Key Highlights:

- Candel Therapeutics to present Phase 3 trial data for cancer immunotherapy at ASCO 2025

- Analysts predict significant upside potential for CADL stock

- Contrasting views evident in GuruFocus's GF Value estimate

Candel Therapeutics (CADL, Financial) is set to reveal significant clinical findings at the 2025 ASCO Annual Meeting from its Phase 3 trial of CAN-2409, an innovative cancer immunotherapy. This therapy strategically targets intermediate-to-high risk localized prostate cancer, with a goal of enhancing disease-free survival in combination with standard treatment protocols.

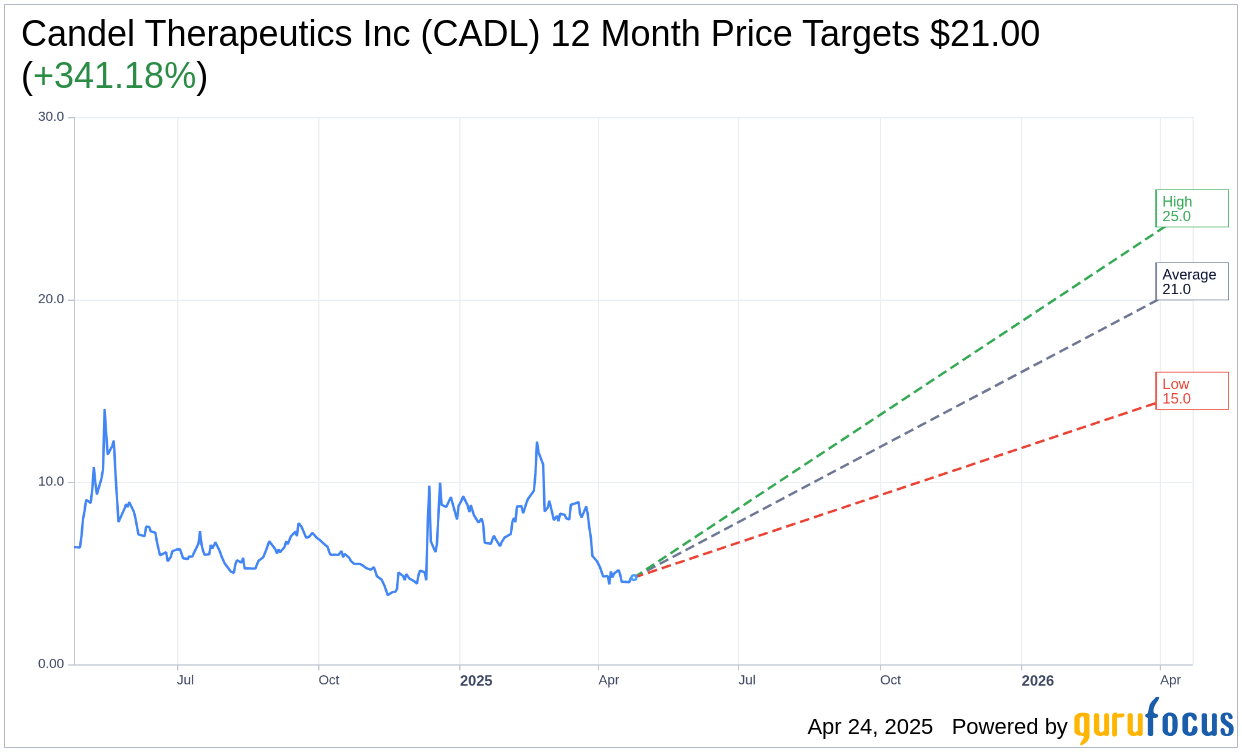

Analyst Predictions Indicate Strong Upside

Wall Street analysts provide a bullish outlook on Candel Therapeutics Inc (CADL, Financial), with a one-year average price target of $21.00. This target suggests a substantial upside potential of 341.18% from the current share price of $4.76, according to estimates from four analysts. The high and low estimates are $25.00 and $15.00, respectively. Comprehensive price target details are accessible on the Candel Therapeutics Inc (CADL) Forecast page.

Brokerage Consensus: A Strong Buy Recommendation

The average recommendation from four brokerage firms positions Candel Therapeutics Inc (CADL, Financial) at a 1.5 rating, aligning with a "Buy" status. On the rating scale, 1 represents a Strong Buy, while 5 indicates a Sell. This consensus underscores a positive sentiment among analysts regarding Candel's market prospects.

Contrasting Valuation Perspectives from GuruFocus

In contrast to the optimistic analyst forecasts, GuruFocus provides a different valuation perspective with its estimated GF Value for Candel Therapeutics Inc (CADL, Financial) at $0.80 for the upcoming year. This estimate implies a significant downside of 83.19% from the current trading price of $4.76. The GF Value is derived from historical trading multiples, previous business growth, and projections of future business performance. Further insights are available on the Candel Therapeutics Inc (CADL) Summary page.