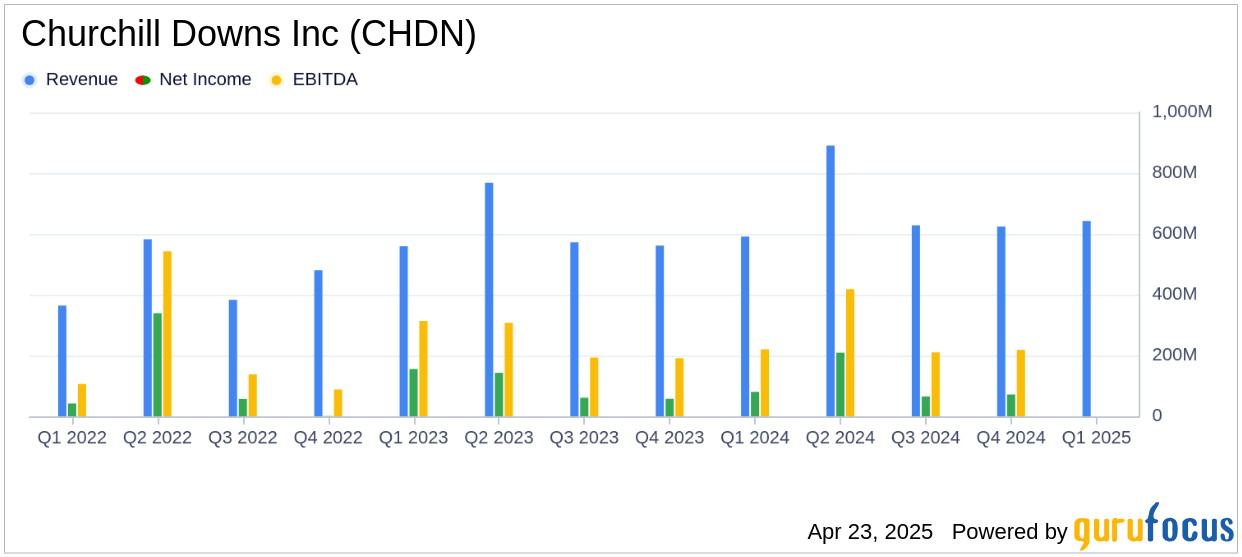

On April 23, 2025, Churchill Downs Inc (CHDN, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. The company, known for its gaming entertainment, online wagering, and racing operations, reported a record net revenue of $642.6 million, surpassing the analyst estimate of $642.17 million. However, the diluted earnings per share (EPS) of $1.02 fell short of the estimated $1.03.

Company Overview

Churchill Downs Inc operates through three main segments: Live and Historical Racing, Wagering Services, and Gaming. The company is renowned for its iconic Kentucky Derby and has expanded its operations to include various entertainment venues and online wagering platforms.

Performance and Challenges

Despite achieving record revenue, Churchill Downs Inc faced a 5% decline in net income, which stood at $76.7 million compared to $80.4 million in the previous year. This decline was attributed to a $6.7 million after-tax decrease in other recoveries, primarily driven by insurance claim proceeds recorded in the prior year. The company also faced challenges such as regional gaming softness, increased competition, and adverse weather conditions affecting its operations.

Financial Achievements

The company's record revenue growth of 9% year-over-year highlights its robust performance in the Travel & Leisure industry. The opening of Owensboro Racing and Gaming in Western Kentucky and the Terre Haute Casino Resort contributed significantly to this growth. Additionally, the company achieved a record Adjusted EBITDA of $245.1 million, reflecting a 1% increase from the previous year.

Segment Performance

| Segment | Revenue (2025) | Revenue (2024) | Adjusted EBITDA (2025) | Adjusted EBITDA (2024) |

|---|---|---|---|---|

| Live and Historical Racing | $276.4 million | $248.9 million | $102.0 million | $100.8 million |

| Wagering Services | $115.8 million | $114.1 million | $41.3 million | $39.6 million |

| Gaming | $267.2 million | $243.2 million | $123.5 million | $122.8 million |

Analysis and Outlook

Churchill Downs Inc's strategic expansions and investments in new venues have bolstered its revenue streams, particularly in the Live and Historical Racing and Gaming segments. However, the decline in net income and EPS indicates challenges in managing costs and external pressures such as competition and economic conditions. The company's decision to pause certain capital projects reflects a cautious approach in the current economic environment.

Overall, Churchill Downs Inc's performance in Q1 2025 demonstrates its resilience and adaptability in a competitive industry, with a focus on strategic growth and shareholder returns through initiatives like the $500 million share repurchase program.

Explore the complete 8-K earnings release (here) from Churchill Downs Inc for further details.