Volkswagen Group of America Inc.'s autonomous mobility arm, Volkswagen ADMT, has struck a notable strategic alliance with Uber Technologies Inc. (UBER, Financial) to introduce a fleet of fully autonomous, all-electric ID. Buzz AD vehicles across various U.S. cities. The collaboration marks a significant step toward the future of urban mobility, beginning with Los Angeles.

The rollout is scheduled to commence with testing phases later this year. These initial trials, which will feature human operators onboard for enhanced safety and technology refinement, lay the groundwork for a commercial launch slated for 2026 in Los Angeles. This progressive deployment approach prioritizes safety and regulatory compliance, ensuring each phase advances only after obtaining the necessary approvals.

Volkswagen’s autonomous mobility brand, MOIA, will facilitate the integration of its complete autonomous driving solution—including both the vehicles and their software systems—on Uber's platform. This joint effort underscores a forward-thinking approach to sustainable, autonomous urban transportation solutions, potentially setting a new standard for mobility services in the coming years.

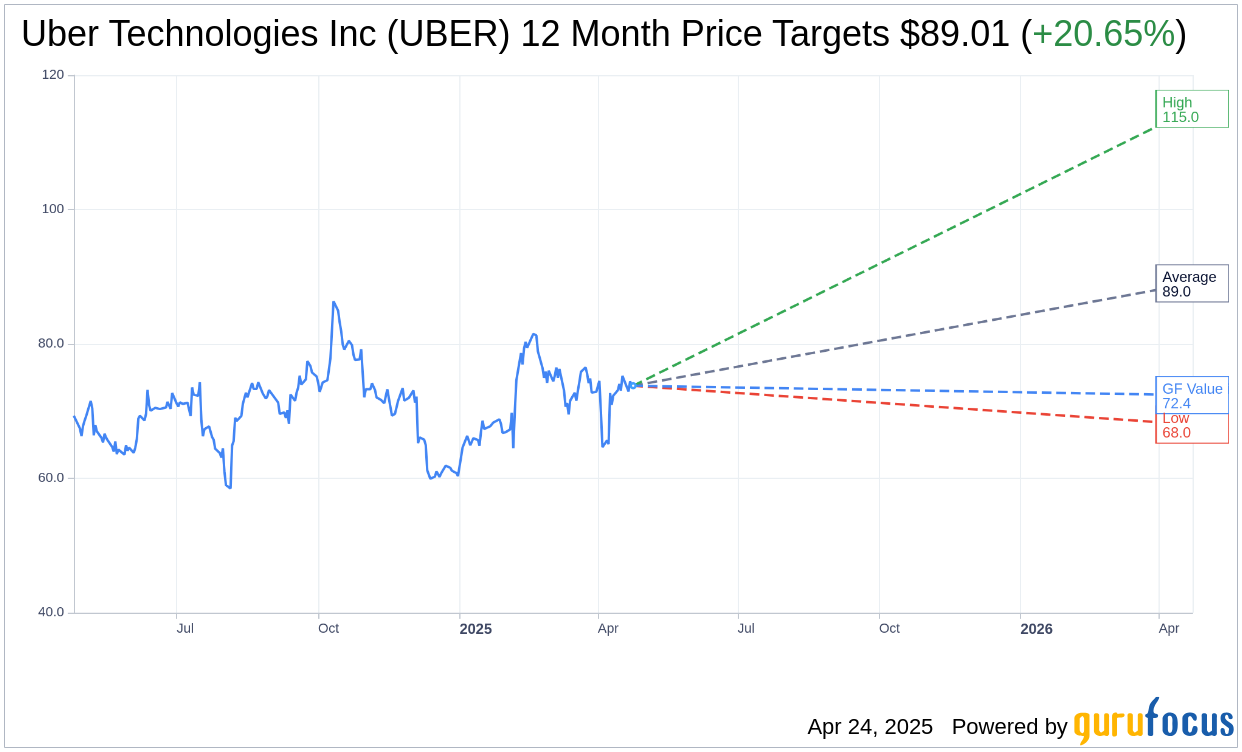

Wall Street Analysts Forecast

Based on the one-year price targets offered by 40 analysts, the average target price for Uber Technologies Inc (UBER, Financial) is $89.01 with a high estimate of $115.00 and a low estimate of $68.00. The average target implies an upside of 20.65% from the current price of $73.77. More detailed estimate data can be found on the Uber Technologies Inc (UBER) Forecast page.

Based on the consensus recommendation from 53 brokerage firms, Uber Technologies Inc's (UBER, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Uber Technologies Inc (UBER, Financial) in one year is $72.38, suggesting a downside of 1.88% from the current price of $73.77. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Uber Technologies Inc (UBER) Summary page.

UBER Key Business Developments

Release Date: February 05, 2025

- Gross Bookings Growth: 21% year-on-year growth on a constant currency basis.

- Adjusted EBITDA Growth: 60% year-on-year increase.

- Free Cash Flow as a Percentage of EBITDA: 106% for the year.

- Uber One Membership Growth: Added 5 million members in the quarter, totaling 30 million, up nearly 60% year-on-year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Uber Technologies Inc (UBER, Financial) reported accelerated growth in audience, trips, and gross bookings, exceeding their own expectations.

- The Uber One membership program saw significant growth, adding 5 million members in the quarter, reaching a total of 30 million members, up nearly 60% year over year.

- Adjusted EBITDA grew 60% year over year, surpassing the company's high 30% to 40% CAGR target.

- Uber Technologies Inc (UBER) achieved an annual free cash flow as a percentage of EBITDA of 106%, exceeding their target of 90%-plus.

- The company is well-positioned in the autonomous vehicle (AV) space, with strategic investments and partnerships, including a collaboration with Waymo in Austin.

Negative Points

- The commercialization of autonomous vehicle technology is expected to take significantly longer than anticipated.

- Uber Technologies Inc (UBER) faces foreign exchange headwinds, with a notable impact on top-line growth due to currency depreciation in key markets like Argentina, Mexico, and Brazil.

- Insurance costs remain a challenge, although there is some easing in the consumer price index for motor vehicle insurance.

- The company is experiencing higher insurance costs, which partially offset the benefits from supply incentives and operating cost leverage.

- The scale of AV deployments is currently very small, limiting the immediate impact on Uber Technologies Inc (UBER)'s overall business.