BioAtla, Inc. (BCAB, Financial) is set to present groundbreaking preclinical research at the 2025 American Association for Cancer Research conference, scheduled to take place from April 25 to 30 at the McCormick Place Convention Center in Chicago, Illinois. The company will unveil two abstracts, selected for poster presentations, that emphasize its unique Conditionally Active Biologic (CAB) technology.

The poster presentations will underscore BioAtla's CAB anti-Nectin4-antibody drug conjugate, which has displayed superior efficacy compared to enfortumab vedotin analogues. This advancement has shown promising results in patient-derived models of lung, breast, pancreatic, and urothelial cancers.

The CAB technology represents a new frontier in biologics, offering an enhanced safety profile and improved therapeutic index. This innovative approach selectively targets cells associated with acidic senescence and the senescence-associated secretory phenotype, offering potential applications in cancer treatment and managing age-related diseases.

BioAtla's contributions in this domain highlight significant potential for advancing oncological therapeutics and improving patient outcomes in various cancer types. As the research community gathers in Chicago for the conference, the spotlight will be on BioAtla’s pioneering work and its implications for future cancer treatment strategies.

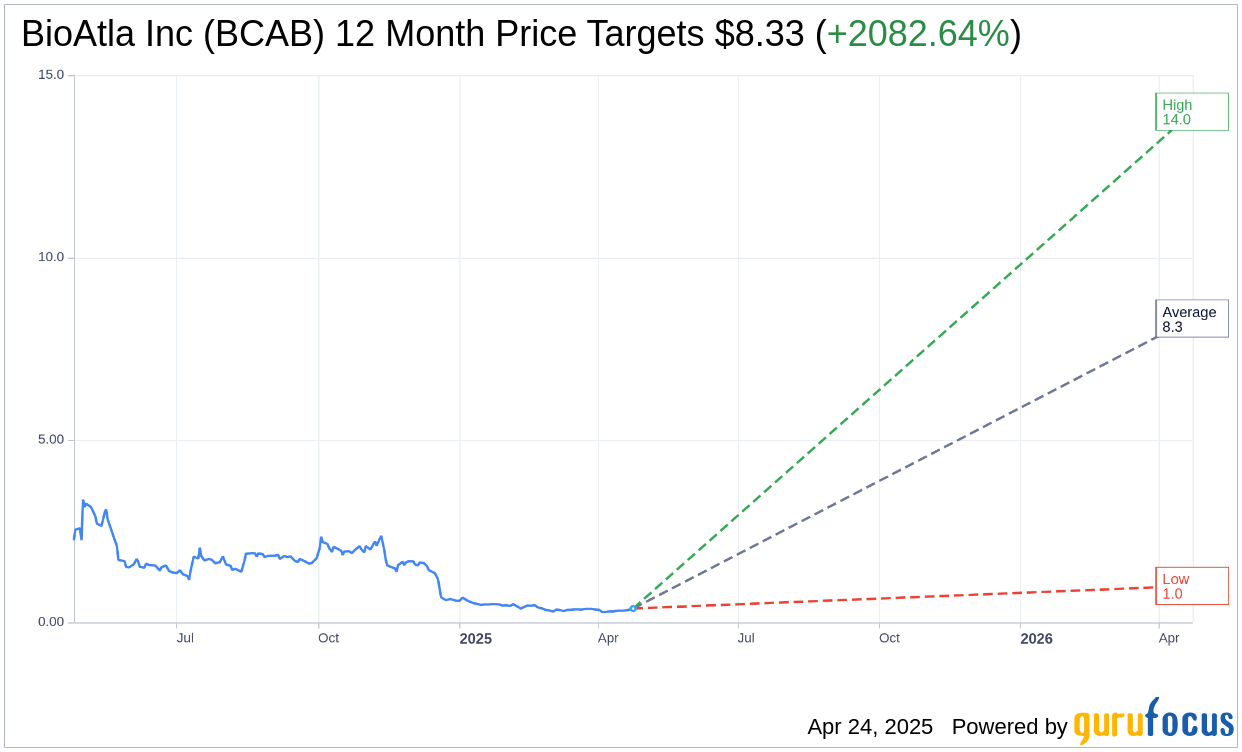

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for BioAtla Inc (BCAB, Financial) is $8.33 with a high estimate of $14.00 and a low estimate of $1.00. The average target implies an upside of 2,082.64% from the current price of $0.38. More detailed estimate data can be found on the BioAtla Inc (BCAB) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, BioAtla Inc's (BCAB, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BCAB Key Business Developments

Release Date: March 27, 2025

- R&D Expenses: $11.6 million for Q4 2024, down from $22.7 million in Q4 2023.

- General and Administrative Expenses: $4.6 million for Q4 2024, down from $5.9 million in Q4 2023.

- Net Loss: $14.9 million for Q4 2024, compared to $26.9 million in Q4 2023.

- Net Cash Used in Operating Activities: $72 million for the full year 2024, down from $104 million in 2023.

- Cash and Cash Equivalents: $49 million as of December 31, 2024, compared to $111.5 million as of December 31, 2023.

- Cash Used for Q4 2024: $7.5 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- BioAtla Inc (BCAB, Financial) is making significant progress with its conditionally active biologic (CAB) platform, which is designed to increase the potency and safety of therapeutic candidates targeting solid tumors.

- The company reported promising results from its phase two assets, Zoyumabotin (OSV) and Mcbodumab thein (McV), with ongoing anti-tumor activity and confirmed responses in patients with various KRAS mutations.

- BioAtla Inc (BCAB) has received fast track designation and actionable guidance from the FDA for its OSV monotherapy in head and neck cancer, indicating potential for becoming a standard of care.

- The company is actively pursuing corporate partnerships for its phase 2 clinical programs, which could enhance its strategic positioning and financial resources.

- BioAtla Inc (BCAB) has streamlined operations and extended its financial runway beyond key clinical readouts in the first half of 2026, demonstrating effective resource management.

Negative Points

- BioAtla Inc (BCAB) faces challenges in targeting the EPA therapeutic target due to its expression in both tumors and normal tissues, making it difficult to drug with traditional antibody technologies.

- The company reported a significant decrease in cash and cash equivalents from $111.5 million in 2023 to $49 million in 2024, indicating financial constraints.

- There is uncertainty regarding the timing and success of potential partnerships, as discussions are still in progress and contingent on future data readouts.

- BioAtla Inc (BCAB) has undergone a workforce reduction of over 30%, which may impact its operational capacity and employee morale.

- The company is still in the process of analyzing patient samples for its Axle program, indicating that further data is needed to fully understand its efficacy and potential.