On April 23, 2025, O'Reilly Automotive Inc (ORLY, Financial) released its 8-K filing, reporting its financial performance for the first quarter ended March 31, 2025. O'Reilly, a prominent retailer in the automotive aftermarket industry, operates over 6,000 stores across the United States and Mexico, catering to both do-it-yourself and professional markets.

Performance Overview

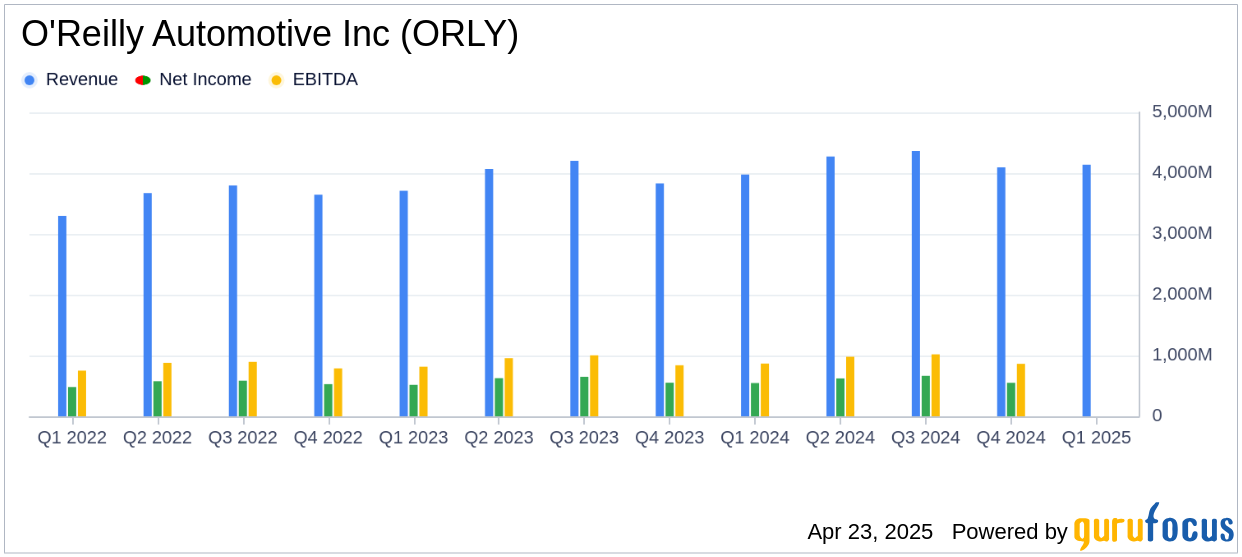

O'Reilly Automotive Inc (ORLY, Financial) reported a 4% increase in sales for the first quarter, reaching $4.14 billion, compared to $3.98 billion in the same period last year. This figure, however, fell short of the analyst revenue estimate of $4,174.66 million. Despite the revenue miss, the company achieved a diluted earnings per share (EPS) of $9.35, falling short of the analyst estimate of $9.94.

Key Financial Achievements

The company's gross profit increased by 4% to $2.12 billion, maintaining a gross margin of 51.3%. This is a slight improvement from the previous year's margin of 51.2%. However, operating income saw a decline of 1% to $741 million, primarily due to an 8% increase in selling, general, and administrative expenses, which rose to $1.38 billion.

Income Statement Highlights

Net income for the quarter decreased by 2% to $538 million, down from $547 million in the previous year. Despite this, the company managed to increase its diluted EPS by 2% to $9.35, benefiting from a reduction in the number of shares outstanding due to share repurchases.

Comparable Store Sales and Share Repurchase Program

O'Reilly reported a 3.6% increase in comparable store sales, driven by growth in both professional and DIY segments. The company also repurchased 0.4 million shares of its common stock during the quarter, at an average price of $1,297.15 per share, totaling $559 million. This strategic move reflects the company's commitment to returning value to shareholders.

Challenges and Future Outlook

Despite the positive sales growth, O'Reilly faces challenges from the changing tariff landscape, which introduces uncertainty in predicting future impacts on the business. The company remains optimistic about its growth opportunities, maintaining its full-year comparable store sales guidance of 2.0% to 4.0% and planning 38 net new store openings in the first quarter.

Brad Beckham, O'Reilly's CEO, stated, "We are pleased to report a solid start to 2025, highlighted by a 3.6% comparable store sales increase, which was at the high end of our expectations for the quarter. Our Team's strong execution continues to generate share gains."

Financial Guidance for 2025

O'Reilly provided updated full-year 2025 guidance, projecting total revenue between $17.4 billion and $17.7 billion, with gross profit margins ranging from 51.2% to 51.7%. The company anticipates operating income margins between 19.2% and 19.7%, and diluted EPS between $42.90 and $43.40.

| Metric | Guidance |

|---|---|

| Net, new store openings | 200 to 210 |

| Comparable store sales | 2.0% to 4.0% |

| Total revenue | $17.4 billion to $17.7 billion |

| Gross profit as a percentage of sales | 51.2% to 51.7% |

| Operating income as a percentage of sales | 19.2% to 19.7% |

| Effective income tax rate | 22.4% |

| Diluted earnings per share | $42.90 to $43.40 |

| Net cash provided by operating activities | $2.8 billion to $3.2 billion |

| Capital expenditures | $1.2 billion to $1.3 billion |

| Free cash flow | $1.6 billion to $1.9 billion |

O'Reilly Automotive Inc (ORLY, Financial) continues to demonstrate resilience in a competitive industry, leveraging its extensive distribution network and commitment to customer service to drive growth. The company's strategic initiatives, including store expansions and share repurchases, position it well for future success, despite external challenges.

Explore the complete 8-K earnings release (here) from O'Reilly Automotive Inc for further details.