Investment Highlights:

- Positive Earnings Forecast: T-Mobile US (TMUS, Financial) is anticipated to report a significant EPS growth.

- Mixed Analyst Sentiment: Analysts express optimism through a high target price, yet recent revisions show caution.

- Valuation Concerns: GuruFocus GF Value presents a significant downside compared to current stock prices.

T-Mobile US (TMUS) is gearing up to announce its first-quarter earnings after the market closes on April 24th. Analysts are projecting an earnings per share (EPS) of $2.48, reflecting an impressive 24% increase year-over-year. Revenue is expected to hit $20.62 billion, marking a 5.3% rise. While T-Mobile has a robust track record of beating EPS estimates 75% of the time over the past two years, the company has faced three downward EPS revisions recently. Additionally, revenue expectations have been adjusted downward six times in recent months.

Analyst Predictions and Price Targets

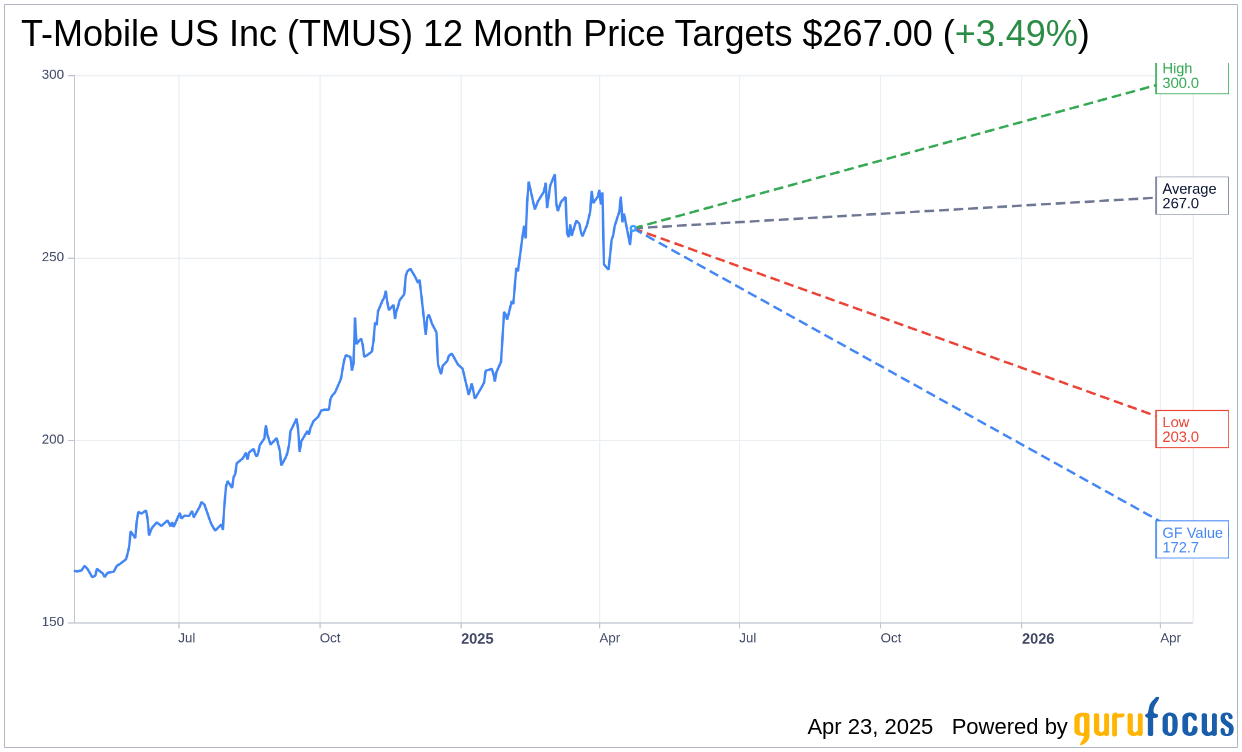

According to 25 analysts, the average price target for T-Mobile US Inc (TMUS, Financial) over the next year is set at $267.00. The forecasts range from a high of $300.00 to a low of $202.99. This average target suggests a potential upside of 2.98% from the current trading price of $259.27. For more detailed estimate data, visit the T-Mobile US Inc (TMUS) Forecast page.

Brokerage Recommendations and Ratings

The consensus recommendation from 30 brokerage firms places T-Mobile US Inc (TMUS, Financial) at an average brokerage recommendation of 2.2, which indicates an "Outperform" status. The rating scale operates from 1 to 5, with 1 representing a Strong Buy and 5 a Sell.

Valuation Analysis: GF Value Insight

According to GuruFocus estimates, the GF Value for T-Mobile US Inc (TMUS, Financial) over the next year is estimated at $172.74. This suggests a potential downside of 33.37% from the current value of $259.27. The GF Value represents GuruFocus' calculation of the fair stock value derived from historical trading multiples, past growth, and future business performance estimates. For a deeper dive into the data, check out the T-Mobile US Inc (TMUS) Summary page.