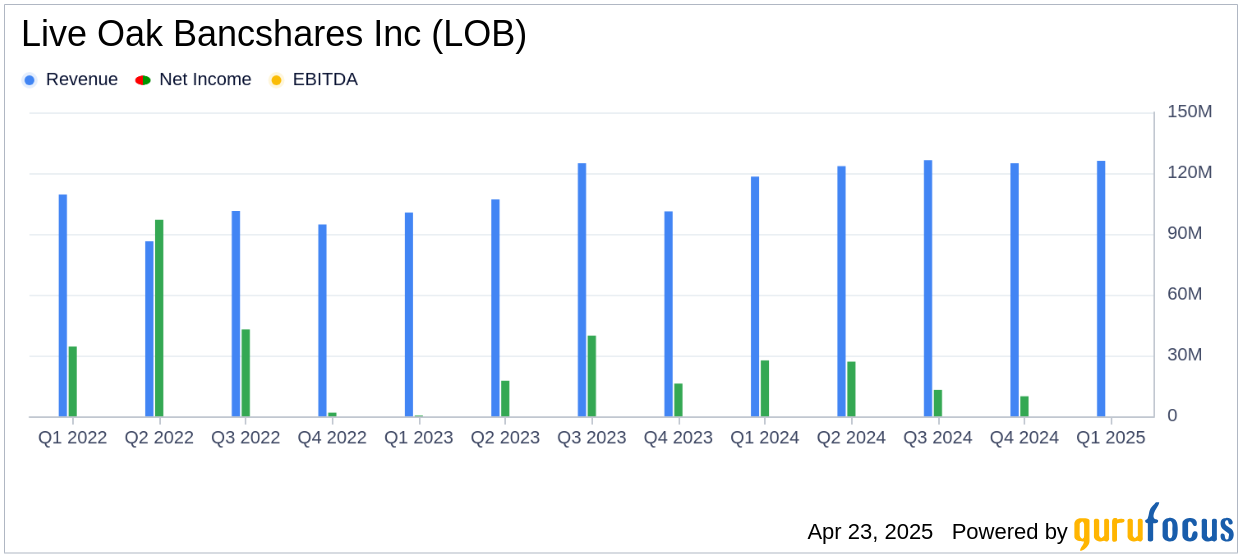

On April 23, 2025, Live Oak Bancshares Inc (LOB, Financial) released its 8-K filing for the first quarter of 2025, reporting a net income attributable to the company of $9.7 million, or $0.21 per diluted share. This result fell short of the analyst estimate of $0.37 per share. However, the company achieved a total revenue of $126.11 million, surpassing the estimated $121.60 million.

Company Overview

Live Oak Bancshares Inc operates as the bank holding company for Live Oak Banking Company, specializing in lending and deposit-related services to small businesses across the United States. The company focuses on lending to credit-worthy borrowers within specific industries and more broadly to select borrowers outside of those industries. A portion of the loans originated by the bank are partially guaranteed by the Small Business Administration and the U.S. Department of Agriculture.

Performance Highlights and Challenges

Live Oak Bancshares Inc reported record first-quarter loan production of $1.40 billion and strong deposit growth of $635.5 million, leading to a 5.0% increase in total assets to $13.60 billion. Despite these achievements, the company faced a 1.5% decline in revenue and a 3.4% increase in noninterest expenses, resulting in a 10% decline in pre-provision net revenue. The provision expense for credit losses was $29.0 million, driven by loan growth amid a challenging macroeconomic environment characterized by elevated interest rates and inflationary pressures.

Financial Achievements and Industry Context

The increase in net interest income by 3.1% and a 5 basis point rise in net interest margin to 3.20% are significant achievements for Live Oak Bancshares Inc, reflecting the company's ability to manage interest rate risks effectively. These metrics are crucial for banks as they indicate the profitability of their core lending activities.

Key Financial Metrics

| Metric | 1Q 2025 | 4Q 2024 | 1Q 2024 |

|---|---|---|---|

| Total Revenue | $126.11 million | $128.07 million | $116.21 million |

| Net Income | $9.7 million | $9.9 million | $27.59 million |

| Diluted EPS | $0.21 | $0.22 | $0.60 |

| Total Assets | $13.60 billion | $12.94 billion | $11.51 billion |

| Total Deposits | $12.40 billion | $11.76 billion | $10.38 billion |

Analysis and Commentary

Live Oak Bancshares Inc's performance in the first quarter of 2025 highlights the company's resilience in a challenging economic environment. The growth in loan production and deposits underscores the company's strong market position and commitment to supporting small businesses. However, the increase in noninterest expenses and provision for credit losses indicates potential challenges in managing operational costs and credit risk.

Live Oak Bank demonstrated strong growth across our lending and deposit franchises in the first quarter, all while navigating the current small business credit cycle and a backdrop of economic uncertainty," said Live Oak Chairman and CEO James S. (Chip) Mahan III.

Overall, while Live Oak Bancshares Inc has shown robust growth in certain areas, the missed earnings estimate and increased expenses highlight areas for improvement. Investors and stakeholders will be keen to see how the company addresses these challenges in the coming quarters.

Explore the complete 8-K earnings release (here) from Live Oak Bancshares Inc for further details.