MarineMax Inc (HZO, Financial) released its 8-K filing on April 24, 2025, announcing its fiscal 2025 second-quarter results. The company reported a record revenue of $631.5 million, surpassing the analyst estimate of $578.62 million, driven primarily by higher boat sales. However, the company's earnings per share (EPS) of $0.14 exceeded the estimated $0.08, reflecting the challenges faced in the current retail environment.

Company Overview

MarineMax Inc is a United States-based company specializing in the sale of new and used recreational boats under premium brands, along with related marine products such as engines, parts, and accessories. The company also provides services including repair, maintenance, storage, boat financing, insurance, brokerage sales, and operates a yacht charter business. The Retail Operations segment is the primary revenue generator, with boat sales contributing significantly to the company's total revenue.

Performance and Challenges

MarineMax Inc's performance in the second quarter highlights its ability to navigate a weak retail market and uncertain macroeconomic conditions. The company achieved an 11% increase in same-store sales, underscoring its strategic execution and collaboration with manufacturing partners. However, the challenging retail environment exerted pressure on margins, with the gross profit margin declining to 30.0% from 32.7% in the previous year. This margin pressure is attributed to lower boat margins and a higher proportion of boat sales during the period.

Financial Achievements

The company's record revenue of $631.5 million, an 8.3% increase from the previous year, is a significant achievement in the Retail - Cyclical industry. This growth was primarily driven by increased boat sales and contributions from finance, insurance, and the Superyachts Division. MarineMax Inc's strategic diversification into high-value segments such as marinas and superyacht services has strengthened its business model, allowing it to maintain a year-to-date gross margin of 32.7% despite industry challenges.

Key Financial Metrics

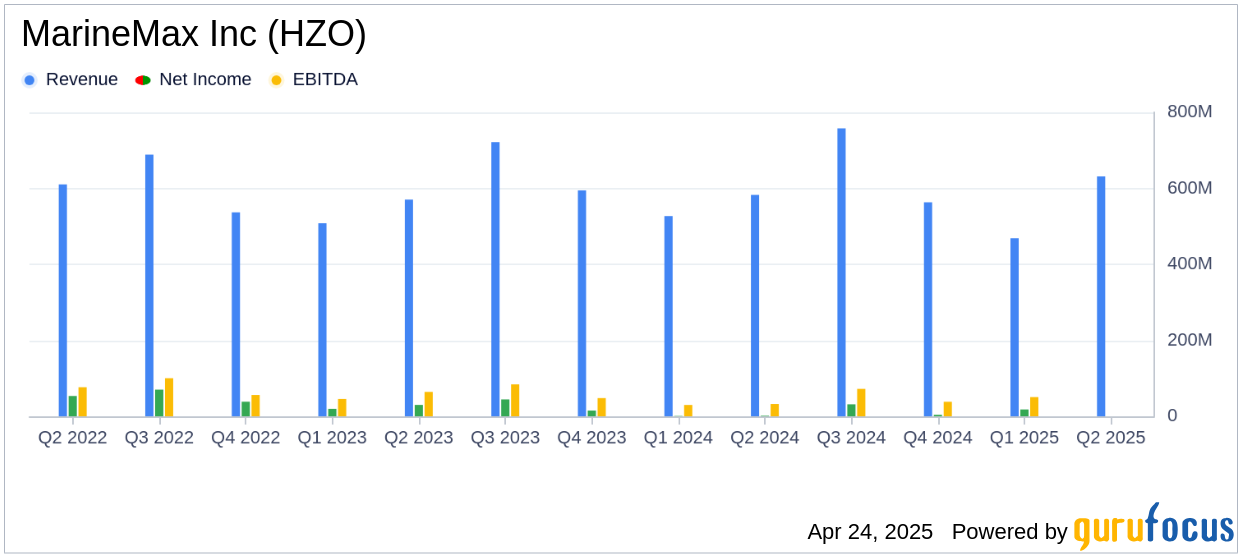

MarineMax Inc reported a net income of $3.3 million, or $0.14 per diluted share, compared to $1.6 million, or $0.07 per diluted share, in the same period last year. Adjusted net income was $5.4 million, or $0.23 per diluted share, up from $4.1 million, or $0.18 per diluted share, in the prior year. The company's adjusted EBITDA increased to $30.9 million from $29.6 million, reflecting improved operational efficiency.

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Revenue | $631.5 million | $582.9 million |

| Net Income | $3.3 million | $1.6 million |

| Adjusted EBITDA | $30.9 million | $29.6 million |

Analysis and Outlook

MarineMax Inc's strategic focus on diversification and cost management has positioned it well to navigate the current economic uncertainties. The company's acquisition of Shelter Bay Marine enhances its service offerings in the Florida Keys, further strengthening its market position. Despite the challenges, MarineMax Inc remains committed to providing exceptional customer service and maintaining a strong balance sheet, with over $200 million in cash and cash equivalents and reduced long-term debt.

Brett McGill, CEO and President of MarineMax, stated, "Despite facing a weak retail market and an uncertain macroeconomic climate, we delivered a strong second-quarter performance. Our 11% same-store sales growth highlights the exceptional execution by our team."

MarineMax Inc's prudent expense management and strategic positioning are expected to support its growth trajectory, although the company has adjusted its fiscal 2025 guidance in response to evolving market conditions and tariff impacts. As consumer interest in boating remains strong, MarineMax Inc is well-positioned to capitalize on future opportunities as market conditions improve.

Explore the complete 8-K earnings release (here) from MarineMax Inc for further details.