Vista Oil & Gas SAB de CV (VIST, Financial) is generating increased attention as options activity remains steady ahead of its earnings announcement. In the options market, the ratio of call options to put options stands at 9:4, indicating a positive sentiment among investors.

The current implied volatility suggests that the market is preparing for a significant share price change of approximately 6.8%, translating to an anticipated $3.21 swing following the release of the earnings report. Historically, Vista has experienced a median movement of 2.9% over the last eight quarters, reflecting a potentially more volatile reaction this time around.

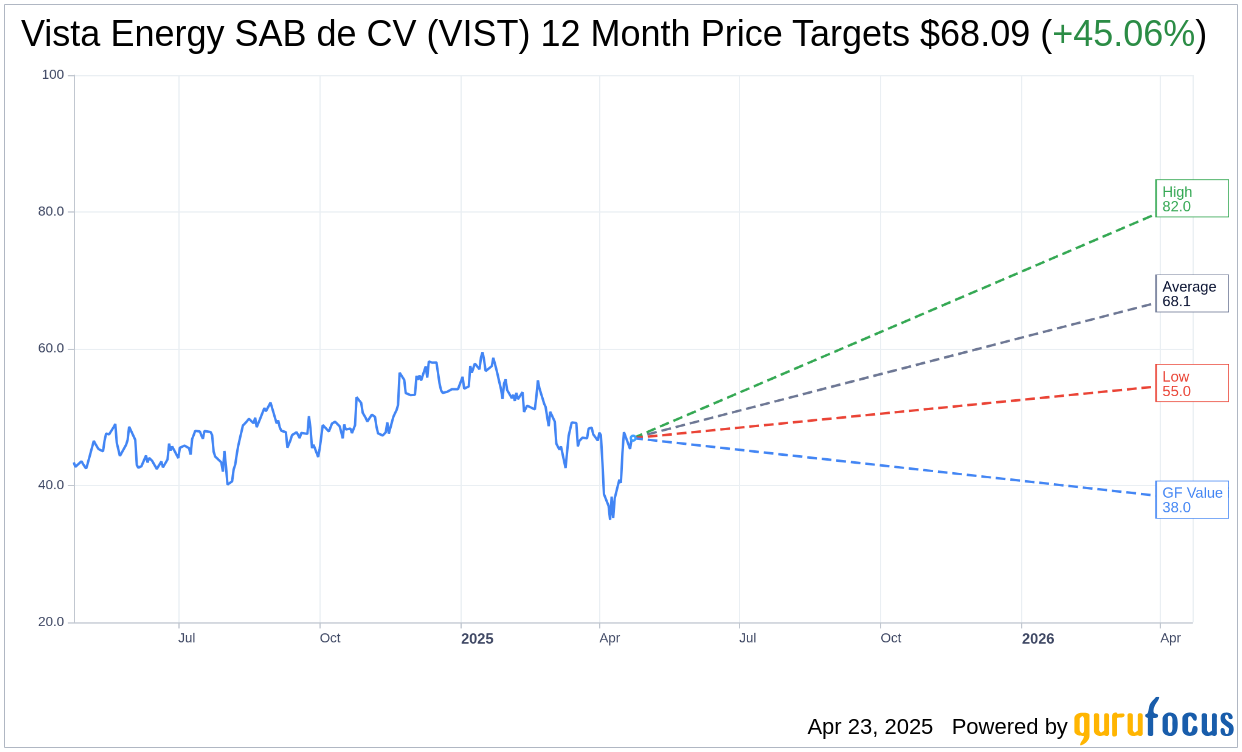

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Vista Energy SAB de CV (VIST, Financial) is $68.09 with a high estimate of $82.00 and a low estimate of $55.00. The average target implies an upside of 44.67% from the current price of $47.07. More detailed estimate data can be found on the Vista Energy SAB de CV (VIST) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Vista Energy SAB de CV's (VIST, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Vista Energy SAB de CV (VIST, Financial) in one year is $37.95, suggesting a downside of 19.37% from the current price of $47.065. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Vista Energy SAB de CV (VIST) Summary page.

Key Business Developments

Release Date: February 27, 2025

- Total Production: 85,300 BOEs per day, 51% increase year over year, 17% increase quarter over quarter.

- Oil Production: 73,500 barrels per day, 52% increase year over year, 16% increase quarter over quarter.

- Total Revenues: $471 million, 52% increase year over year.

- Lifting Cost: $4.7 per BOE, almost flat quarter over quarter.

- Capital Expenditure: $340 million, with 11 wells drilled and 13 wells completed.

- Adjusted EBITDA: $273 million, 5% decrease year over year; 27% increase excluding export repatriation effects.

- Net Income: $94 million, EPS of $0.98 per share.

- Adjusted Net Income: $22 million after deducting deferred income tax.

- Free Cash Flow: $57 million during the quarter.

- Net Leverage Ratio: 0.63 times adjusted EBITDA.

- Realized Oil Price: $67.1 per barrel, 1% decrease year over year.

- Exported Oil: 3.6 million barrels, 79% increase year over year.

- Cash at Period-End: $764 million.

- Full-Year Adjusted EBITDA: $1.1 billion, 25% increase year over year.

- EPS for Full Year: $5 per share, 18% increase year over year.

- Share Price Increase: 83% from year-end 2023 to year-end 2024.

- Share Repurchase: $100 million at an average price of $48 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Vista Energy SAB de CV (VIST, Financial) achieved a 51% increase in total production in Q4 2024 compared to the same quarter last year, driven by new oil activity in Vaca Muerta.

- The company reported a 52% year-over-year increase in total revenues for Q4 2024, reaching $471 million.

- Vista Energy SAB de CV (VIST) successfully ramped up its new well activity from 31 new wells in 2023 to 50 in 2024, supporting robust production growth.

- The company achieved a significant reduction in greenhouse gas emissions, with a 44% decrease in emission intensity compared to the previous year.

- Vista Energy SAB de CV (VIST) delivered an 83% increase in share price from year-end 2023 to year-end 2024, reflecting strong shareholder returns.

Negative Points

- Adjusted EBITDA for Q4 2024 was 5% lower on an inter-annual basis, partly due to a decrease in income from the repatriation of export proceeds.

- The company faced an 8% year-over-year increase in lifting costs per BOE, driven by inflation in US dollars and increased oilfield expenditures.

- Realized oil prices were slightly lower, with a 1% decrease on an inter-annual basis and a 2% decrease sequentially, impacting revenue growth.

- Vista Energy SAB de CV (VIST) experienced a temporary increase in trucking expenditures, which impacted sales expenses by $25 million on a sequential basis.

- The company anticipates flat to slightly lower production in Q1 2025 due to logistical challenges and delays in well connections.