Freeport-McMoRan Inc. (FCX, Financial) has released its sales forecast for the remaining quarters of 2023, indicating steady output across its product line, which includes copper, gold, and molybdenum. In the third quarter, the company anticipates selling approximately 1.095 billion pounds of copper, with a slight decrease to 1.025 billion pounds expected in the fourth quarter.

In terms of gold, projections for the third quarter stand at 475,000 ounces, following the second quarter's estimate of 500,000 ounces. The company expects to return to 500,000 ounces in gold sales for the final quarter. This consistency highlights Freeport-McMoRan's robust production capabilities despite fluctuating market demands and conditions.

Looking at molybdenum, Freeport-McMoRan forecasts sales of 23 million pounds for both the third and fourth quarters, a slight increase from the 22 million pounds anticipated for the second quarter. These figures underscore the company's stable output as it responds to market needs and sustains its competitive edge in the global metals market.

Wall Street Analysts Forecast

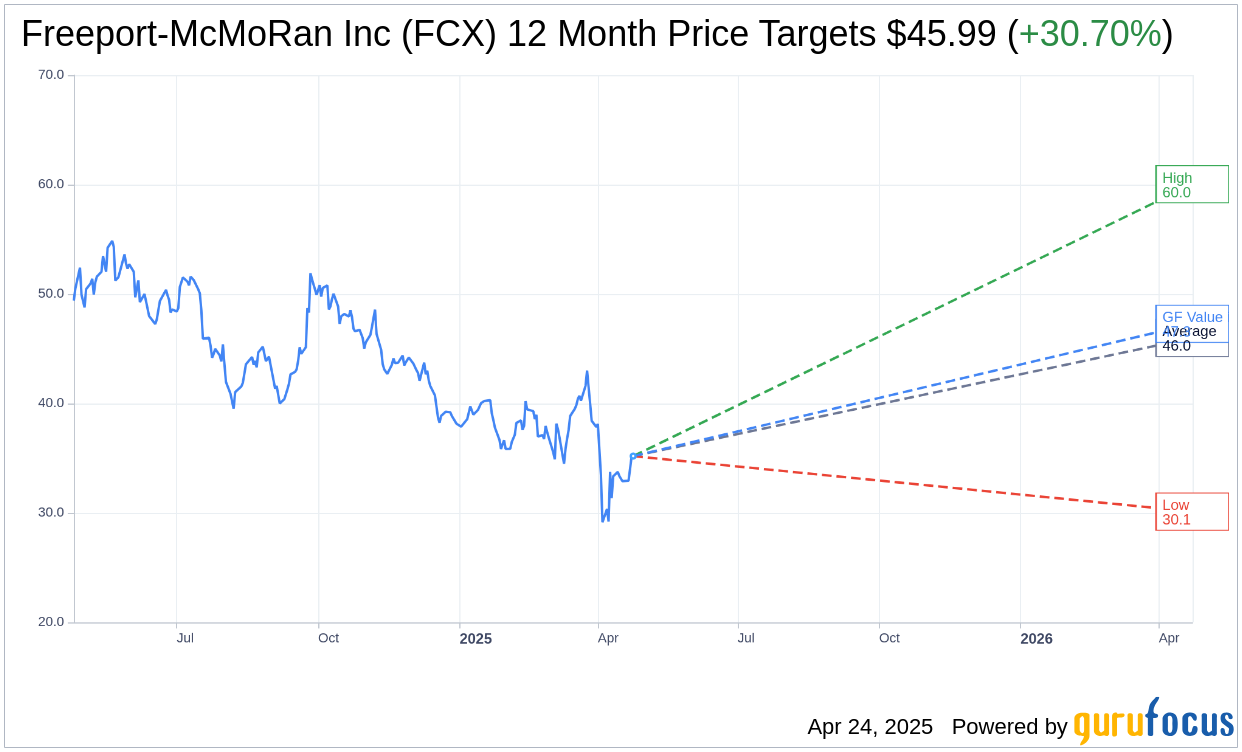

Based on the one-year price targets offered by 18 analysts, the average target price for Freeport-McMoRan Inc (FCX, Financial) is $45.99 with a high estimate of $60.04 and a low estimate of $30.12. The average target implies an upside of 30.70% from the current price of $35.19. More detailed estimate data can be found on the Freeport-McMoRan Inc (FCX) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Freeport-McMoRan Inc's (FCX, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Freeport-McMoRan Inc (FCX, Financial) in one year is $47.28, suggesting a upside of 34.36% from the current price of $35.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Freeport-McMoRan Inc (FCX) Summary page.