Key Takeaways:

- Amphenol Corporation (APH, Financial) achieves unprecedented Q1 2025 sales of $4.811 billion, representing a 48% surge year-over-year.

- The company reports a record high adjusted diluted EPS of $0.63, marking a significant 58% increase from last year.

- Optimistic projections for Q2 with predicted sales of $4.9 billion to $5 billion and EPS in the range of $0.64 to $0.66.

Amphenol's Stellar Financial Performance

Amphenol Corporation (APH) recently announced record-breaking financial results for the first quarter of 2025. The company posted sales of $4.811 billion, which signifies a remarkable 48% increase compared to the same period last year. This impressive performance is further highlighted by the record adjusted diluted EPS of $0.63, reflecting a 58% growth from the previous year. The successful integration of the Andrew acquisition has significantly boosted orders to $5.292 billion, leading to a favorable book-to-bill ratio of 1.1.

Looking Forward: Q2 2025 Projections

Building on its momentum, Amphenol projects promising financial outcomes for the second quarter of 2025. The company anticipates sales to be between $4.9 billion and $5 billion, alongside an expected EPS range of $0.64 to $0.66. These projections underscore Amphenol's robust growth trajectory and strategic market positioning.

Analyst Insights and Price Targets

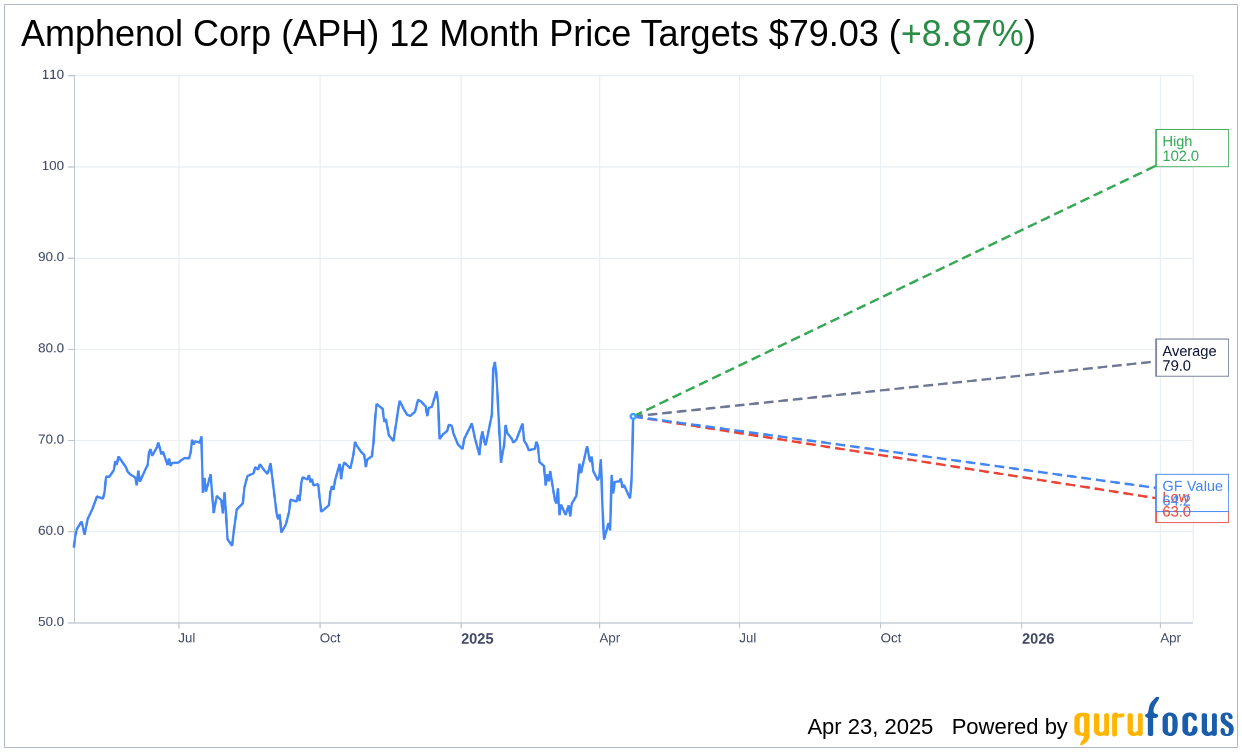

Wall Street analysts have provided their insights through one-year price targets for Amphenol Corp (APH, Financial). The average target price is $79.03, with estimates ranging from a high of $102.00 to a low of $63.00. This average target suggests a potential upside of 11.07% from the current trading price of $71.15. For more detailed estimate data, visit the Amphenol Corp (APH) Forecast page.

Brokerage Recommendations

The consensus recommendation from 19 brokerage firms presents Amphenol Corp's (APH, Financial) stock with an average brokerage recommendation of 2.3, indicating it is presently an "Outperform" investment. This recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), reflecting strong market confidence in the company's future performance.

Evaluating Amphenol's GF Value

According to GuruFocus estimates, the estimated GF Value for Amphenol Corp (APH, Financial) is projected at $64.20 in one year. This suggests a potential downside of 9.77% from the current price of $71.15. The GF Value represents GuruFocus' calculated fair value of the stock, derived from historical trading multiples, past business growth, and future performance estimates. For more comprehensive data, please visit the Amphenol Corp (APH) Summary page.