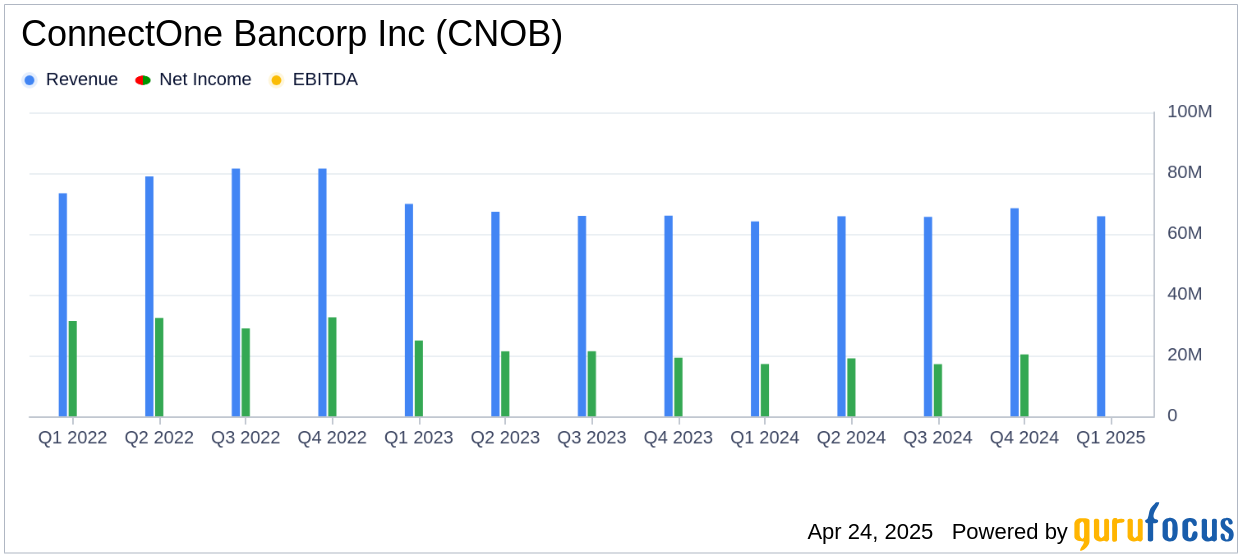

On April 24, 2025, ConnectOne Bancorp Inc (CNOB, Financial) released its 8-K filing for the first quarter of 2025, showcasing a solid financial performance. The community-based, full-service New Jersey-chartered commercial bank reported a net income available to common stockholders of $18.7 million, slightly down from $18.9 million in the previous quarter but up from $15.7 million in the same quarter last year. The diluted earnings per share (EPS) stood at $0.49, surpassing the analyst estimate of $0.44.

Performance and Challenges

ConnectOne Bancorp Inc's performance in the first quarter of 2025 reflects a disciplined execution strategy, as highlighted by Chairman and CEO Frank Sorrentino. The company's net interest margin widened by 7 basis points to 2.93%, driven by a decrease in the average costs of deposits. However, the company faces challenges such as a slight contraction in its loan portfolio and increased noninterest expenses due to merger-related costs.

Financial Achievements

The bank's financial achievements include a $5.5 million increase in net interest income compared to the first quarter of 2024, primarily due to a 29 basis-point widening in the net interest margin. This is significant for banks as it indicates improved profitability from core banking operations. Additionally, the company's tangible book value per share increased by more than 3% since announcing its merger with The First of Long Island Corporation, reflecting strong shareholder value creation.

Key Financial Metrics

ConnectOne Bancorp Inc reported a return on average assets of 0.84% and a return on average tangible common equity of 8.25% for the first quarter of 2025. These metrics are crucial as they indicate the company's efficiency in utilizing its assets and equity to generate profits. The provision for credit losses remained stable at $3.5 million, reflecting sound credit quality.

| Metric | Q1 2025 | Q4 2024 | Q1 2024 |

|---|---|---|---|

| Net Income Available to Common Stockholders | $18.7 million | $18.9 million | $15.7 million |

| Diluted EPS | $0.49 | $0.49 | $0.41 |

| Net Interest Income | $65.8 million | $64.7 million | $60.3 million |

| Noninterest Income | $4.5 million | $3.7 million | $3.8 million |

| Noninterest Expenses | $39.3 million | $38.5 million | $37.1 million |

Analysis and Outlook

ConnectOne Bancorp Inc's performance in the first quarter of 2025 demonstrates resilience and strategic growth, with a focus on expanding its net interest margin and maintaining credit quality. The planned merger with The First of Long Island Corporation is expected to enhance its market presence and provide attractive opportunities for its client base. Despite challenges such as increased noninterest expenses, the company's robust loan pipeline and stable credit quality trends position it well for future growth.

“We are pleased with ConnectOne’s solid performance to start the year, demonstrating disciplined execution across the organization,” said Frank Sorrentino, Chairman and Chief Executive Officer of ConnectOne.

ConnectOne Bancorp Inc's strategic initiatives and financial performance in the first quarter of 2025 highlight its commitment to delivering value to shareholders while navigating industry challenges effectively. For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from ConnectOne Bancorp Inc for further details.