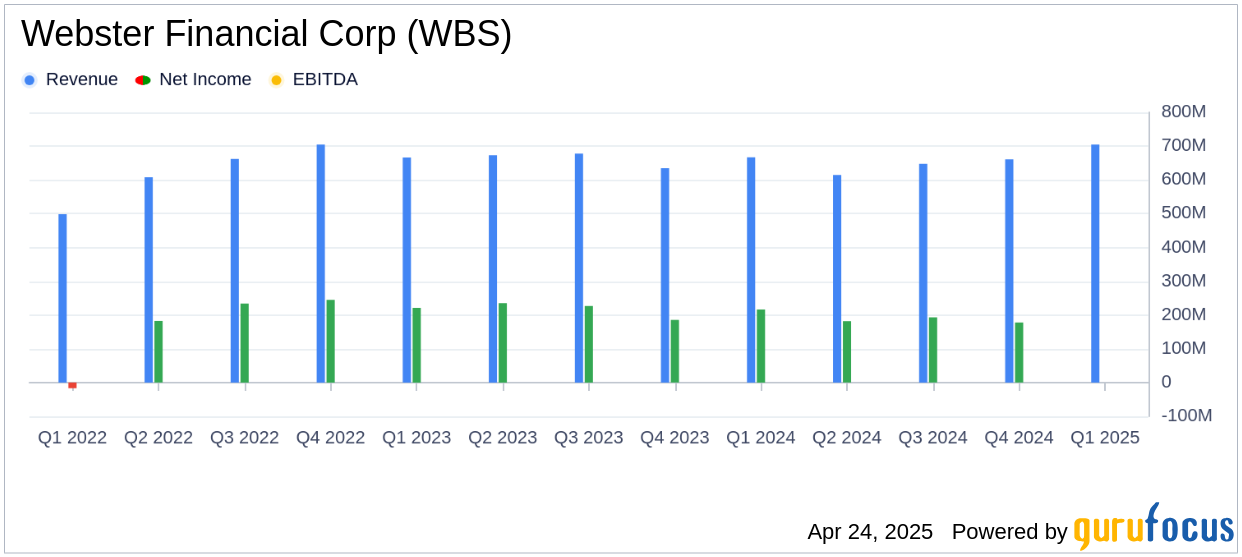

On April 24, 2025, Webster Financial Corp (WBS, Financial) released its 8-K filing for the first quarter of 2025. The company reported a diluted earnings per share (EPS) of $1.30, falling short of the analyst estimate of $1.38. However, the company exceeded revenue expectations, reporting $704.8 million compared to the estimated $634.82 million.

Webster Financial Corp is a full-service provider of financial services, offering commercial and consumer banking, mortgages, and investment advisory along with trust and wealth management services in Connecticut, New York, Rhode Island, Massachusetts, and Pennsylvania. The company's segments include Commercial Banking, HSA Bank, and Consumer Banking, with the majority of revenue generated from the Commercial Banking segment.

Performance Overview and Challenges

Webster Financial Corp reported a net income applicable to common stockholders of $220.4 million for the quarter, an increase from $210.1 million in the same period last year. Despite the increase in net income, the EPS of $1.30 was below the analyst estimate of $1.38, indicating potential challenges in meeting market expectations.

The company experienced growth in loans and deposits, with period-end loans and leases reaching $53.1 billion, up 1.0% from the previous quarter, and deposits increasing by 1.3% to $65.6 billion. However, the provision for credit losses rose to $77.5 million, reflecting a cautious approach amid market volatility and economic uncertainty.

Financial Achievements and Industry Importance

Webster Financial Corp's revenue of $704.8 million surpassed analyst expectations, showcasing the company's ability to generate strong returns for stockholders. The net interest margin improved to 3.48%, up from 3.41% in the previous year, highlighting effective management of interest-earning assets and liabilities.

The company's return on average tangible common equity was 15.93%, demonstrating robust profitability and efficient capital utilization, which are critical metrics for banks in maintaining investor confidence and competitive positioning.

Key Financial Metrics and Statements

Net interest income increased to $612.2 million from $567.7 million in the previous year, driven by a 6.0% rise in average interest-earning assets. However, non-interest income decreased to $92.6 million from $99.4 million, primarily due to lower gains on investment securities and mortgage servicing rights.

The efficiency ratio stood at 45.79%, indicating the company's operational efficiency in generating revenue. The common equity tier 1 ratio was 11.26%, reflecting a strong capital position essential for regulatory compliance and financial stability.

Webster has again proven its capacity to consistently execute through a variety of operating environments," said John R. Ciulla, chairman and chief executive officer. "Growth in loans and deposits was generated by a breadth of businesses, as we continue to generate strong returns for our stockholders."

Segment Performance and Analysis

The Commercial Banking segment reported a decrease in pre-tax, pre-provision net revenue to $241.5 million, primarily due to lower loan yields and non-interest income. The Healthcare Financial Services segment, however, saw an increase in pre-tax net revenue to $70.0 million, driven by higher deposit balances.

Consumer Banking experienced a decline in pre-tax, pre-provision net revenue to $105.6 million, impacted by lower non-interest income and increased investments in technology and professional services.

Conclusion

Webster Financial Corp's Q1 2025 earnings report highlights a mixed performance, with revenue exceeding expectations but EPS falling short. The company's strategic focus on loan and deposit growth, coupled with a strong capital position, positions it well to navigate economic uncertainties. However, increased provisions for credit losses and challenges in non-interest income underscore the need for cautious optimism moving forward.

Explore the complete 8-K earnings release (here) from Webster Financial Corp for further details.