Key Takeaways:

- Vertiv Holdings Co. (VRT, Financial) reveals robust financial performance with a considerable rise in Q1 2025 earnings.

- Analysts forecast a promising outlook for Vertiv, though GuruFocus offers a more conservative valuation.

- Investors should weigh growth prospects against valuation metrics for informed decision-making.

Impressive Financial Growth in Q1 2025

Vertiv Holdings Co. (VRT) delivered remarkable results in the first quarter of 2025, highlighted by a 25% increase in organic net sales. Further demonstrating its financial health, the company saw a significant 49% surge in earnings per share (EPS) to $0.64. Vertiv's backlog reached $7.9 billion, reflecting strong demand and a 35% increase in adjusted operating profit, totaling $337 million. In response to these successes, management has upgraded its 2025 sales growth guidance to 18%.

Wall Street Analysts' Insights

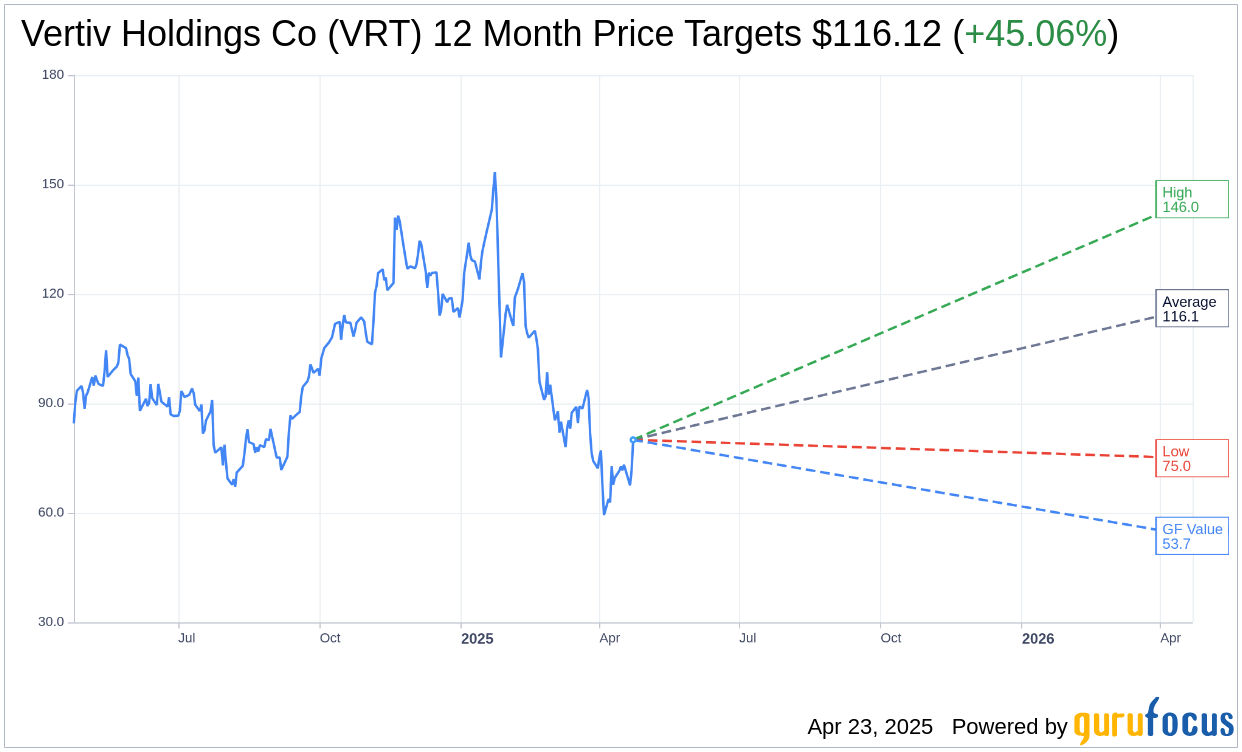

According to projections from 20 analysts, the one-year price target for Vertiv Holdings Co. (VRT, Financial) averages at $116.12. Forecasts range from a high estimate of $146.00 to a low of $75.00. This average target suggests a potential 50.23% upside from the current stock price of $77.29. For a more detailed analysis, visit the Vertiv Holdings Co (VRT) Forecast page.

Brokerage Recommendations and GF Value Assessment

The consensus recommendation among 24 brokerage firms assigns Vertiv Holdings Co. (VRT, Financial) an average rating of 1.9, marked as "Outperform." This rating scale ranges from 1 (Strong Buy) to 5 (Sell), suggesting optimism from analysts.

However, according to GuruFocus estimates, the GF Value of Vertiv Holdings Co (VRT, Financial) in one year is projected to be $53.72, indicating a potential downside of 30.5% from its current price of $77.29. The GF Value represents GuruFocus' calculated fair market value based on the stock's historical trading multiples, historical and forecasted business growth. For an in-depth exploration, refer to the Vertiv Holdings Co (VRT) Summary page.