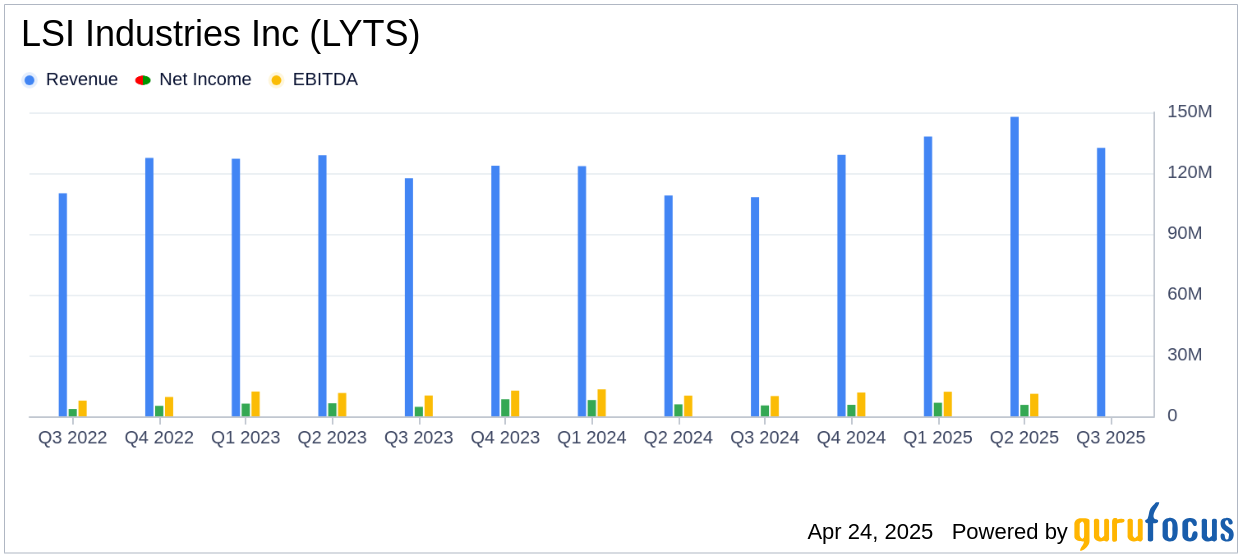

On April 24, 2025, LSI Industries Inc (LYTS, Financial) released its 8-K filing detailing the financial results for the fiscal third quarter ended March 31, 2025. The company, a prominent provider of corporate visual image solutions, reported net sales of $132.5 million, exceeding the analyst estimate of $129.72 million. However, the diluted earnings per share (EPS) of $0.13 fell short of the estimated $0.16. LSI Industries operates through two main segments: Lighting and Display Solutions, with the latter contributing significantly to the revenue growth this quarter.

Performance and Challenges

LSI Industries Inc (LYTS, Financial) achieved a 22% year-over-year increase in net sales, driven by robust performance in the Display Solutions segment, which saw a 70% increase in sales. This growth was partly fueled by organic expansion and the acquisition of Canada's Best Holdings. However, the company faced challenges with fluctuating demand and customer schedule changes, impacting short-term margins. Despite these hurdles, the company managed to stabilize its operations towards the end of the quarter.

Financial Achievements and Industry Impact

The company's financial achievements are noteworthy, particularly in the Display Solutions segment, which experienced significant growth due to increased demand in the refueling/c-store and grocery verticals. The acquisition of Canada's Best Holdings further strengthens LSI's market position in North America, aligning with its strategic growth plan. The company's ability to adapt to market changes and maintain a strong backlog highlights its competitive advantage in the hardware industry.

Key Financial Metrics

LSI Industries reported a net income of $3.9 million, or $0.13 per diluted share, compared to $5.4 million, or $0.18 per share, in the same period last year. The adjusted net income was $6.3 million, or $0.20 per diluted share. The company generated an EBITDA of $9.3 million and an adjusted EBITDA of $11.3 million, representing 8.5% of net sales. Free cash flow for the quarter was $4.7 million, reflecting continued profitability and efficient working capital management.

| Metric | Q3 2025 | Q3 2024 |

|---|---|---|

| Net Sales | $132.5 million | $108.2 million |

| Net Income | $3.9 million | $5.4 million |

| Diluted EPS | $0.13 | $0.18 |

| Adjusted Diluted EPS | $0.20 | N/A |

| EBITDA | $9.3 million | N/A |

| Adjusted EBITDA | $11.3 million | N/A |

Analysis of Company Performance

LSI Industries Inc (LYTS, Financial) demonstrated resilience in a challenging market environment, achieving substantial revenue growth while navigating demand fluctuations. The company's strategic acquisitions and focus on high-growth verticals have positioned it well for future expansion. However, the decline in net income and EPS compared to the previous year indicates the need for continued focus on margin improvement and cost management.

“Our Company delivered solid fiscal third quarter results, achieving sales growth of 22%, while successfully managing a period of significant variability in customer project schedules and demand levels,” stated James A. Clark, President, and Chief Executive Officer of LSI.

Overall, LSI Industries Inc (LYTS, Financial) continues to build a robust platform for lighting and display solutions, leveraging both organic and inorganic growth strategies to enhance its market presence and drive long-term value for shareholders.

Explore the complete 8-K earnings release (here) from LSI Industries Inc for further details.