- Uber Technologies (UBER, Financial) teams up with Volkswagen for driverless rides in the U.S., launching commercially by 2026.

- Wall Street analysts suggest a potential 20.65% upside for UBER with a strong consensus rating of "Outperform."

- GuruFocus’ GF Value indicates a mild downside of 1.88%, highlighting UBER's current valuation dynamics.

Uber Technologies (UBER) is set to redefine urban mobility in the U.S. through a promising partnership with Volkswagen's autonomous mobility unit. This collaboration aims to deploy a fleet of self-driving, all-electric ID. Buzz AD vehicles over the next decade. Initial testing in Los Angeles is slated for this year, with plans for a broader commercial launch by 2026.

Wall Street Analysts Forecast

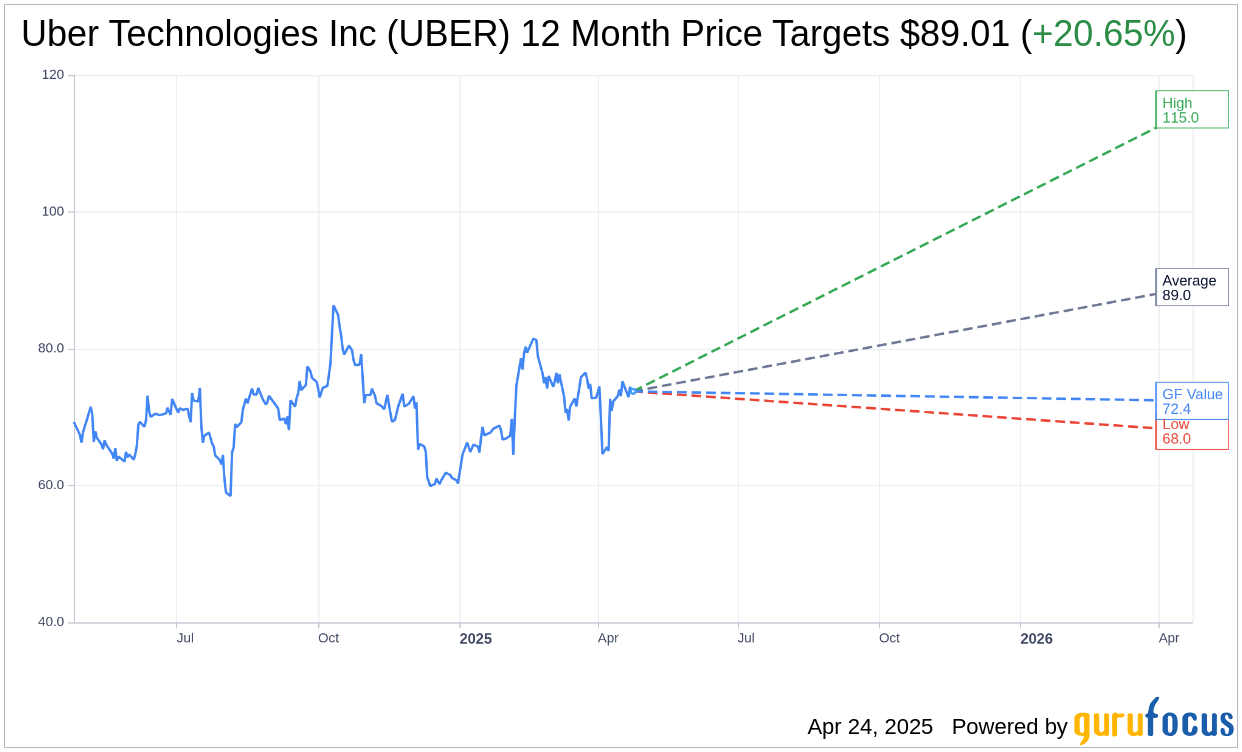

According to 40 analysts' one-year price targets, Uber Technologies Inc (UBER, Financial) is projected to reach an average target price of $89.01. This includes a high estimate of $115.00 and a low estimate of $68.00. The average target suggests a potential upside of 20.65% from its current trading price of $73.77. For further insights, visit the Uber Technologies Inc (UBER) Forecast page.

The average brokerage recommendation for Uber Technologies Inc (UBER, Financial), compiled from 53 firms, stands at 1.9. This indicates an "Outperform" status on the recommendation scale ranging from 1 (Strong Buy) to 5 (Sell).

Based on GuruFocus estimates, the GF Value for Uber Technologies Inc (UBER, Financial) in one year is projected at $72.38. This suggests a minor downside of 1.88% from its current price of $73.77. The GF Value is GuruFocus’ assessment of the stock's fair trading value, derived from historical multiples, past growth metrics, and future business performance estimates. For more comprehensive data, explore the Uber Technologies Inc (UBER) Summary page.