Carter Bank (CARE, Financial) reported an increase in its net interest margin, reaching 2.70% on a fully taxable equivalent basis in the first quarter of 2025. This marks a rise of 12 basis points from the prior quarter's 2.58% and a 10 basis point increase compared to the same period last year.

The bank's financial performance has been affected by its largest lending relationship, which has remained on nonaccrual status since the second quarter of 2023. Despite this, Carter Bank remains well-capitalized with a Tier 1 Capital ratio of 11.01% as of March 31, 2025, up from 10.88% at the end of 2024. Additionally, the leverage ratio improved slightly to 9.67%, and the Total Risk-Based Capital ratio grew to 12.27% over the same period.

Focusing on expanding core deposits and enhancing loan growth, Carter Bank saw substantial growth in interest-bearing checking accounts and money market accounts during the first quarter. The bank expects to complete a branch purchase in May 2025, which will add approximately $60 million to its funding base and welcome new customers from First Reliance.

The Federal Reserve’s late 2024 interest rate cuts have positively impacted Carter Bank, lowering its cost of funds and contributing to the net interest margin expansion. The bank anticipates continued benefits from potential further rate declines due to its slightly liability-sensitive balance sheet.

CEO Litz Van Dyke highlighted a solid loan production pipeline and future growth expectations from ongoing construction projects set to progress over the next 12 to 18 months. Despite the ongoing issues with a large nonperforming credit relationship, Van Dyke emphasized the bank's strong financial fundamentals and its commitment to resolving this challenge to safeguard the interests of the bank and its stakeholders.

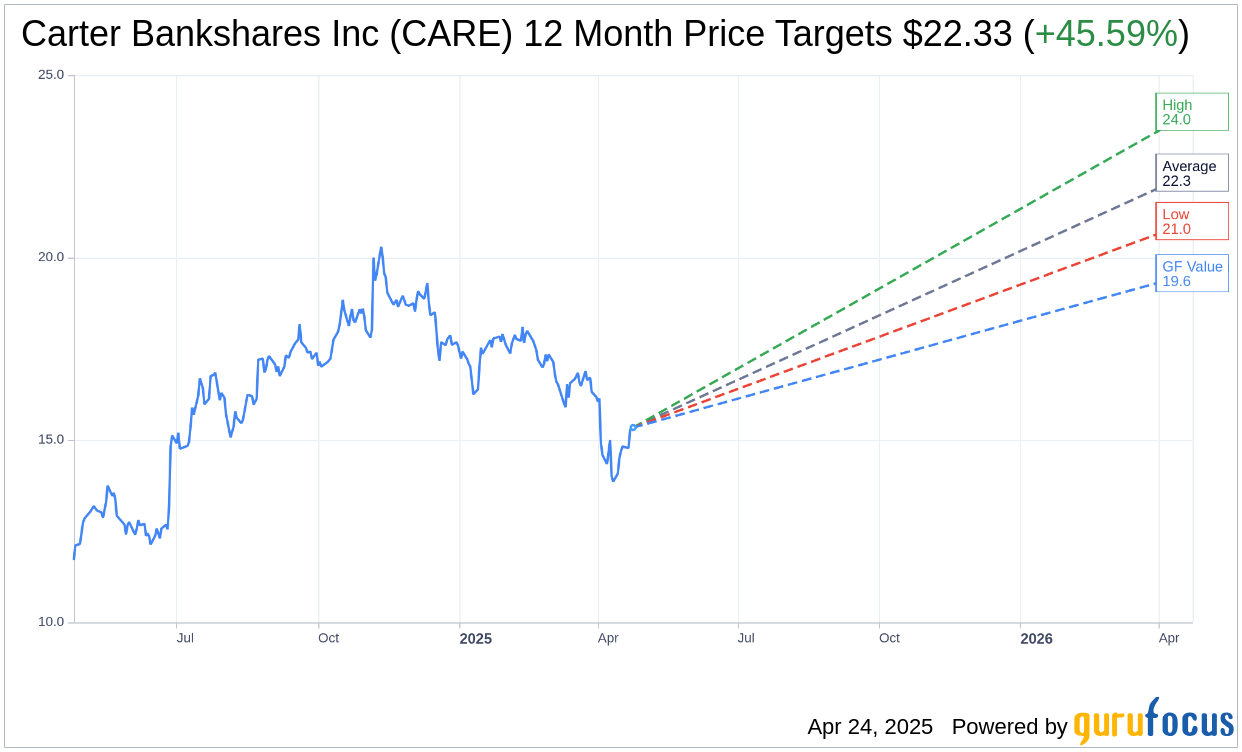

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Carter Bankshares Inc (CARE, Financial) is $22.33 with a high estimate of $24.00 and a low estimate of $21.00. The average target implies an upside of 45.59% from the current price of $15.34. More detailed estimate data can be found on the Carter Bankshares Inc (CARE) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Carter Bankshares Inc's (CARE, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Carter Bankshares Inc (CARE, Financial) in one year is $19.57, suggesting a upside of 27.57% from the current price of $15.34. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Carter Bankshares Inc (CARE) Summary page.