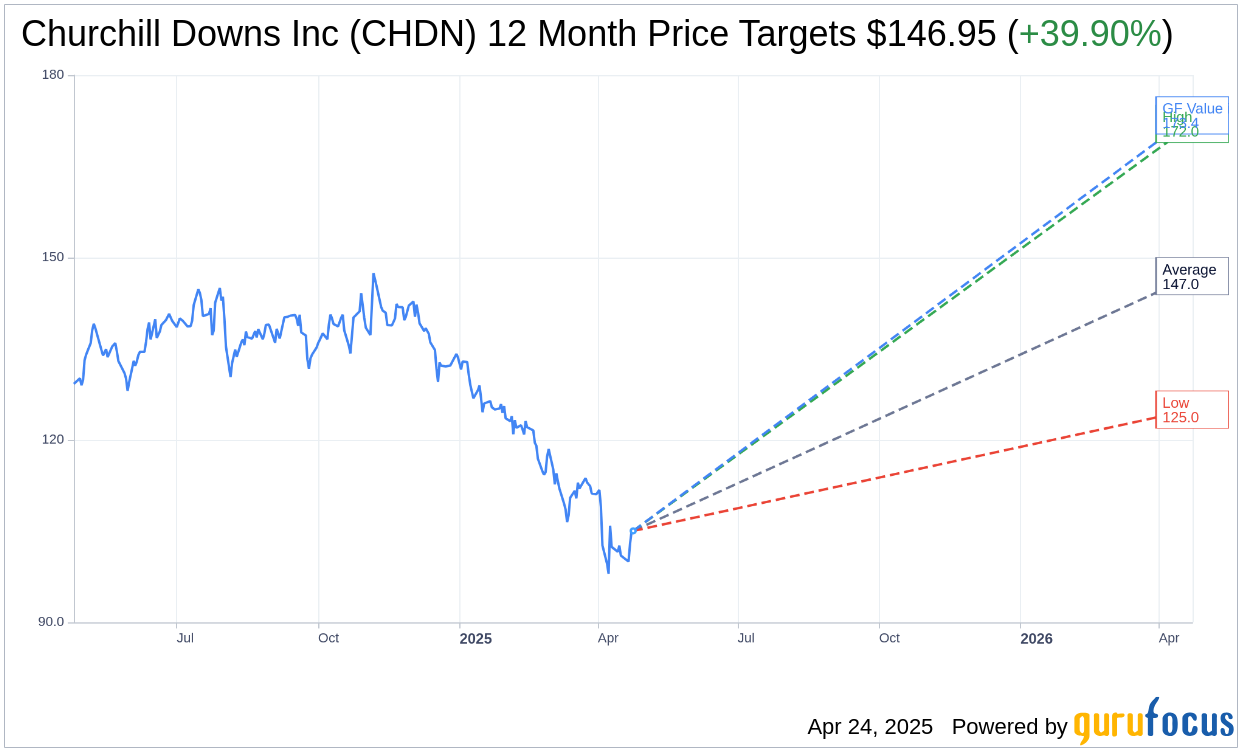

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Churchill Downs Inc (CHDN, Financial) is $146.95 with a high estimate of $172.00 and a low estimate of $125.00. The average target implies an upside of 51.44% from the current price of $97.04. More detailed estimate data can be found on the Churchill Downs Inc (CHDN) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Churchill Downs Inc's (CHDN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Churchill Downs Inc (CHDN, Financial) in one year is $173.39, suggesting a upside of 78.69% from the current price of $97.035. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Churchill Downs Inc (CHDN) Summary page.

CHDN Key Business Developments

Release Date: February 20, 2025

- Net Revenue: Record net revenue, up 11% over 2023.

- Adjusted EBITDA: Record adjusted EBITDA, up 13% over 2023.

- Virginia HRM Venues Contribution: 20% of nearly $1.2 billion adjusted EBITDA in 2024.

- Free Cash Flow: $688 million or $9.22 per share, up nearly 33% per share over the prior year.

- Maintenance Capital Expenditure: $84 million in 2024; expected $100 million to $110 million in 2025.

- Project Capital Expenditure: $463 million in 2024; expected $350 million to $400 million in 2025.

- Share Repurchases and Dividends: Over $218 million returned to shareholders in 2024.

- Bank Covenant Net Leverage: 4.0 times at the end of December 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Churchill Downs Inc (CHDN, Financial) achieved record net revenue and adjusted EBITDA in 2024, with an 11% and 13% increase respectively over 2023.

- The company successfully opened major projects like the Terre Haute casino resort and the Rose gaming resort, which are expected to drive growth in the coming years.

- The Kentucky Derby continues to be a significant asset, with ongoing investments in infrastructure and hospitality expected to enhance the guest experience and drive future revenue.

- CHDN's HRM venues in Virginia contributed significantly to the company's financial performance, accounting for 20% of the nearly $1.2 billion adjusted EBITDA in 2024.

- The company maintains a strong balance sheet, allowing for continued investment in growth opportunities while returning capital to shareholders through share repurchases and dividends.

Negative Points

- The introduction of new projects and expansions, such as the Starting Gate Courtyard and Pavilion, may pose risks of construction disruptions, although the company aims to minimize these impacts.

- The Rose gaming resort in Virginia is still in its early stages, requiring significant marketing investment to educate the market and attract customers.

- CHDN faces challenges from gray market gaming, which continues to impact revenue despite progress in enforcement in states like Kentucky and Virginia.

- The regional gaming market shows signs of maturity in certain areas, which may limit growth opportunities compared to other segments like HRMs and the Kentucky Derby.

- The company is exposed to potential economic headwinds, such as inflation and wage growth, which could impact consumer spending and operational costs.