Susquehanna has adjusted its price target for Advanced Micro Devices (AMD, Financial), reducing it from $150 to $135 while maintaining a Positive rating on the stock. This adjustment comes as the firm prepares for AMD's first-quarter results, which are anticipated to align with or slightly exceed expectations due to improved performance in the PC sector.

Despite the optimistic outlook for Q1, Susquehanna raises concerns about future guidance. The introduction of new U.S. export restrictions is expected to hinder AMD's ability to sell its MI308 chips to China, potentially affecting future revenue streams.

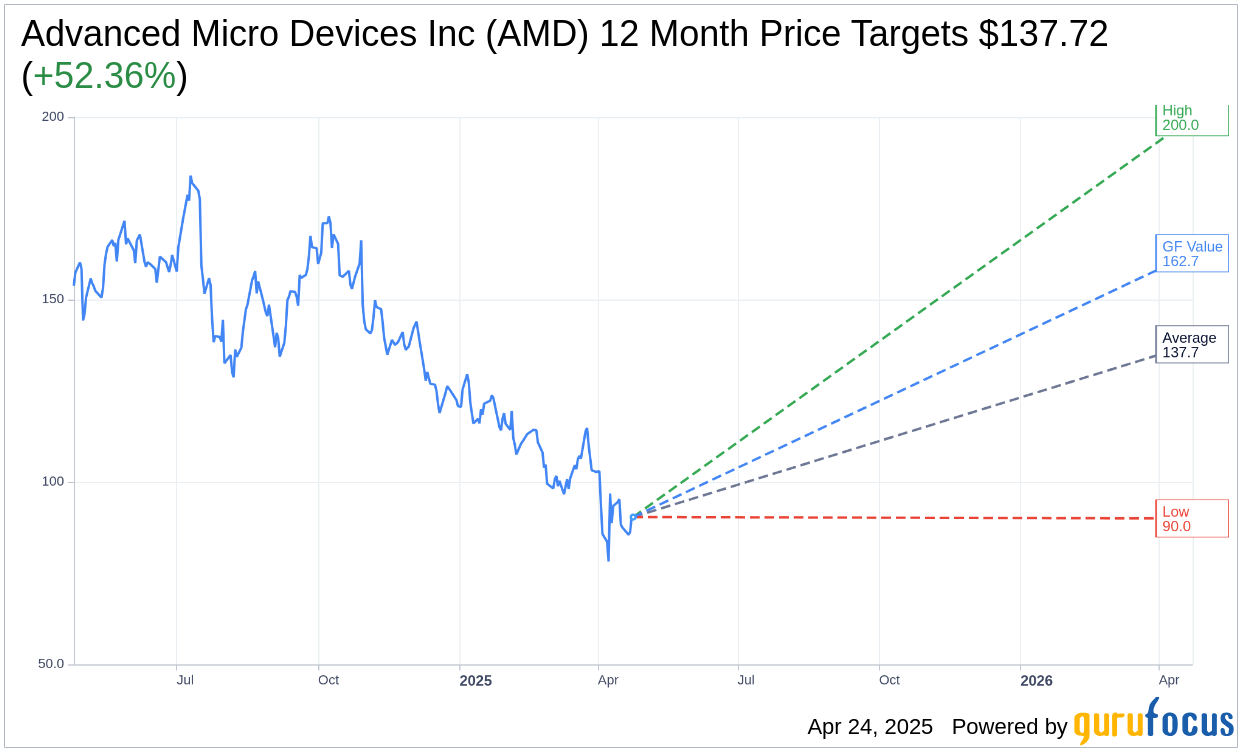

Wall Street Analysts Forecast

Based on the one-year price targets offered by 40 analysts, the average target price for Advanced Micro Devices Inc (AMD, Financial) is $137.72 with a high estimate of $200.00 and a low estimate of $90.00. The average target implies an upside of 52.36% from the current price of $90.39. More detailed estimate data can be found on the Advanced Micro Devices Inc (AMD) Forecast page.

Based on the consensus recommendation from 50 brokerage firms, Advanced Micro Devices Inc's (AMD, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advanced Micro Devices Inc (AMD, Financial) in one year is $162.68, suggesting a upside of 79.98% from the current price of $90.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advanced Micro Devices Inc (AMD) Summary page.

AMD Key Business Developments

Release Date: February 04, 2025

- Annual Revenue: $25.8 billion, up 14% year over year.

- Fourth Quarter Revenue: $7.7 billion, up 24% year over year.

- Data Center Segment Revenue: $3.9 billion, up 69% year over year.

- Client Segment Revenue: $2.3 billion, up 58% year over year.

- Gaming Segment Revenue: $563 million, down 59% year over year.

- Embedded Segment Revenue: $923 million, down 13% year over year.

- Gross Margin: 54%, up 330 basis points year over year.

- Operating Income: $2 billion, representing 26% operating margin.

- Diluted Earnings Per Share: $1.09, up 42% year over year.

- Free Cash Flow: $1.1 billion for the fourth quarter.

- Cash and Cash Equivalents: $5.1 billion at the end of the quarter.

- Share Repurchase: 1.8 million shares repurchased in the fourth quarter, totaling $256 million returned to shareholders.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Advanced Micro Devices Inc (AMD, Financial) achieved record annual revenue of $25.8 billion in 2024, marking a 14% increase year over year.

- The Data Center segment contributed roughly 50% of annual revenue, with a 69% year-over-year increase to a record $3.9 billion.

- AMD's Client segment revenue increased 58% year over year to a record $2.3 billion, driven by strong demand for Ryzen processors.

- The company successfully established a multi-billion-dollar Data Center AI franchise, delivering over $5 billion in revenue for 2024.

- AMD expanded its ROCm software suite, enhancing inferencing and training performance, and achieved significant customer adoption.

Negative Points

- Gaming segment revenue declined 59% year over year to $563 million, primarily due to a decrease in semi-custom sales.

- Embedded segment revenue decreased 13% year over year to $923 million, with mixed demand across markets.

- The company anticipates a significant decline in its Gaming business and a modest decline in its Embedded business for the first quarter of 2025.

- AMD's gross margin guidance for the first quarter of 2025 remains flat at 54%, indicating potential pressure on profitability.

- The company faces competitive pressures in the server CPU market, with concerns about aggressive pricing from competitors.