- Vista Energy's (VIST, Financial) Q1 2025 results show a remarkable revenue increase of 38.2%, reaching $438.5 million.

- Average analyst target price suggests a 42.34% upside from the current stock value.

- Current brokerage recommendation positions Vista Energy as "Outperform" with a 1.7 rating.

Vista Energy (VIST) has released its first-quarter 2025 financial results, showcasing impressive growth metrics. The company reported a GAAP EPS of $0.86, alongside a significant revenue uptick to $438.5 million, which is a 38.2% increase compared to the previous year. Furthermore, Vista Energy's total production saw a notable rise, recording 80,913 boe/d, up 47% from the prior year. The growth in production also bolstered the adjusted EBITDA, which climbed 25% to $275.4 million.

Wall Street Analysts Forecast

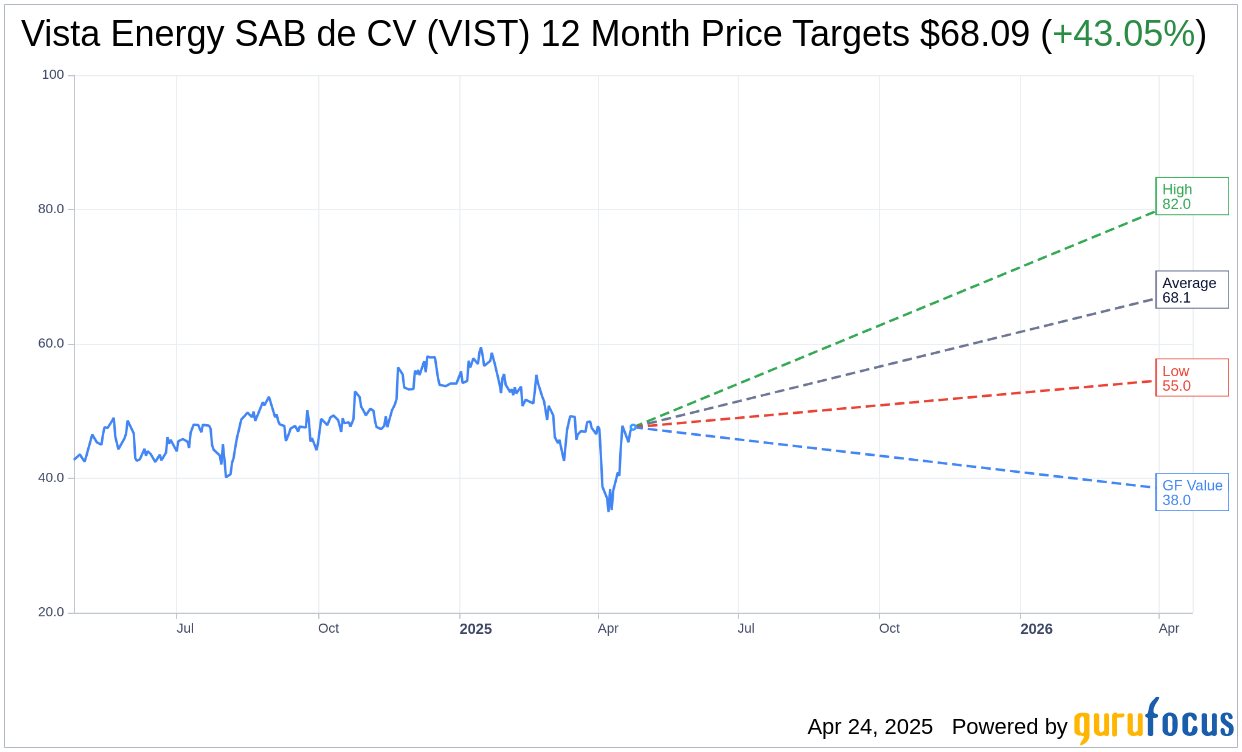

Wall Street analysts have provided one-year price targets for Vista Energy SAB de CV (VIST, Financial), with 10 analysts offering an average target price of $68.09. The highest estimate stands at $82.00, while the lowest is $55.00. Compared to the current stock price of $47.84, the average target suggests a potential upside of 42.34%. Investors can access more detailed estimate data on the Vista Energy SAB de CV (VIST) Forecast page.

The consensus recommendation from 11 brokerage firms currently rates Vista Energy SAB de CV (VIST, Financial) at 1.7, which falls under the "Outperform" category. This rating system ranges from 1, representing a Strong Buy, to 5, signifying a Sell.

GuruFocus Valuation Insights

GuruFocus provides an estimated GF Value for Vista Energy SAB de CV (VIST, Financial) at $37.95 for the next year, indicating a potential downside of 20.66% from its present price of $47.835. The GF Value estimation reflects GuruFocus's assessment of the stock's fair trading value, considering historical trading multiples, past business growth, and future business performance projections. For a more comprehensive analysis, visit the Vista Energy SAB de CV (VIST) Summary page.