On April 23, 2025, Veris Residential Inc (VRE, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. Veris Residential Inc is a fully-integrated, self-administered, and self-managed real estate investment trust (REIT) that primarily focuses on multifamily rental properties in the Northeast. The company operates in two segments: multifamily real estate & services and commercial & other real estate, with the majority of revenue derived from multifamily services.

Performance Overview and Challenges

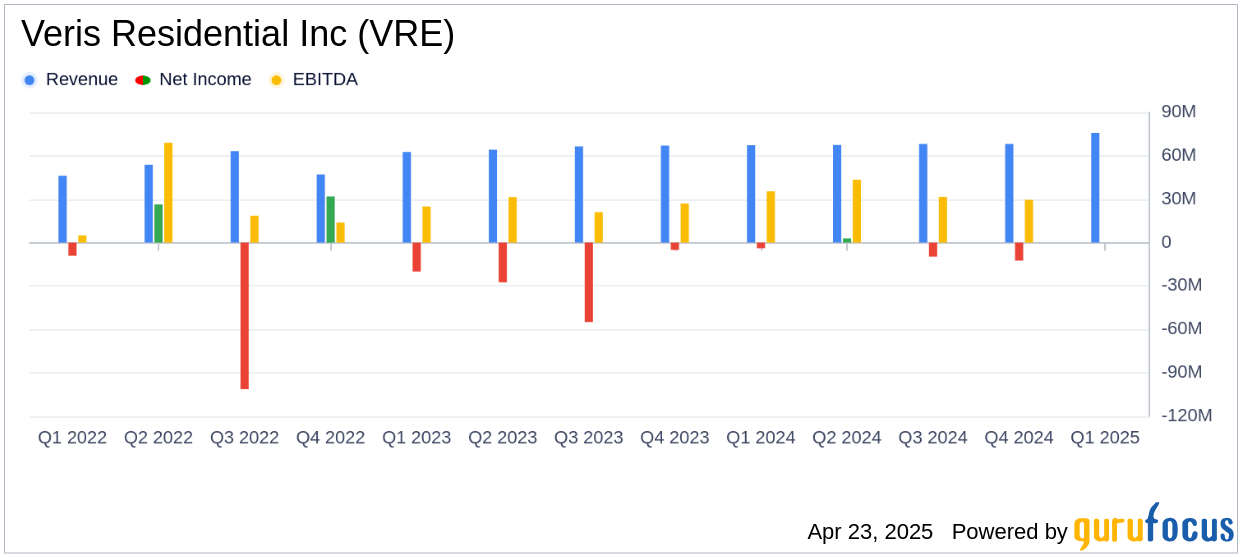

Veris Residential Inc reported a net loss per diluted share of $0.12 for Q1 2025, which is below the analyst estimate of -$0.10. However, the company's revenue of $75.76 million exceeded the estimated $68.45 million. This performance highlights the company's ability to generate higher-than-expected revenue despite facing challenges such as market volatility and a net loss per share.

Financial Achievements and Industry Context

During the first quarter, Veris Residential achieved a year-over-year same-store multifamily blended net rental growth rate of 2.4% and a same-store NOI growth of 3.2%. These metrics are crucial for REITs as they indicate the company's ability to increase rental income and manage expenses effectively. Additionally, the company sold $45 million of non-strategic assets and has $34 million under binding contract, demonstrating its strategy to unlock value and streamline its portfolio.

Income Statement and Key Metrics

The company's core FFO per diluted share was $0.16, an improvement from $0.14 in the previous year, while core AFFO per diluted share slightly decreased to $0.17 from $0.18. The dividend per diluted share increased to $0.08 from $0.0525, reflecting the company's commitment to returning value to shareholders.

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Total Property Revenue | $75,761 | $73,978 | 2.4% |

| Same Store NOI | $50,893 | $49,314 | 3.2% |

Balance Sheet and Liquidity

Veris Residential's debt is predominantly hedged or fixed, with a weighted average effective interest rate of 4.96% and a weighted average maturity of 2.8 years. The company reported liquidity of approximately $146 million, including cash on hand and available funds on the revolver, which provides financial flexibility to manage its operations and pursue strategic initiatives.

Strategic Transactions and Future Outlook

The company completed significant transactions, including the acquisition of its partner's interest in the Jersey City Urby joint venture, now rebranded as "Sable." This consolidation is expected to generate over $1 million in annualized synergies. The strategic sale of non-strategic assets and the focus on core operations are expected to enhance the company's financial position and operational efficiency.

Mahbod Nia, Chief Executive Officer, commented, “During the first quarter, Veris Residential continued to achieve strong operational results while advancing the corporate plan announced earlier this year. With a combined $79 million of non-strategic asset sales either closed or under binding contract this year, we continue to unlock value embedded within the Company, despite elevated levels of market volatility.”

In conclusion, while Veris Residential Inc faced challenges with a net loss per share, its ability to exceed revenue expectations and strategically manage its portfolio positions the company for potential growth and stability in the competitive REIT industry. For more detailed insights, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Veris Residential Inc for further details.