Fidelity D & D Bancorp Inc (FDBC, Financial) released its 8-K filing on April 23, 2025, announcing its unaudited financial results for the first quarter ended March 31, 2025. The bank holding company, through its subsidiary The Fidelity Deposit and Discount Bank, offers a comprehensive range of traditional banking services, including personal and corporate trust services, alternative financial products, and asset management services, primarily in Pennsylvania.

Performance Overview

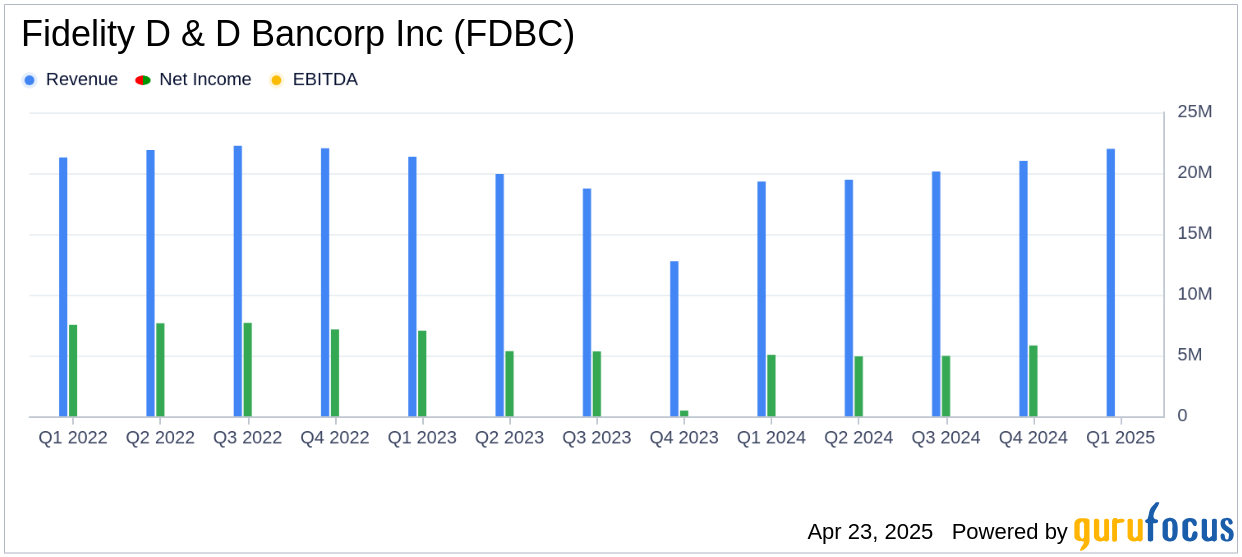

Fidelity D & D Bancorp Inc reported a net income of $6.0 million, or $1.03 diluted earnings per share, for the first quarter of 2025, marking an 18% increase from $5.1 million, or $0.88 diluted earnings per share, in the same period of 2024. This growth was primarily fueled by a $2.1 million increase in net interest income and a $0.4 million rise in non-interest income. However, these gains were partially offset by increases in non-interest expenses, income tax provisions, and credit loss provisions.

Financial Achievements and Challenges

The company's total assets reached $2.7 billion, supported by significant loan and deposit growth and an improved net interest margin. Net interest income rose to $17.0 million, a 14% increase from the previous year, driven by a $148.0 million increase in the average balance of interest-earning assets and a 21 basis point rise in the fully-taxable equivalent yield. Despite these achievements, the company faced challenges with a $0.9 million increase in non-interest expenses and a $0.3 million rise in credit loss provisions, reflecting higher loan growth and net charge-offs.

Income Statement Highlights

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Interest Income | $17.0 million | $14.9 million |

| Non-Interest Income | $5.0 million | $4.6 million |

| Net Income | $6.0 million | $5.1 million |

Net interest margin improved to 2.89% from 2.69% in the previous year, attributed to the growth in the loan and lease portfolio and strategic reinvestment into higher-yielding assets. Non-interest income increased by 9% to $5.0 million, driven by wealth management and interchange fees, although offset by losses on securities sales.

Balance Sheet and Asset Quality

Fidelity D & D Bancorp Inc's total assets increased by $126.7 million from December 31, 2024, primarily due to growth in cash and cash equivalents and the loan portfolio. Total liabilities rose by $119.0 million, with deposit growth funding loan expansion and boosting interest-bearing cash balances. The company's asset quality improved, with non-performing assets decreasing to $6.1 million, or 0.23% of total assets, from $7.8 million, or 0.30%, at the end of 2024.

Capital and Equity

Shareholders' equity increased by $7.7 million to $211.7 million, driven by higher retained earnings and improvements in accumulated other comprehensive income. The company remains well-capitalized, with a Tier 1 capital ratio of 9.22% and a total risk-based capital ratio of 14.74% as of March 31, 2025. Tangible book value per share rose to $33.16 from $31.98 at the end of 2024.

“Highlights of our first quarter results include achieving total assets of $2.7 billion, along with strong net income primarily driven by accelerated loan and deposit growth and improvement in net interest margin,” said Dan Santaniello, President and CEO.

Fidelity D & D Bancorp Inc's first quarter results reflect robust financial performance, with significant growth in net interest income and asset quality improvements. However, the company must continue to manage rising expenses and credit provisions to sustain its positive trajectory in a competitive banking environment.

Explore the complete 8-K earnings release (here) from Fidelity D & D Bancorp Inc for further details.