Darling Ingredients Inc (DAR, Financial) released its 8-K filing on April 24, 2025, reporting a net loss of $(26.2) million, or $(0.16) per diluted share for the first quarter of 2025. This result fell short of the analyst estimate of $0.40 earnings per share. The company's total net sales reached $1.38 billion, also below the estimated revenue of $1,451.84 million. This performance reflects the broader challenges faced by the biofuel industry, impacting the company's earnings.

Company Overview

Darling Ingredients Inc develops and manufactures sustainable ingredients for various industries, including pharmaceutical, food, pet food, fuel, and fertilizer. The company transforms animal by-products into valuable ingredients and converts used cooking oil and bakery remnants into feed and fuel ingredients. With three primary business segments—feed ingredients, food ingredients, and fuel ingredients—Darling Ingredients derives most of its revenue from North American customers.

Performance and Challenges

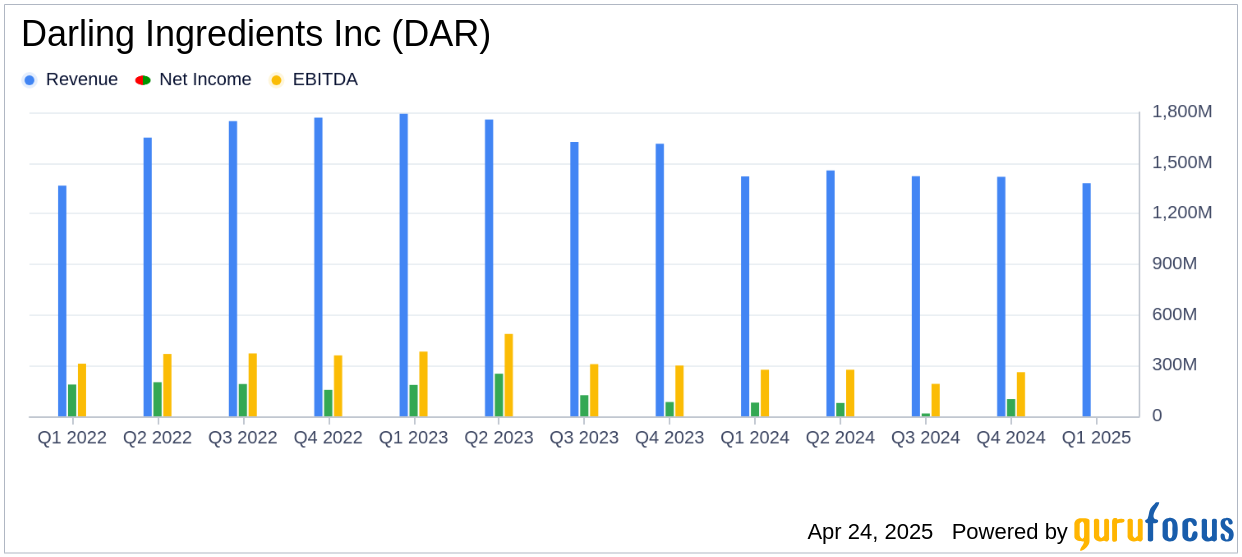

The first quarter of 2025 saw Darling Ingredients Inc grappling with a net loss of $(26.2) million, a stark contrast to the net income of $81.2 million in the same period last year. The decline was primarily driven by lower earnings at Diamond Green Diesel (DGD), a joint venture in renewable fuels. Total net sales decreased to $1.38 billion from $1.42 billion a year ago, attributed to lower finished product pricing.

“Despite the broader challenges faced by the biofuel industry during the first quarter of 2025, Darling Ingredients' core business performed well, resulting in overall positive cash flow and demonstrating stability in an otherwise volatile business environment,” said Randall C. Stuewe, Chairman and Chief Executive Officer.

Financial Achievements and Metrics

Despite the challenges, Darling Ingredients Inc achieved several financial milestones. The company received $129.5 million in cash dividends from DGD and repurchased $35 million of common stock. Additionally, Darling Ingredients paid down $146.2 million in debt, reflecting its commitment to deleveraging the balance sheet.

Combined Adjusted EBITDA for the first quarter was $195.8 million, down from $280.1 million in the previous year. The company anticipates generating approximately $950 million to $1 billion EBITDA for fiscal year 2025, driven by strong market demand for domestic fats and improving margins in the biofuel sector.

Income Statement and Balance Sheet Highlights

Key details from the income statement reveal a decrease in net sales to third parties and related parties, with total net sales dropping by $39.7 million compared to the previous year. Operating income also declined significantly to $28.4 million from $137.2 million in the first quarter of 2024.

On the balance sheet, Darling Ingredients reported $81.5 million in cash and cash equivalents, with $1.27 billion available under its committed revolving credit agreement. Total debt stood at $3.9 billion, with a preliminary leverage ratio of 3.33X.

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Net Sales | $1.38 billion | $1.42 billion | $(39.7) million |

| Net Income/(Loss) | $(26.2) million | $81.2 million | $(107.4) million |

| Combined Adjusted EBITDA | $195.8 million | $280.1 million | $(84.3) million |

Analysis and Outlook

Darling Ingredients Inc's performance in the first quarter of 2025 highlights the challenges posed by the biofuel industry's volatility. However, the company's core business remains robust, generating positive cash flow and enabling strategic debt reduction and share repurchases. The anticipated improvement in biofuel margins and strong demand for domestic fats are expected to support future growth.

“We are confident in our ability to navigate challenges and capitalize on opportunities, ensuring continued growth and success,” Stuewe added.

Explore the complete 8-K earnings release (here) from Darling Ingredients Inc for further details.