Goldman Sachs has revised its price target for Thermo Fisher Scientific (TMO, Financial), lowering it from $670 to $610, while maintaining a Buy rating on the stock. This adjustment comes in light of the company's latest quarterly performance and evolving market conditions.

During the first quarter, Thermo Fisher displayed significant growth in sectors such as bioproduction, pharma services, and the research and safety market. However, the company faced challenges in its operations linked to academic and government sectors in the United States and China.

The adjustment in the price target also corresponds with a reduction in margin and earnings per share (EPS) guidance, reflecting external challenges, including foreign exchange fluctuations. Nevertheless, Thermo Fisher is actively addressing these challenges, employing strategies like flexible manufacturing and pricing adjustments to counter tariff-related headwinds.

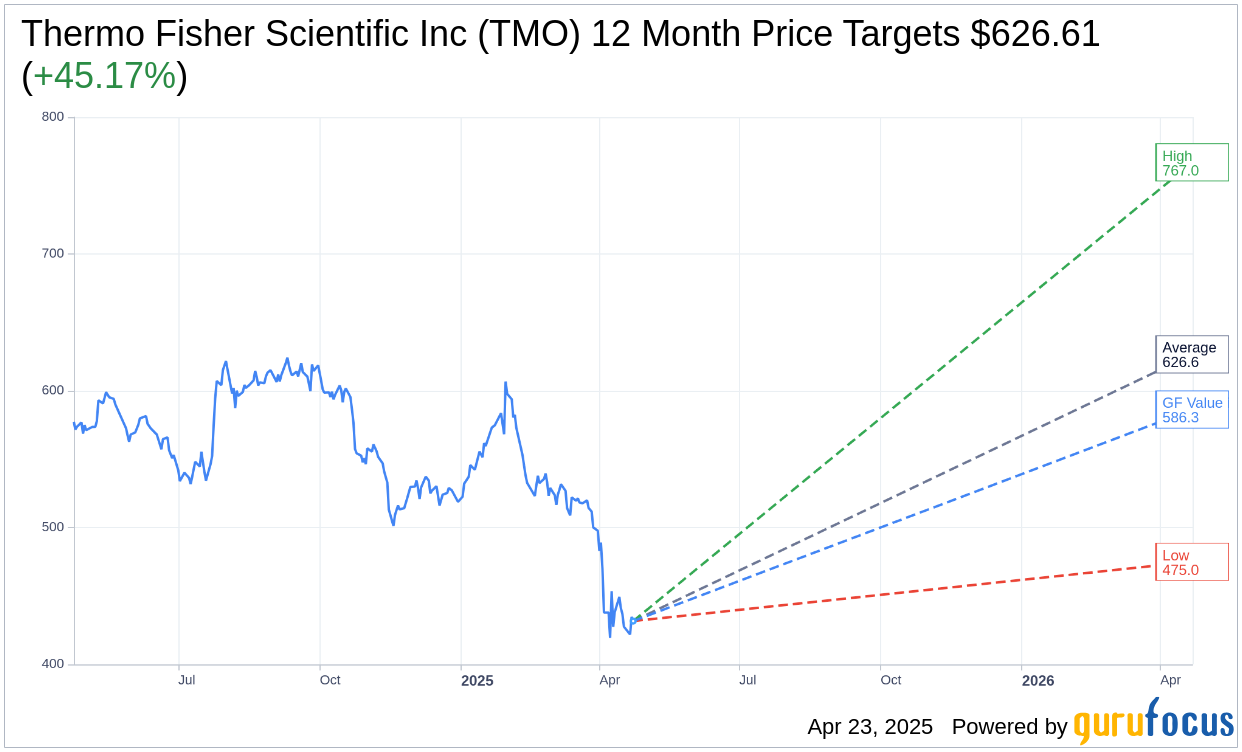

Wall Street Analysts Forecast

Based on the one-year price targets offered by 28 analysts, the average target price for Thermo Fisher Scientific Inc (TMO, Financial) is $626.61 with a high estimate of $767.00 and a low estimate of $475.00. The average target implies an upside of 45.17% from the current price of $431.64. More detailed estimate data can be found on the Thermo Fisher Scientific Inc (TMO) Forecast page.

Based on the consensus recommendation from 33 brokerage firms, Thermo Fisher Scientific Inc's (TMO, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Thermo Fisher Scientific Inc (TMO, Financial) in one year is $586.30, suggesting a upside of 35.83% from the current price of $431.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Thermo Fisher Scientific Inc (TMO) Summary page.

TMO Key Business Developments

Release Date: January 30, 2025

- Q4 Revenue: $11.4 billion, a 5% year-over-year increase.

- Q4 Adjusted Operating Income: $2.72 billion, a 7% increase.

- Q4 Adjusted Operating Margin: 23.9%, an expansion of 50 basis points.

- Q4 Adjusted EPS: $6.10, an 8% increase.

- Full-Year 2024 Revenue: $42.9 billion.

- Full-Year 2024 Adjusted Operating Income: $9.71 billion.

- Full-Year 2024 Adjusted EPS: $21.86 per share.

- Full-Year Free Cash Flow: $7.3 billion.

- 2024 Capital Return to Shareholders: $4.6 billion through stock buybacks and dividends.

- 2025 Revenue Guidance: $43.5 billion to $44 billion, with 3% to 4% organic growth.

- 2025 Adjusted EPS Guidance: $23.10 to $23.50, representing 6% to 8% growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Thermo Fisher Scientific Inc (TMO, Financial) reported strong revenue growth of 5% year over year in Q4, reaching $11.4 billion.

- The company achieved an 8% increase in adjusted EPS for Q4, reaching $6.10 per share.

- Thermo Fisher Scientific Inc (TMO) expanded its adjusted operating margins by 50 basis points to 23.9% in Q4.

- The company launched several innovative products in 2024, including the Thermo Scientific Stellar mass spectrometer and the Thermo Scientific Iliad Scanning Transmission Electron Microscope.

- Thermo Fisher Scientific Inc (TMO) returned $4.6 billion of capital to shareholders in 2024 through stock buybacks and dividends.

Negative Points

- The pharma and biotech segment experienced a low single-digit decline for the full year, impacted by a mid-single-digit headwind from the runoff of vaccine and therapy-related revenue.

- Diagnostics and healthcare declined in low single digits for the full year, affected by the runoff of COVID-19 testing-related revenue.

- The Laboratory Products and Biopharma Services segment saw an 8% decline in adjusted operating income for the full year.

- The company faces a 1% headwind from the remaining runoff of pandemic-related revenue in its 2025 guidance.

- Thermo Fisher Scientific Inc (TMO) anticipates a 1.5% revenue headwind from foreign exchange in 2025.