RBC Capital has revised its price target for Masco Corporation (MAS, Financial), reducing it from $74 to $62 following a disappointing first-quarter earnings report. Despite this, the firm maintains a Sector Perform rating for the company.

The revision is largely attributed to the substantial impact of tariffs, including a significant 145% tariff on China, as well as 10% global tariffs and additional steel and aluminum duties. These factors are somewhat balanced by Masco's efforts in adjusting pricing and reducing costs.

Furthermore, the company recently withdrew its guidance, acknowledging the ongoing volatility in tariff policies. Though specific guidance was not provided, the company did offer sufficient information to help investors understand the potential implications of the current tariff environment.

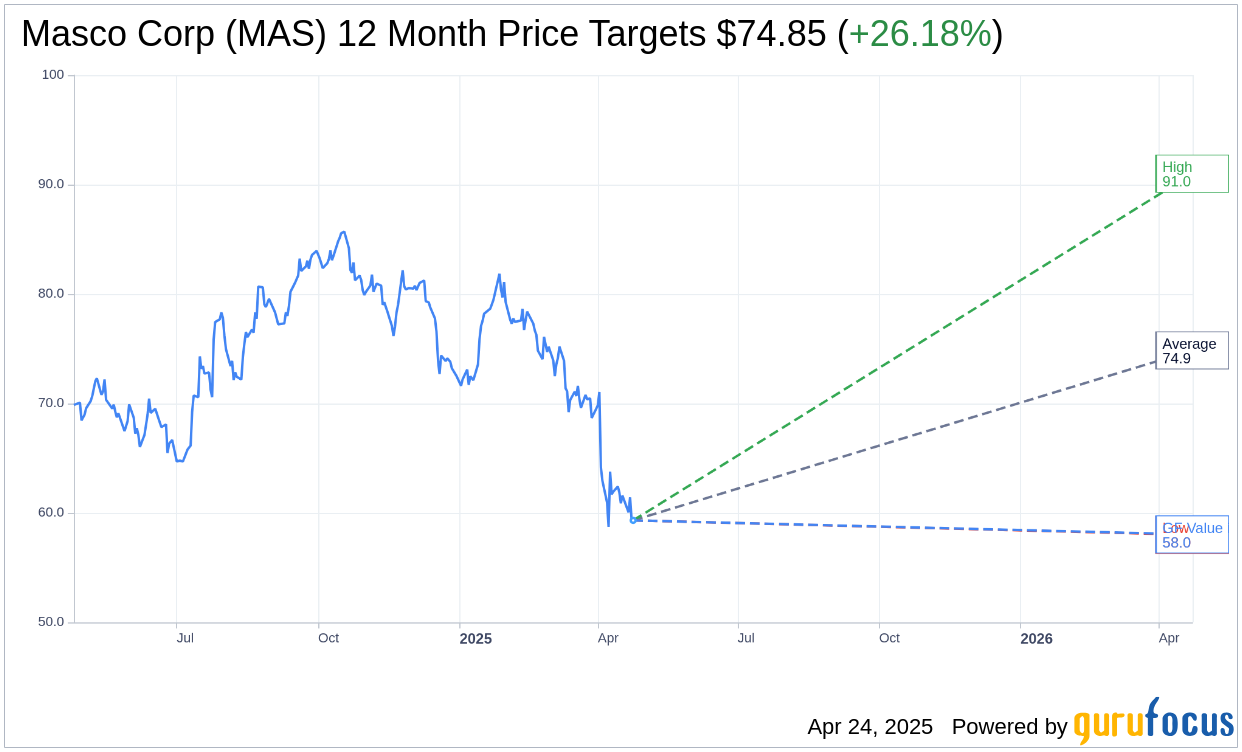

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Masco Corp (MAS, Financial) is $74.85 with a high estimate of $91.00 and a low estimate of $58.00. The average target implies an upside of 26.18% from the current price of $59.32. More detailed estimate data can be found on the Masco Corp (MAS) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Masco Corp's (MAS, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Masco Corp (MAS, Financial) in one year is $58.04, suggesting a downside of 2.16% from the current price of $59.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Masco Corp (MAS) Summary page.

MAS Key Business Developments

Release Date: April 23, 2025

- Revenue: Decreased 6% in the first quarter; excluding divestiture and currency impact, sales decreased 3%.

- Gross Margin: Increased 20 basis points to 35.9%.

- Operating Profit: $288 million with an operating profit margin of 16%.

- Earnings Per Share (EPS): $0.87 for the quarter.

- Plumbing Segment Sales: Increased 1% in local currency; operating profit was $219 million with an 18.5% margin.

- Decorative Architectural Segment Sales: Decreased 16%; operating profit was $96 million with a 15.6% margin.

- North American Sales: Decreased 7% in local currency; decreased 3% excluding divestiture impact.

- International Sales: Flat in local currency.

- SG&A Expenses: Decreased by $9 million year-over-year; SG&A as a percent of sales was 19.9%.

- Liquidity: $1.2 billion, including cash and availability under revolving credit facility.

- Shareholder Returns: $196 million returned through dividends and share repurchases, including $130 million in stock repurchases.

- Tariff Impact: Expected in-year cost of approximately $400 million before mitigation; estimated mitigation of $200 million to $250 million in 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Masco Corp (MAS, Financial) has successfully embedded its operating system throughout the company, significantly expanding operating profit margins.

- The company has achieved compound annual earnings per share growth of more than 12% over the last five years.

- Masco Corp (MAS) introduced several innovative new products and received multiple awards, including the J.D. Powers Customer Service Excellence Award for Delta Faucet.

- The Plumbing segment saw a 1% increase in sales in local currency, driven by higher volumes in the spa and sauna business and favorable pricing.

- Masco Corp (MAS) continues to gain market share in the pro paint category, driven by strong partnerships and product performance.

Negative Points

- The company is facing significant cost increases due to new tariffs on imports from China, particularly affecting the Plumbing segment.

- Masco Corp (MAS) is not providing full-year financial guidance due to uncertainty around tariffs and macroeconomic conditions.

- Sales in the first quarter decreased by 6%, with a notable decline in the Decorative Architectural segment.

- DIY paint sales were down high single digits, reflecting ongoing demand pressure and a dampened macroeconomic environment.

- The company anticipates demand softening as consumers spend more cautiously amidst economic uncertainty.