The company, in light of current market conditions and anticipated fuel prices, has released its earnings forecast for the second quarter of 2025. Adjusted earnings per diluted share are predicted to fall between $0.50 and $1.00. This projection excludes the influence of any special items that might affect the outcome.

This guidance reflects the company's analysis of prevailing demand trends and their potential impact on financial performance. The forecast is intended to provide investors with a clear understanding of expected earnings while managing expectations for the upcoming fiscal period.

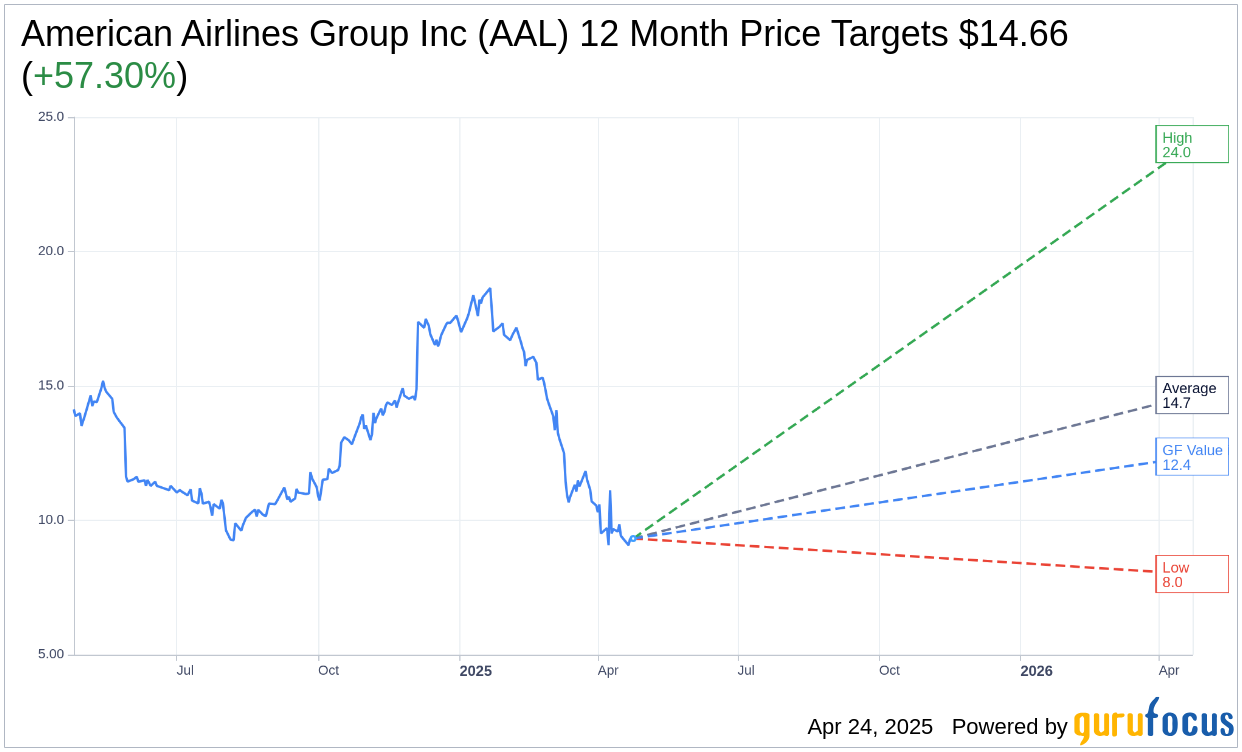

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for American Airlines Group Inc (AAL, Financial) is $14.66 with a high estimate of $24.00 and a low estimate of $8.00. The average target implies an upside of 57.30% from the current price of $9.32. More detailed estimate data can be found on the American Airlines Group Inc (AAL) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, American Airlines Group Inc's (AAL, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Airlines Group Inc (AAL, Financial) in one year is $12.37, suggesting a upside of 32.73% from the current price of $9.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Airlines Group Inc (AAL) Summary page.