Republic Bancorp Inc (RBCAA, Financial) released its 8-K filing on April 24, 2025, reporting a robust financial performance for the first quarter of 2025. The company, headquartered in Louisville, Kentucky, operates as a financial institution offering a range of traditional and non-traditional banking products through its five reportable segments. These include Traditional Banking, Warehouse Lending, Tax Refund Solutions (TRS), Republic Payment Solutions, and Republic Credit Solutions (RCS).

Financial Performance and Challenges

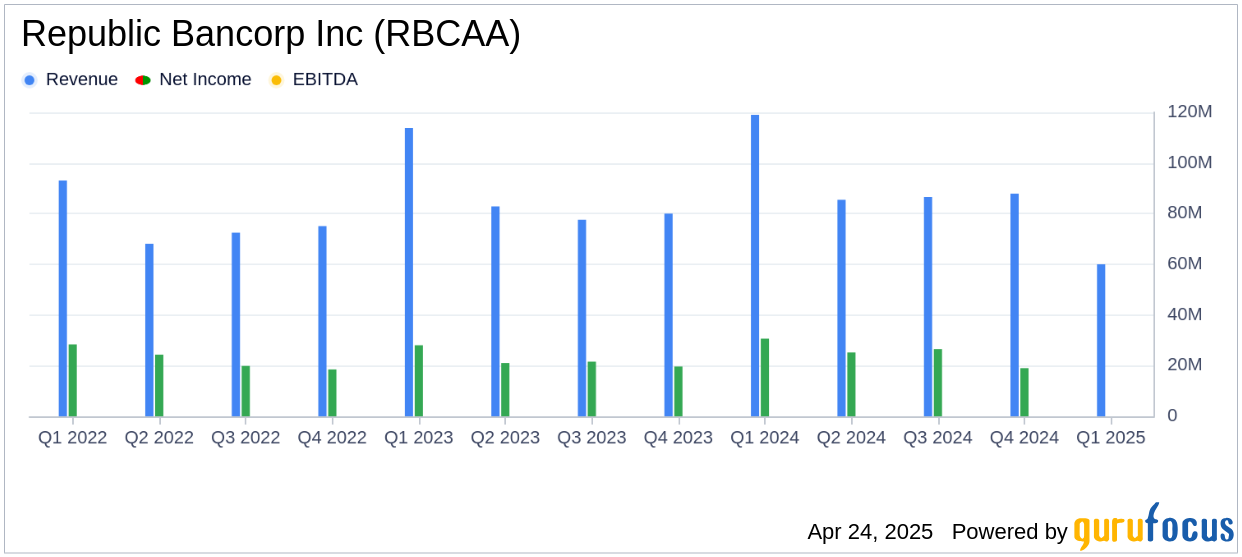

Republic Bancorp Inc (RBCAA, Financial) reported a net income of $47.3 million for Q1 2025, a significant 54% increase from $30.6 million in the same quarter of the previous year. The diluted earnings per share (EPS) rose to $2.42, surpassing the analyst estimate of $1.86. This marks a 53% increase from $1.58 in Q1 2024. This performance underscores the company's strong operational capabilities and strategic initiatives across its segments.

Despite the impressive results, the company acknowledges potential challenges, particularly the threat of global tariff uncertainty, which could impact the broader economic environment. However, Republic Bancorp Inc (RBCAA, Financial) remains confident in its strong capital and liquidity positions to navigate these uncertainties.

Key Financial Achievements

The company's return on average assets (ROA) and return on average equity (ROE) were 2.61% and 18.74%, respectively, reflecting substantial improvements from the previous year. These metrics are crucial for banks as they indicate efficient asset utilization and shareholder value creation.

Logan Pichel, President & CEO of Republic Bank & Trust Company, commented, “We are pleased to report one of the best all-around performances in our Company’s history with a 54% increase in our first quarter 2025 net income. In addition to the increase in net income for the total Company, all five of our SEC reporting segments are reporting an increase in net income for the first quarter of 2025 compared to the first quarter of 2024.”

Income Statement and Segment Performance

Republic Bancorp Inc (RBCAA, Financial) achieved a 55% increase in income before income tax expense, reaching $59.96 million compared to $38.7 million in Q1 2024. The Core Bank segment reported a net income of $17.4 million, a 32% increase driven by a $5.8 million rise in net interest income and a favorable net credit to the Provision for Expected Credit Losses.

The Tax Refund Solutions (TRS) segment experienced a remarkable 123% increase in net income, attributed to a reduction in the segment's estimated Provision and enhancements to its Refund Transfer product. The Republic Processing Group (RPG) also saw a significant boost, with net income rising by $12.4 million to $29.9 million.

Balance Sheet and Cash Flow Highlights

Republic Bancorp Inc (RBCAA, Financial) reported total assets of approximately $7.1 billion as of March 31, 2025. The company's strategic focus on maintaining strong liquidity and capital levels positions it well for future growth and stability.

Analysis and Outlook

Republic Bancorp Inc (RBCAA, Financial)'s strong Q1 2025 performance highlights its effective management and strategic initiatives across its diverse segments. The company's ability to exceed analyst estimates and achieve significant growth in key financial metrics underscores its resilience and adaptability in a challenging economic environment. As the company continues to navigate potential challenges, its robust capital and liquidity positions provide a solid foundation for sustained success.

Explore the complete 8-K earnings release (here) from Republic Bancorp Inc for further details.