Banc of California (BANC, Financial) reported first-quarter revenue of $266.01 million, surpassing analysts' expectations of $244.99 million. The financial institution attributed its performance to positive trends in several core earnings drivers. Notably, there was an expansion in net interest margins and solid growth in loan portfolios.

The company effectively leveraged its market position to attract new client relationships, leading to opportunities in high-quality lending and stable deposit inflows. This strategy contributed to an increase in both book value and tangible book value per share. Furthermore, Banc of California maintained high liquidity levels, underscoring its stable financial footing.

In light of its robust capital and liquidity status, Banc of California initiated a share buyback program in mid-March. As of April 21, the company successfully repurchased 6.8% of its outstanding shares, a move aimed at delivering sustainable returns to shareholders.

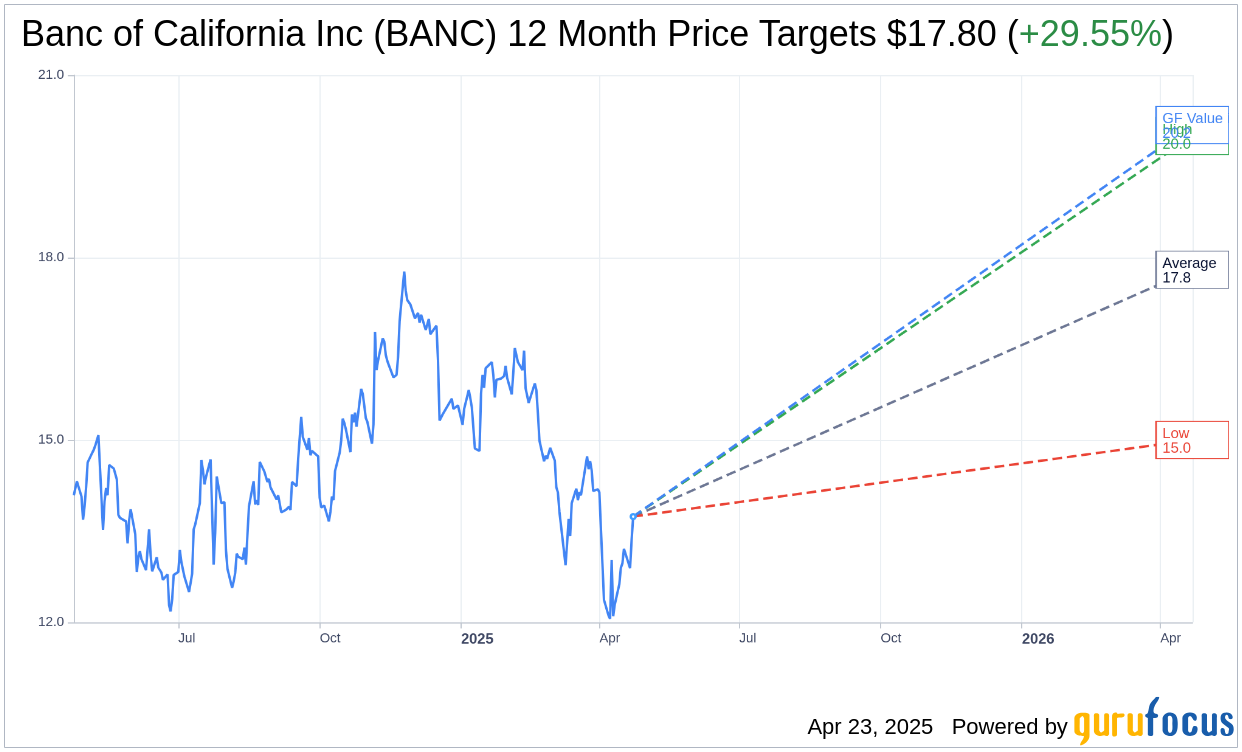

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Banc of California Inc (BANC, Financial) is $17.80 with a high estimate of $20.00 and a low estimate of $15.00. The average target implies an upside of 29.55% from the current price of $13.74. More detailed estimate data can be found on the Banc of California Inc (BANC) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Banc of California Inc's (BANC, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Banc of California Inc (BANC, Financial) in one year is $20.18, suggesting a upside of 46.87% from the current price of $13.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Banc of California Inc (BANC) Summary page.

Key Business Developments

Release Date: January 23, 2025

- Net Income: $47 million or $0.28 per share for the fourth quarter.

- Net Interest Income: $235 million, up 1% from the prior quarter.

- Net Interest Margin (NIM): Increased 11 basis points to 3.04%.

- Noninterest Operating Expenses: Decreased by 36% from a normalized fourth quarter of 2024.

- Loan Production: $1.8 billion, resulting in portfolio growth of 1.5% or about 6% on an annualized basis.

- Cost of Deposits: Declined 28 basis points from 2.54% to 2.26%.

- Noninterest Income: $29 million in the fourth quarter.

- Total Deposits: $27.2 billion, increased by $364 million in the fourth quarter.

- Loan Portfolio Reserve Levels: 1.13% of total loans and 142% coverage of nonperforming loans.

- Commercial New Production Loan Rates: 7.6% for the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Banc of California Inc (BANC, Financial) reported a strong fourth quarter, marking the end of a transformational year with significant progress in executing its strategy and optimizing its balance sheet.

- The company achieved a notable increase in non-interest-bearing deposits (NIB), which grew to 29.1% of total average deposits, up nearly 7% from the previous year.

- Net interest margin (NIM) expanded by 135 basis points year over year, contributing to higher profitability.

- Banc of California Inc (BANC) successfully reduced wholesale funding to 10.3% of assets, down from nearly 17% in the previous year.

- The company launched the Banc of California Wildfire Relief & Recovery Fund, donating $1 million to support relief efforts for the Los Angeles wildfires, demonstrating community commitment.

Negative Points

- The company experienced an increase in nonaccrual loans, primarily driven by a single borrower relationship, which could indicate potential credit risk.

- Despite strong performance, the company anticipates seasonal weakness in deposit flows and loan demand in the first quarter of 2025.

- There was a charge-off of two non-performing loans, one in Life Sciences and another in the Civic portfolio, indicating some credit quality issues.

- Banc of California Inc (BANC) faces competitive pressure in deposit pricing, although it is starting to see less demand for higher rates.

- The company expects noninterest expenses to increase in the first quarter of 2025 due to seasonal factors such as payroll tax resets and wage inflation.